2018 is now in the bank and it was pretty ugly no matter how you look at it….but first a quick look at December.

December 2018

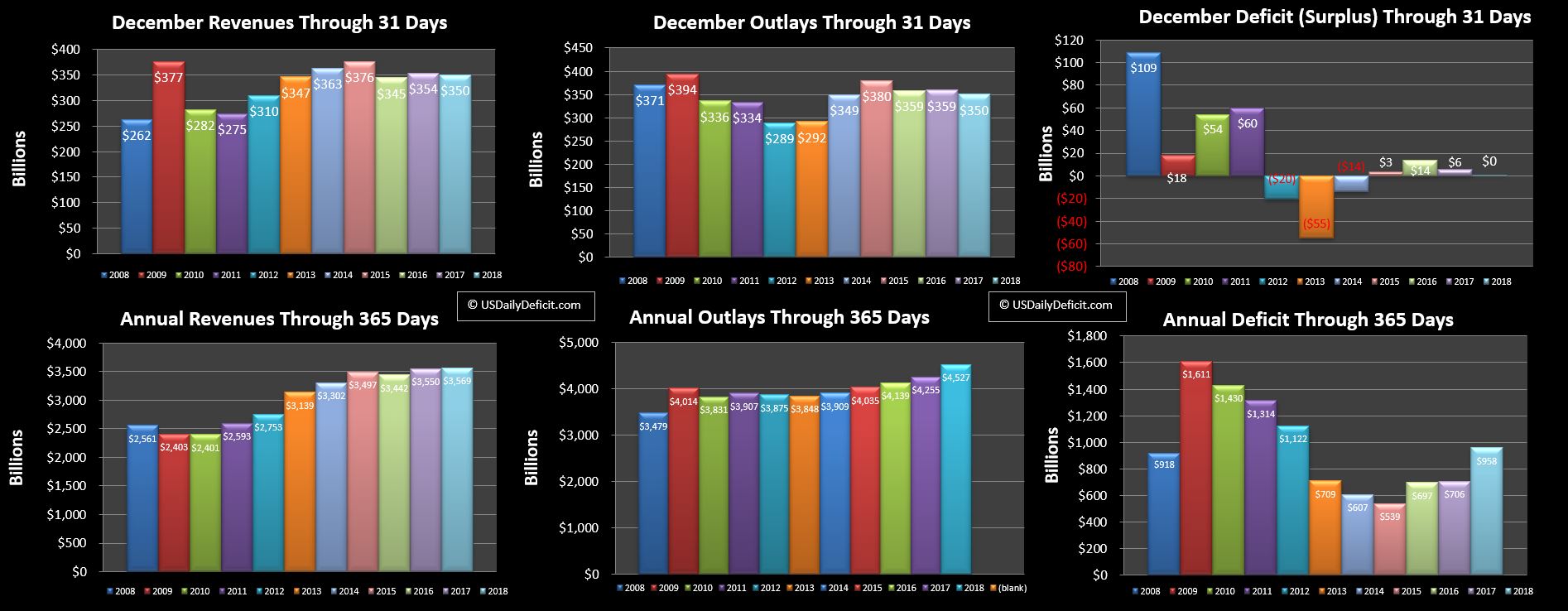

We entered December with a $958B deficit and I expected a small surplus of about $20B as the timing issues from last month rolled off, helped by strong December revenues we normally see at the end of a quarter. But it wasn’t to be….despite dumping $45B of cost into November, December only managed underspend 2017 by $9B…good for an adjusted $36B increase in spending…about 10%. Revenues were down $4B…again, not a surprise given the tax cuts but still not the right direction. Put it all together and while it shows up as 0 on our chart…December posted a small $83M deficit….$0.1B for fans of rounding….leaving the 2018 cash deficit unchanged at $958B

Revenues

Looking at the full year, revenues were essentially flat, up just $19B, or about 0.5%. That’s actually less impressive than it looks if you can remember April which posted a blowout $65B increase in revenue YOY….the last breath of 2017 pre-tax cut rates. Pull that out and we would have been negative 1.3%. But…it did happen…good for 2018, but when we start looking at 2019 YOY…it could get very ugly very fast, but who knows….

Outlays

Outlays were the surprise for me…up 272B on the year good for a +6.4% increase over 2017. In”normal” year….if there is such a thing…I would say +4%…which was my estimate 12 months ago, and will be my estimate for 2019 as well. Most of the increase is where you would expect….medicare, medicaid, and social security, but also interest was up big and growing fast as rates were increased…so expiring debt is being rolled into higher rates…for example 3 month yield started the year at 1.29% and ended it over 1% higher at 2.44%….and all of this is off lows nearly 0% not so long ago. Put the big boys together with increases across the board and +6.4% wow!!….

Deficit

$958B!! After bottoming out in 2015 at $539B…it has taken just 3 years to get back to the cusp of $1T again….which we will probably touch no later than this coming April with the TTM. Looking at the wayback machine I had forecasted a $980B deficit…no too shabby right!! However…I did miss on the internals…guessing outlays at +4% and revenues down 3%. Revenues ended up flat, and outlays were up 6.4%…still…I’ll take it!! 🙂

2019 Forecast

First off…nothing here is rocket science….with numbers this big….it’s really hard to see big swings….so I am going to go with outlays +4% and revenues +2%. Pencil that out and we should see the cash deficit grow $110B next year to $1.068T….growing at ~$125B a year beyond that….if we assume a nice steady state :)…not a bet I would take by the way….but a good reference point if you want it.

Default Near?

I asked this question last year….so we’ve made it another 365 days. Here is what I know…the debt is unpayable. Period. No combination of growth/tax increases could ever pay down this debt…much less pay it off….we are after all digging at a rate of $1T per year despite an economy that seems to be humming along ok with very low unemployment. What we can do…and what we have been doing for the last decade is continue to roll the debt at honestly…not so high interest rates as long as the market will allow….until the day we can’t…..in which case it could all get quite nasty over just a few months. Will that be 10 years from now as the debt closes in on $35T….or could it be this as soon as this year when it becomes clear Trump and Pelosi will not make nice? I don’t know….but I do know we are now 365 days closer to default day than we were last year….and our hand is getting worse by the day…..penny by penny. Throw in even a mild recession and that $1T could turn into $2T nearly overnight as Republicans and Democrats unite to increase spending and lower taxes. So is 2019 the year?…. It certainly feels a lot riskier than 2018, but to be honest…Hell if I know….stay tuned!!