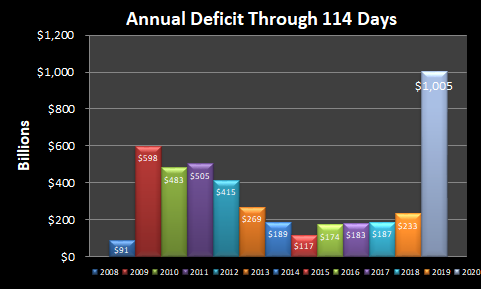

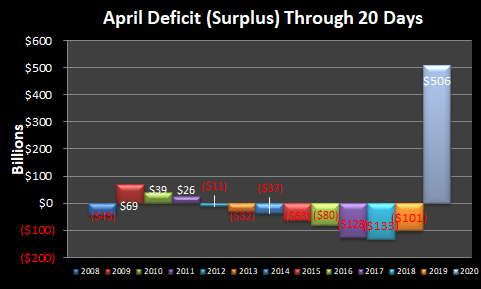

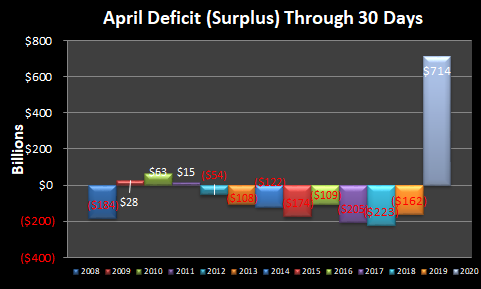

This is not a surprise given the surging outlays and collapsing revenue due to the Covid 19 pandemic…$714B is the deficit for April 2020. That’s huge…back in 2008/2009 the largest deficit posted was $306B driven by large TARP expenditures. To further put it in perspective it is larger than the entire annual deficit for every year between 2013 and 2016. Add to that the fact that April is generally a pretty solid surplus month thanks to tax day…we are really just a bit shy of a $900B YOY swing…in 30 days!!

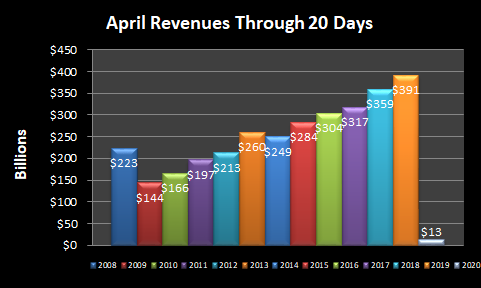

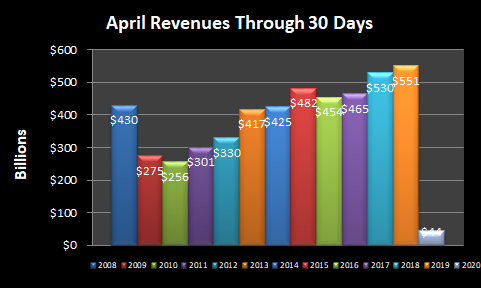

Revenues:

Revenues Collapsed as tax day was pushed back to July and at the same time refunds went out…we count refunds as negative revenue, so the combination reduced revenue from $552B last year down to just $44B. It’s bad, but not as bad as it looks…we should get some of that back in July…how much we will have to wait and see…maybe $100-$200B unless it is further delayed or offset.

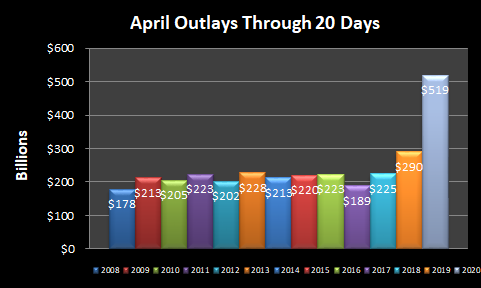

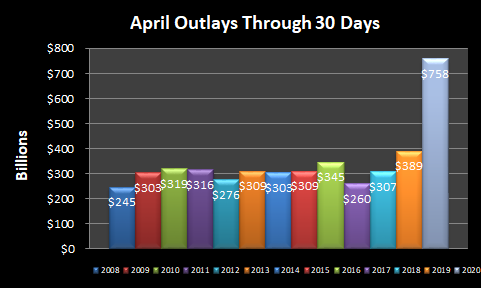

Outlays:

Outlays increased $369B YOY including a lot of new categories including the Coronavirus relief fund (140B) and 89B sent to the Federal Hospital Insurance Trust Fund.

Bottom line here is that this was just as big of a disaster as I expected, with the headline being a little worse than reality because of the push of tax day back to July which may just be a timing event. As a one time event…this certainly looks bad and accelerates the timeline of a US default, but I wouldn’t expect any issues like that immediately…that will happen with a sudden crisis of confidence…. I of course lost confidence years ago, but my little vote doesn’t count for a lot.. Real trouble begins when the US can’t issue new debt, people start to refuse to pay taxes into a failing system, and people start to refuse payment in currency because it is obvious to all it is worthless. We aren’t there yet…but the risk of this happening is higher than ever…especially with what is sure to be a nasty election just around the corner. We may make it through this gauntlet, but what if a State or Region decides they are not OK with another 4 years of Trump…or 4 with Biden? We are a divided county on so many issues…half or more of the population is going to be quite disillusioned after the election…paying off the debts of prior politicians whom they despise is unlikely to be a high priority…in fact they might make walking away that much easier…