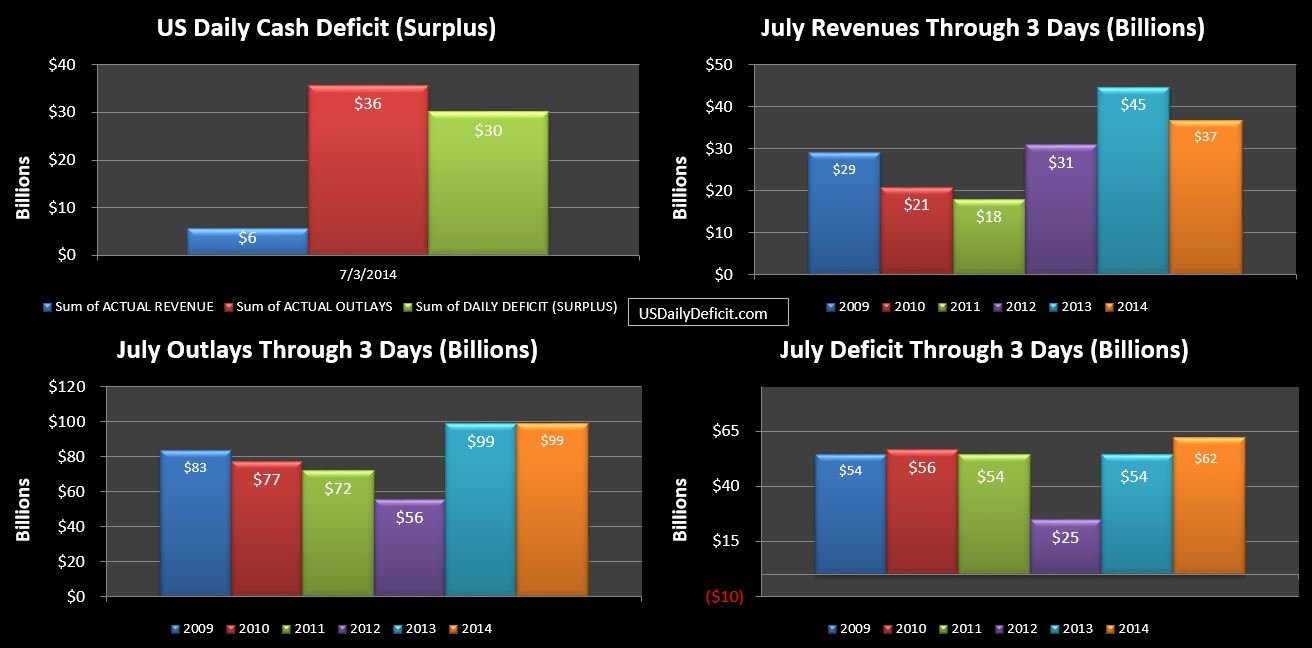

The US Daily Cash Deficit for Thursday 7/3/2014 was $30.1B, following a $6.4B surplus on 7/2 and a $38.4B deficit on 7/1. Add them all up and the Deficit through 3 days rings up to $62B….knocking out a big chunk of June’s $78B surplus in only 3 days. Nothing extraordinary about this…most months are heavily front loaded in outlays thanks to Medicare, SS payments, and other monthly outlays that typically go out in the first few days of the month. Still…it’s a bit sobering.

Above is our first chart of the month….with revenues down $8B and outlays flat. Also note that this is completely unadjusted….3 days of 2013 vs. 3 days of 2014….I noted in my forecast post that July was at a bit of a timing disadvantage, and a big part of that is that it started on a Tuesday…which typically has weak revenues, especially compared to July 2013, which started on Monday…which generally has the strongest revenues. Regardless…2014 starts in a hole…and is going to need solid revenue growth for the remainder of the month to dig its way out.

It was just a few days ago that I forecasted a $60B deficit for the entire month…and yet here we are 3 days in at $62B. I’m going to stick to it for now though… In a few weeks the timing should start to even out and if revenue continues to show moderate growth between 5-10%….my forecast should be ok…..if….