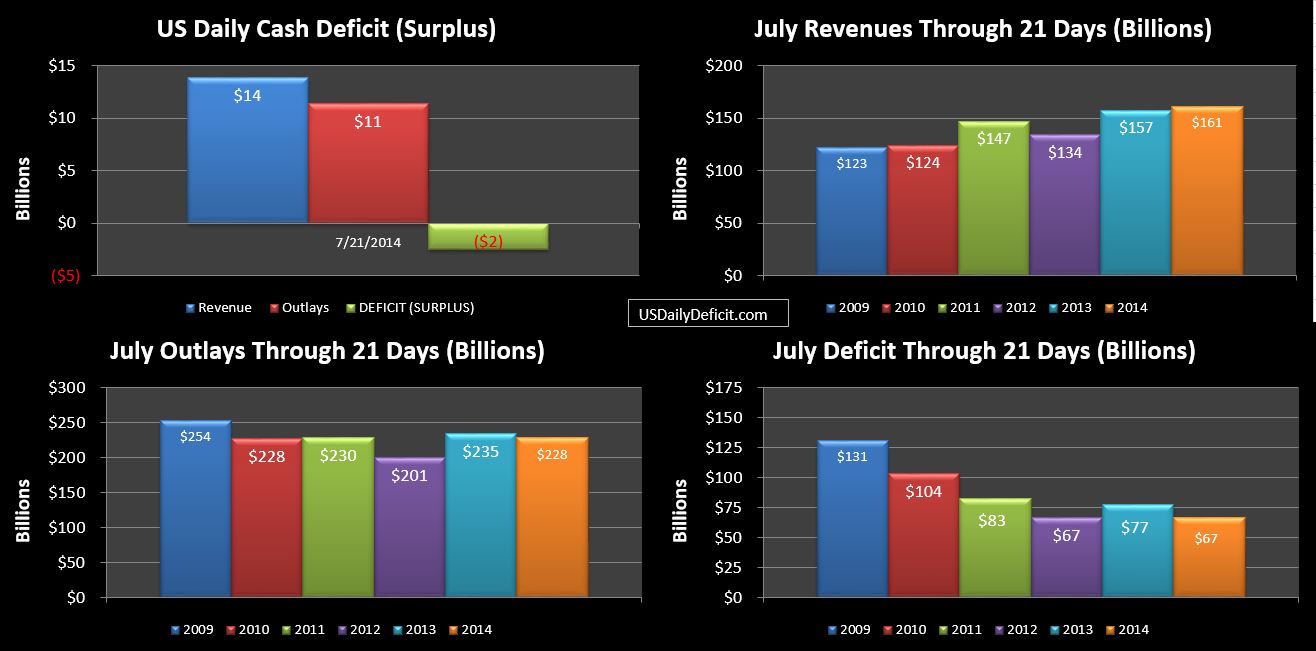

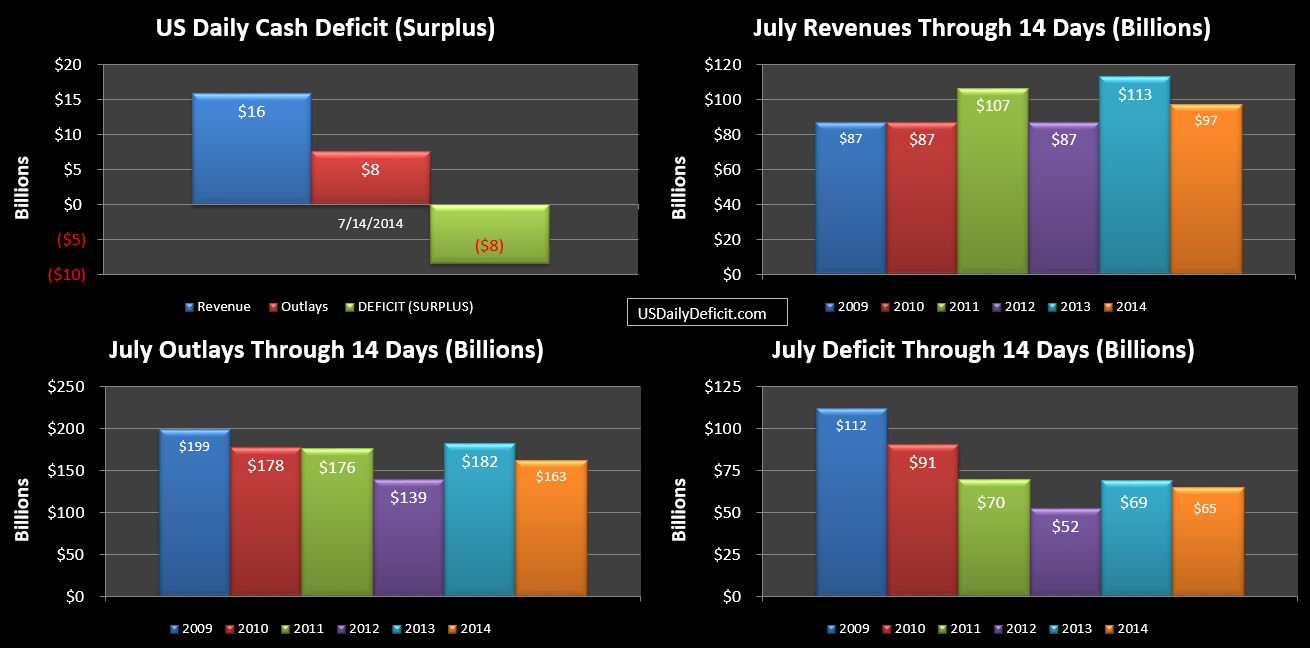

The US Daily Cash Surplus for Monday 7/21/2014 was $2.5B bringing the July 2014 deficit through 21 days to $67B.

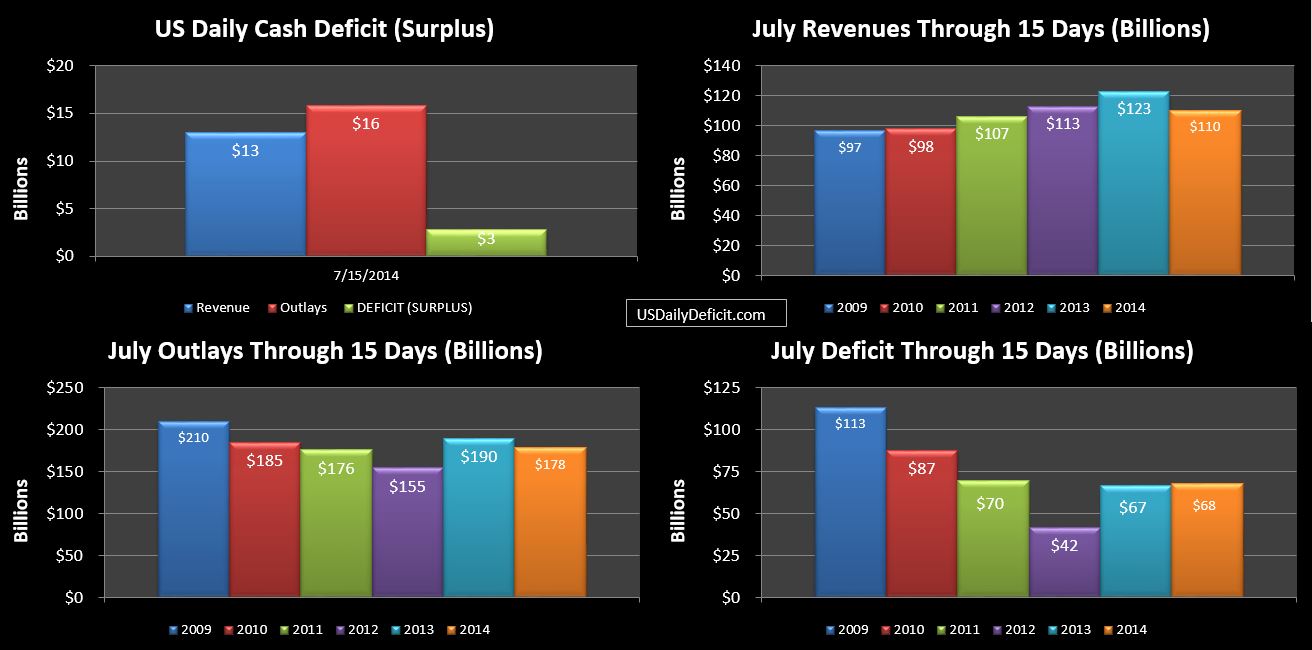

For the day…YOY revenues were flat with outlays gaining about $3B mostly on Medicare and Medicaid. Medicaid now sits at $19.442B, just ~$3B shy of the full month of July in 2013 at $22.744B. With 8 days remaining, and a run rate a bit over $1B a day…$27B is quite possible. That’s nearly 18% YOY growth for the month, but to put it in perspective….that’s about $50B per year annualized…or about the same annualized $ growth we are seeing out of SS…a program nearly 3 times the size of Medicaid.

That said….as long as revenue keeps growing at a +5% rate…the deficit will continue shrinking…just not as fast as it has been. And that’s why I watch revenues so closely… If we get 3-4 months in a row of minimal revenue growth….it’s time to start getting worried(more). April-May was close…but June was ok after adjustments for Fannie, and July looks to be over 5%