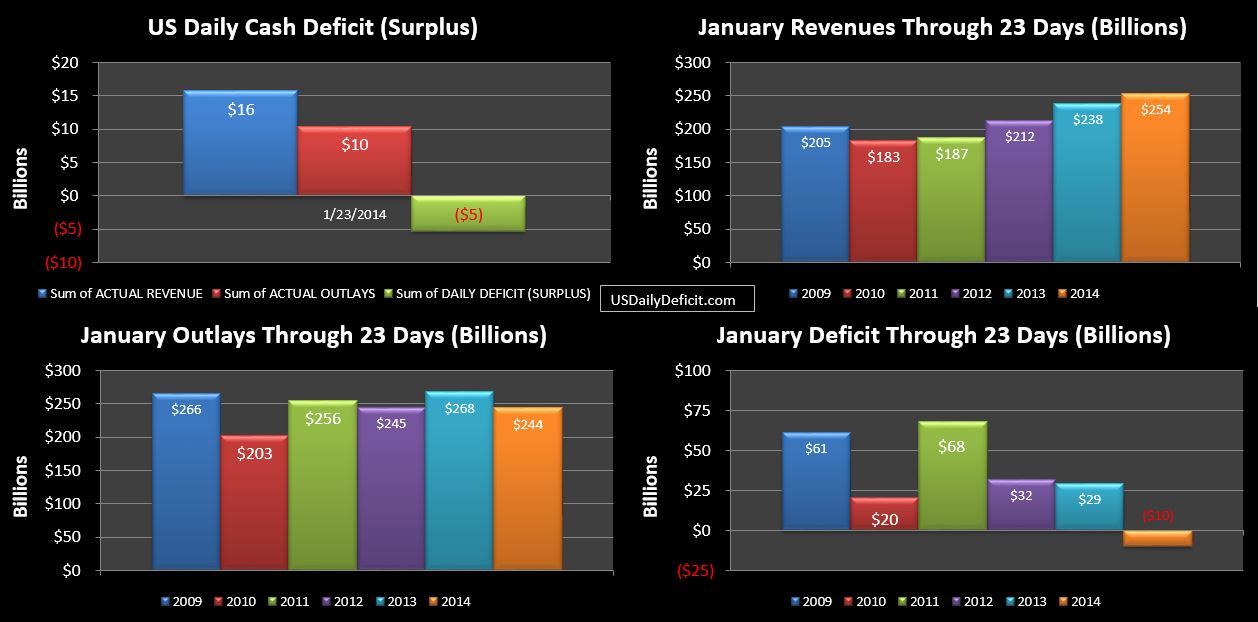

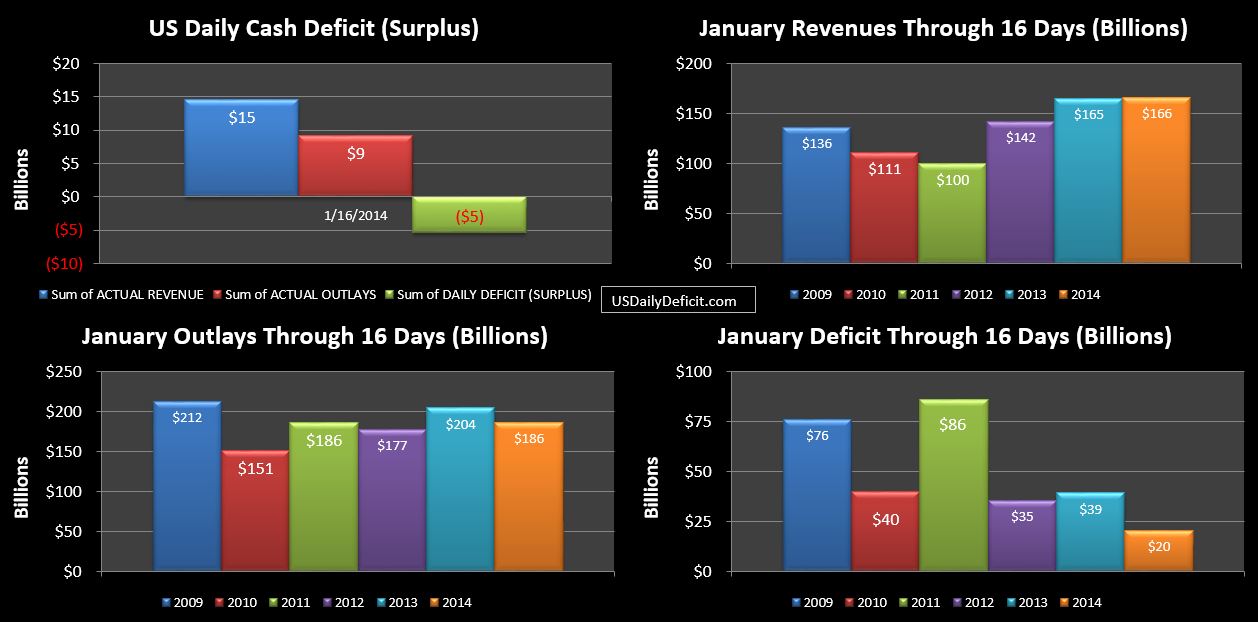

The US Daily Cash Surplus…the 8th surplus in the last nine days, with the only exception being an $11M deficit on 1/15 came in at $5.4B, bringing the cash surplus to $10B for the month.

Another good day for revenues…adding another $+5B on the day versus last year, though a good chunk of that was a $3B TARP deposit…cash is cash right? Per the Daily TARP report…the balance of TARP Assets remaining is now down to $8B…

So two days ago….I was sitting here pondering about whether or not we would make it to +$17B for the month…equating to a moderate 6% YOY gain. Two days later, we are sitting at +$16B….with 6 days left…so without a doubt…January is looking pretty good on the revenue front perhaps with even +10% is striking distance. I’m no optimist, but there is no denying that the trend is looking good through 23 days of 2014…let’s just hope it still looks this good in 2 more days 🙂