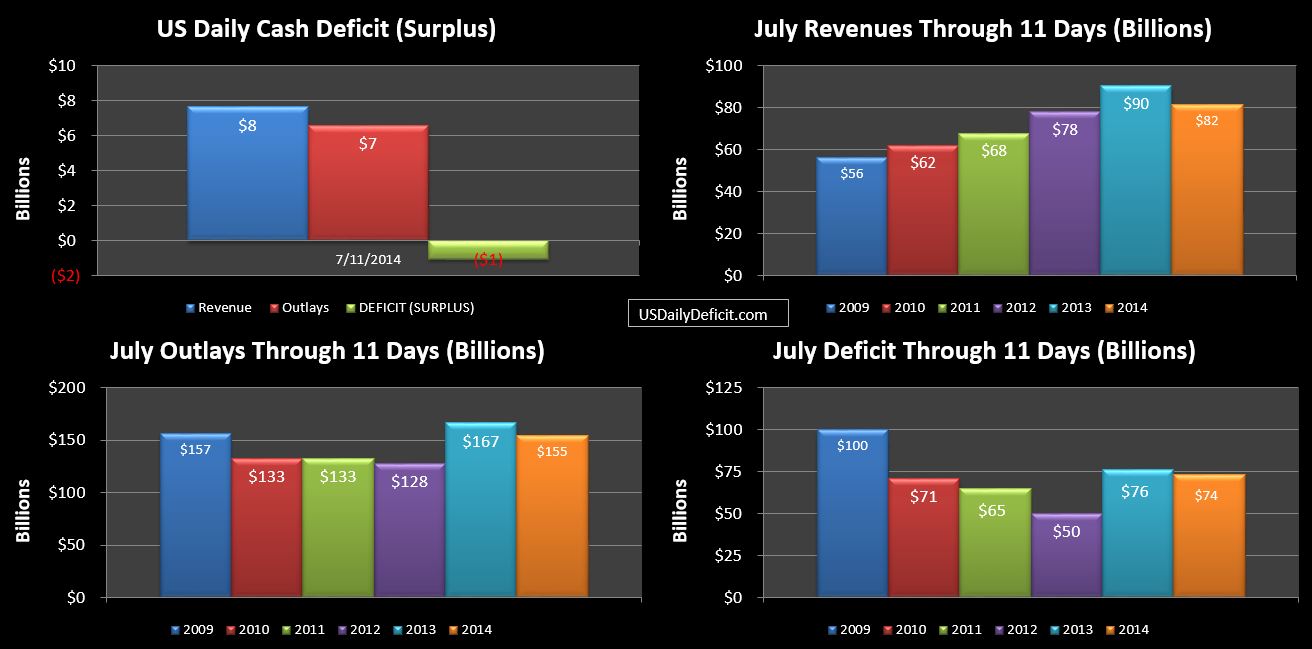

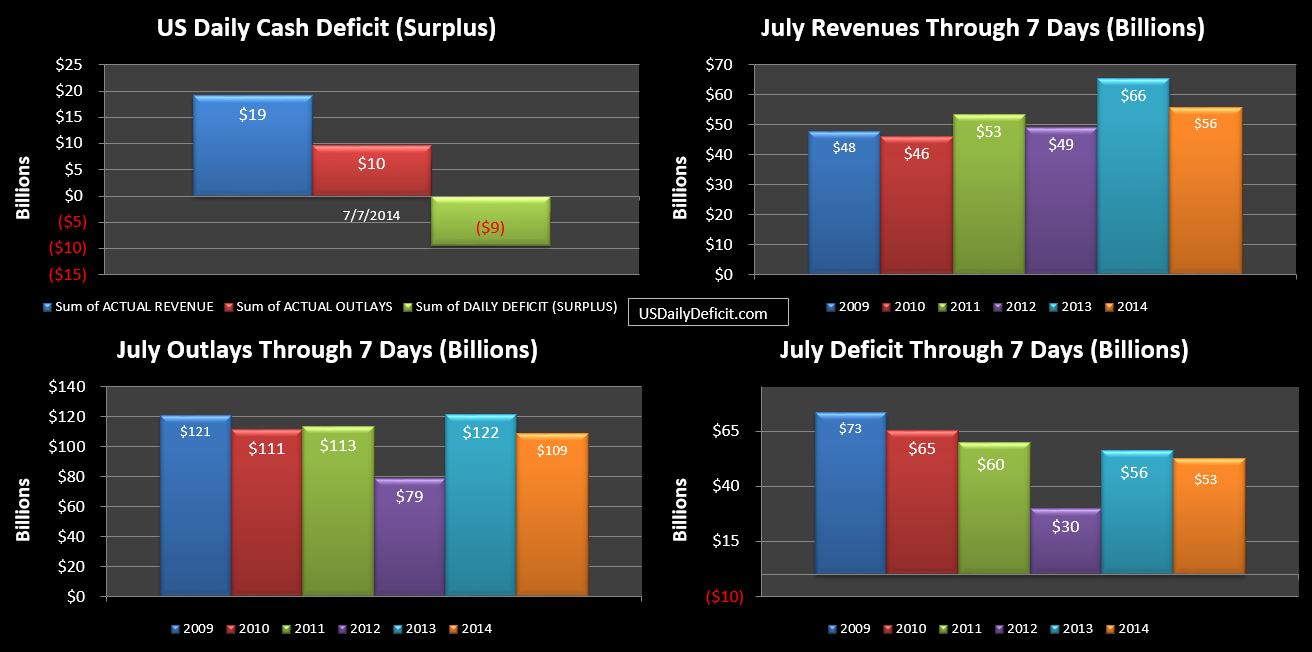

The US Daily Cash Surplus for Friday 7/11/2014 was $1.1B bringing the July 2014 deficit to $74B through 11 days.

Revenues slipped a bit…probably due to timing of corporate income taxes and excise taxes….so we should get that back over the next few days. Outlays were also down, roughly offsetting the revenue declines and leaving the July 2013 vs 2014 deficit unchanged at -$2B. Recall…my July forecast was for a $60B deficit…compared to 2013 at $90B….so we have a lot of ground to make up if we are going to hit $-30B. There are 14 business days remaining…so we need to average $2B a day to get there.