If you listen to the news or read any article, there is a lot of hype around this 10/17 “default” date. “The US has never defaulted….this would be catastrophic”…they all claim.

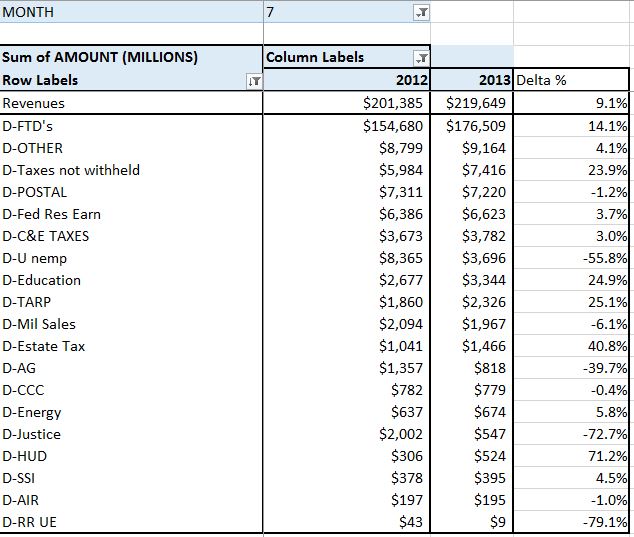

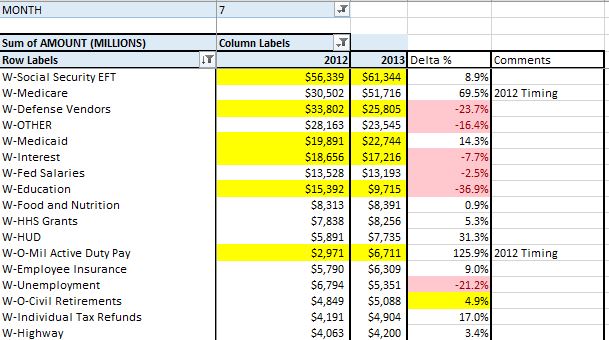

So first we need to discuss what we mean by default. As discussed in The Debt Limit Will Be Raised, looking at the first full month…November, the government will still have about $200B of revenues coming in, but about $330B of scheduled cash outflows. So we really aren’t talking about the federal government grinding to a stop…just being forced to live within it’s means. Most (but not all) of the commentators are being careful with their words…saying we would default on out “obligations”…which I suppose means all currently planned government spending (is it a default if I decide to eat in instead of taking the family out to dinner tomorrow night?).

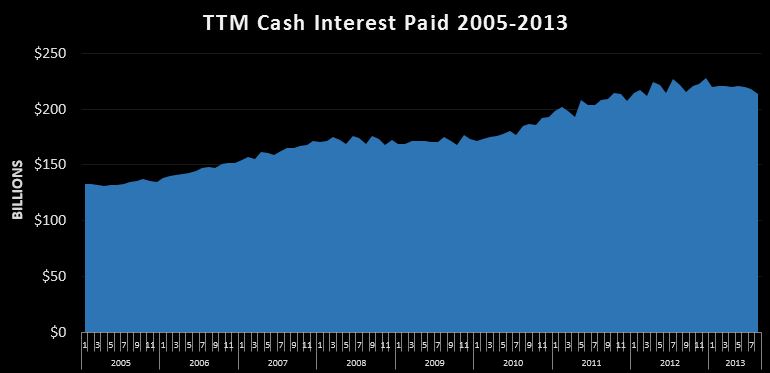

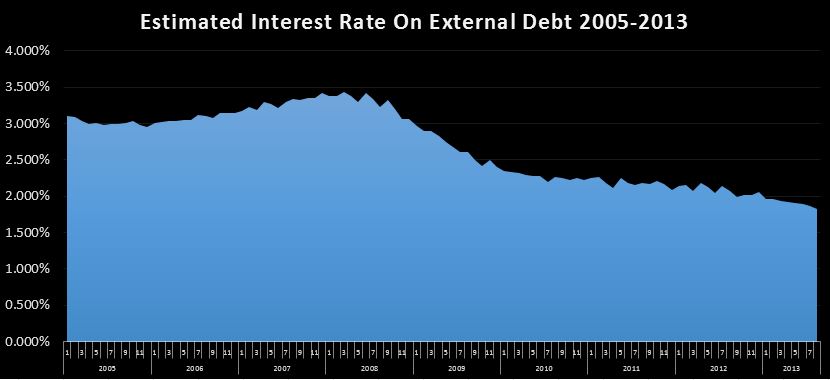

We should be very clear however, that the federal government will have more than enough cash inflows to cover all interest payments and continue to roll current debt as it expires. Over the past 12 months, the government had $3.058T of cash revenues….and only $225B of cash interest payments…a coverage ratio of over 13X.

So…this is extremely clear… any technical default on bona fide on the books debt…will be a completely voluntary event. I have read some articles saying the treasury system simply is not set up to prioritize payments….basically first in, first out. To that I say…BS.

But on the other hand…default on “obligations”…is definitely imminent. In November, there will be a ~$130B cash shortfall if treasury isn’t allowed to issue debt….more than 1/3 of scheduled cash outflows. The only think that even comes close to that is cancelling Social Security, Medicare, and Medicaid….not exactly a solid 2014 election platform….which is why I still expect the debt limit to be raised, probably before it comes an issue, but if not, by early November.

I’ve been saying for nearly a year now that the US will ultimately default on both on and off balance sheet debt. We have reached a point where the promises made for debt and social programs are simply impossible to ever make good on. I still think it is unlikely that October 2013 is the date of that default. (not that it will be one date…probably a long drawn string of broken promises) So to wrap it up…default will happen and default needs to happen…..but what is going on now is just political gamesmanship, so sit back and enjoy the show. Odds are, they will raise the limit, and agree to shave a few billion off the 10 year deficit at some date to be determined….ensuring an even bigger and “badder” default at some point in the future. Note to self…”don’t lend Uncle Sam any money”