Well…I’m a bit behind so let’s play catch up. January, if you recall posted a $24B surplus which was welcome but smaller than January 2017’s $32B surplus. It was an odd month…with an extra business day and “extrordinary measures” ongoing since the debt limit was not raised until early February. All together, revenues were up 5%, but outlays were up 8%…so the surplus declined.

Now time for my “Extrordinary Measures(EM)” Rant 🙂 As you all know, EM allows treasury to hide certain kinds of debt…making them disappear from the balance sheet…so they can issue new debt in its place…using those cash proceeds to fund the government when we are bumped up against the debt limit.

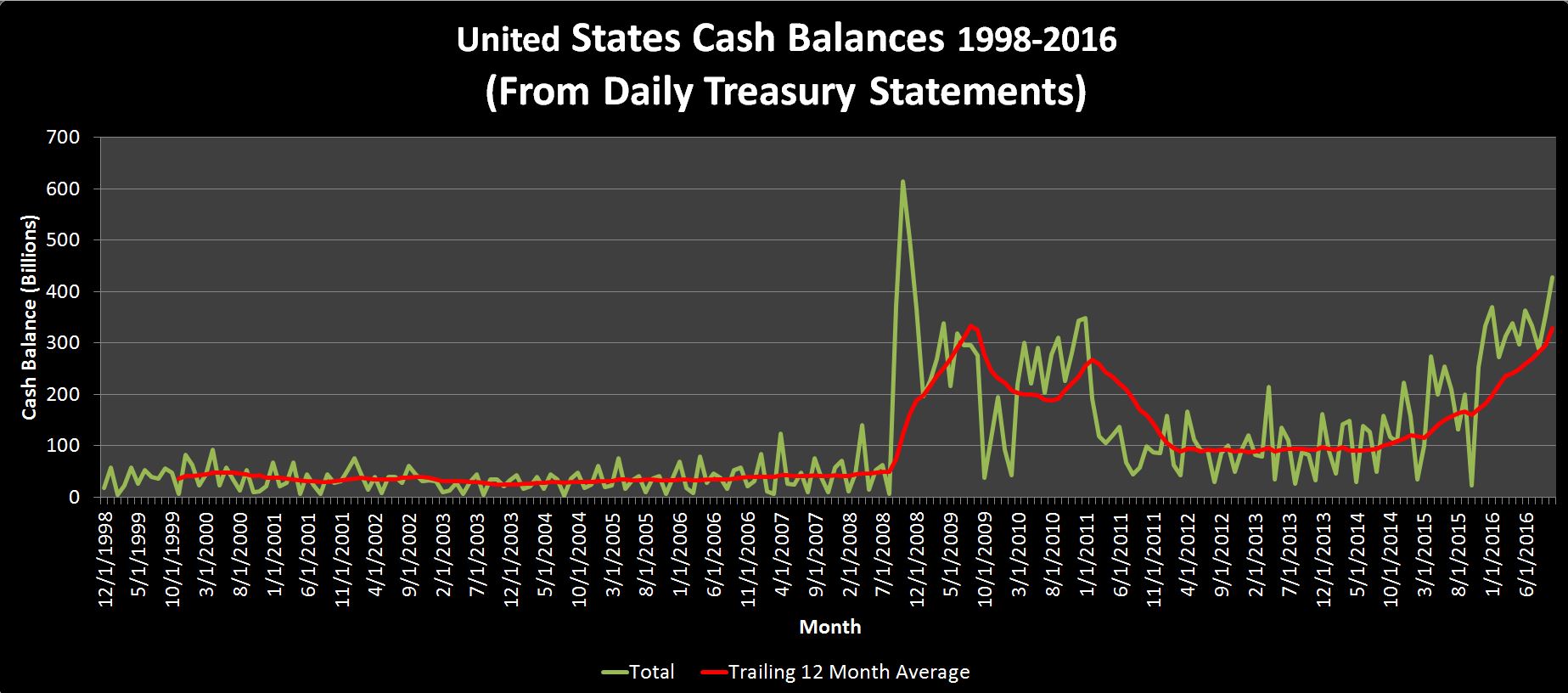

Now…what’s the point of a “debt limit” that you can essentially ignore to the tune of $300B??…but that’s not what my rant is about. We’ve gone over it before, but the cash deficit is an extremely simple concept….we look at the change in debt and the change in cash over a given period, and that’s the cash deficit. So if in a given day(or month)…treasury issues $100B of debt (debt +$100B) and cash balances increase $50B, we would say that the cash deficit for the day was $50B. We don’t book the deficit until the cash flows out the door. This used to not be an issue, but since 2008, Treasury has carried cash balances between a low of $3B and a high if $715B, where as before they kept it pretty flat at around $25B. Bottom line…if we ignore changes in cash, we can understate or overstate deficit/surplus by hundreds of billions for a given month.

Back to the rant :)… EM essentially nukes this math. I can estimate it during EM, but it can be off by ~5B a month. So…WHat I have to do after EM is finished is recalculate the deficit from the start of EM to the end…..figure out how much I missed it by, then I just divide that by the number of days and plug in an adjustment….which drives me nuts. It’s not huge, but essentially is taints year over year variances for a year or so, and since we play this game every 18 months or so, it just drives the accountant in me nuts….rant off, and thanks for bearing with me:)

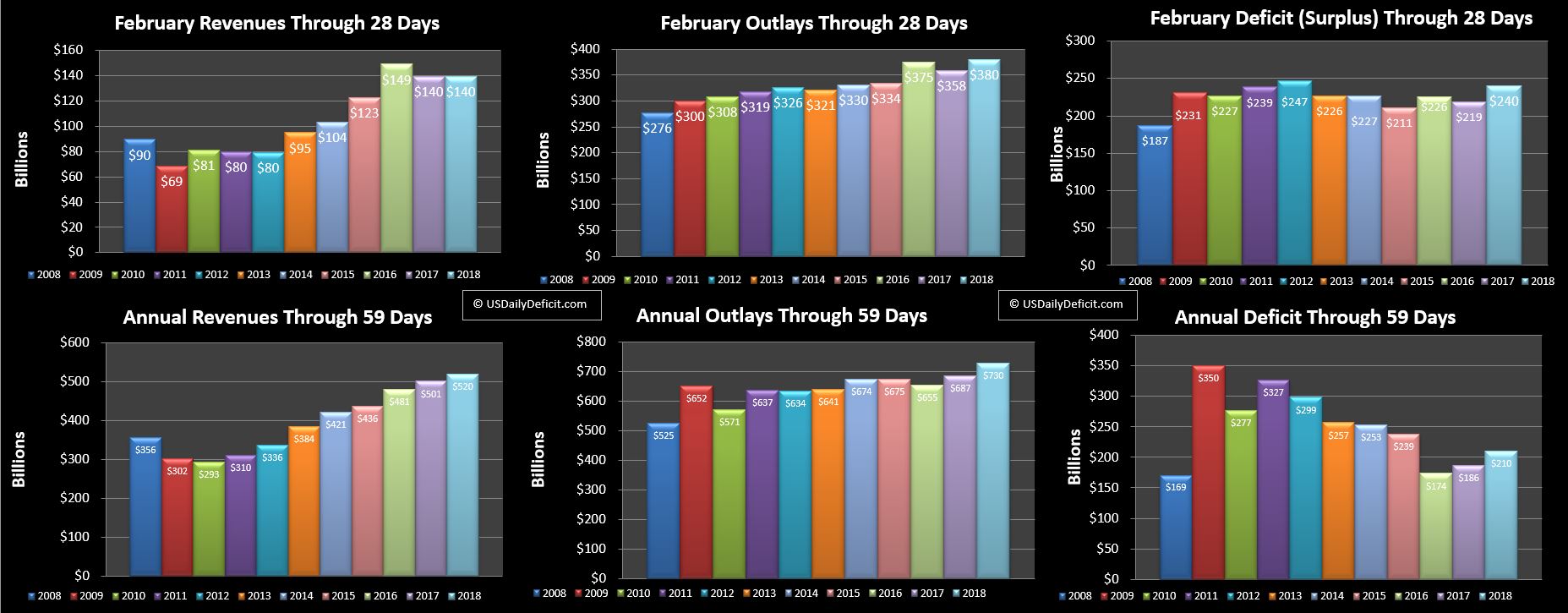

Now… to catch up…Real quick, let’s use the EM adjusted numbers…January improves a bit posting a $30B surplus and February is below:

February always has a massive deficit due to tax refunds, so while $240B isn’t a surprise it tops 2017 by $21B, and that’s more than a rounding error. We see that revenues are flat and outlays are up….remember that because it is likely to be the story of 2018.

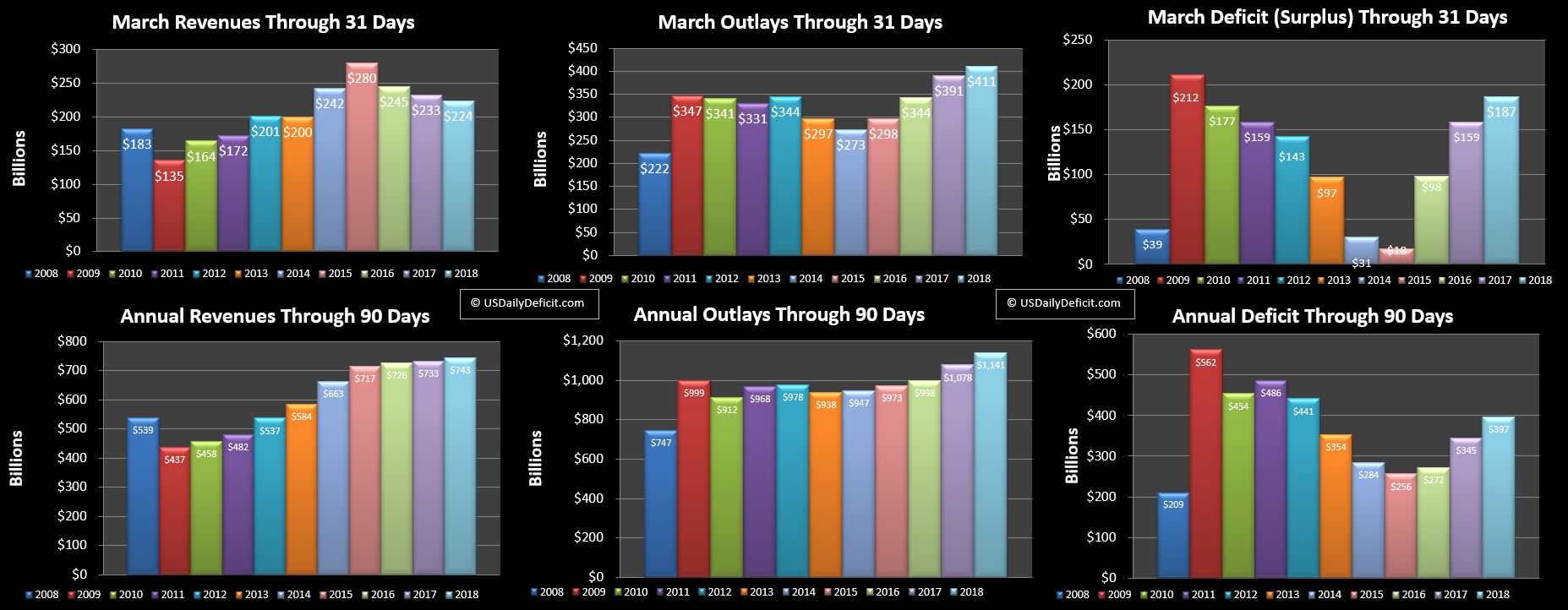

And now let’s look at March:

Again, March is a big deficit month, so this isn’t a big surprise but $187B is $28B higher than last year. Pay attention guys….it might be time to start getting worried.

Revenues:

Recall January….unaffected by the tax law changes actually posted a good revenue month. February was flat YOY and now we have an actual decline. Looking at the year through 3 months 2018 is still holding on to its January lead but it is only $10B and +1.4%…..and apparently declining. Now, April is always a wildcard with tax day 4/15…it could save the day or blow a hole in the whole year…we’ll know more in a few weeks. Looking at the big picture beyond April, while my crystal ball is as hazy as ever, we now have a few data points that indicate the tax cuts are indeed reducing tax receipts….nothing huge, just a few percent probably….but that’s a material difference from the past where revenue growth was at least a few percent positive and able to somewhat blunt the deficit impact of growing outlays.

Outlays:

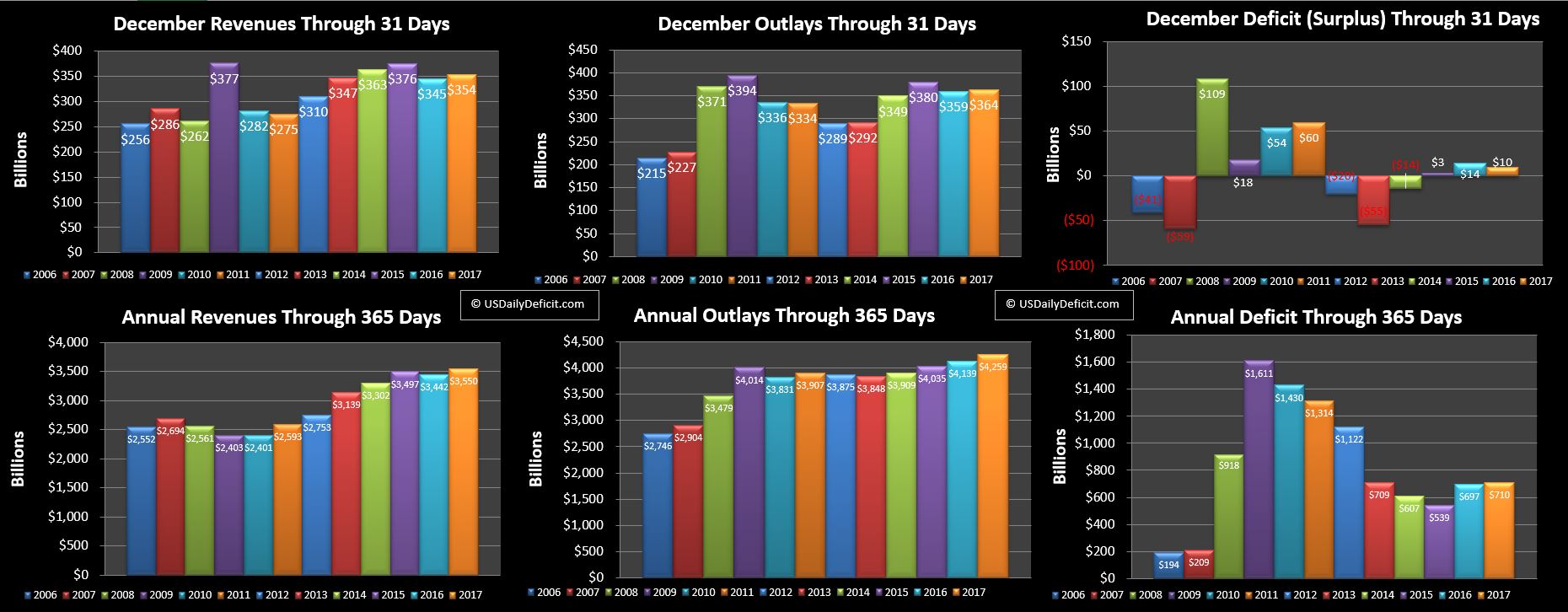

While revenues are at +1.4% and declining, Outlays are up huge at +5.8%. That may not seem so massive, but when the federal budget is $4.3T….that’s about +$250B a year, and without revenue gains to offset it it’s not hard to see how we could be knocking on $1T deficits by the end of the year and blowing past it in 2019, and that’s assuming business as usual….can we assume that with all the craziness going on? I guess we still have hope 🙂

Deficit:

Through 3 months we are sitting at $397B, $52B over last year, and as noted above, the problem is simple…revenue is up 1%, outlays are up 6%. We can swing that for a quarter, or even a year….but all it will take is a few years of compounding and …well…you do the math:)

Looking Forward to April:

April is tax month, so look for a big surplus to provide some temporary relief to our current $400B deficit through the first quarter alone. Last April we had a $206B surplus and that seems like a reasonable estimate again, but April can be wild, so +/- $50B to cover:)

Looking Forward 2018+:

I’ve been watching this series for long enough to know better than to get too excited over a few months of data, but my eyebrows are definitely raised by February and March revenue data. There are a few one off’s in there that make it look better than it really is, and +1.4% doesn’t look good at all. Now, I know this site is called the Daily Deficit, but the truth is I haven’t reported daily deficit numbers in a while…though I do still track them daily here.

For years now, if you lined up the days of the week with the prior year, you could see that withheld taxes were edging up…just a few percent, a few tens of millions, perhaps a hundred million in a given day. This made sense…more people were employed, maybe making a little bit more money, so Uncle Sam got a little more each day. Now, for the first time since 2008/2009…this is not the case. Obviously we know why, and for those who got tax cuts that’s not exactly bad news, but I have to wonder if perhaps the end is getting near.

It’s no secret the US government will ultimately default on its debt….the on($21T+) and off balance sheet debt ($100T+??) is unpayable, and has been for a long time now…nobody wants to talk about it, but it’s true and indisputable. However….with interest rates near 0, and the deficit more or less stabilized at $500B +/-$200B…as recently as a few years ago it looked like the game could go on, if not forever, perhaps maybe a few decades more??

That equilibrium now appears to be on the brink of being nuked. If the above discussed rates hold, or even get worse, we could be blowing through $1T annual deficit by early next year and past $2T just 3-4 years later. I’ve been wrong before (and will be again) but I don’t think we’ll get too many years of $2T deficits in the bank before it all goes boom….not that this would be a bad thing….For those not foolish enough to lend Uncle Sam tens of trillions of dollars, post Bankruptcy USA might just be a good place to enjoy the American Dream!!

As always…stay tuned!! April’s going to be exciting so I’ll try to do a mid month update, but no promises.