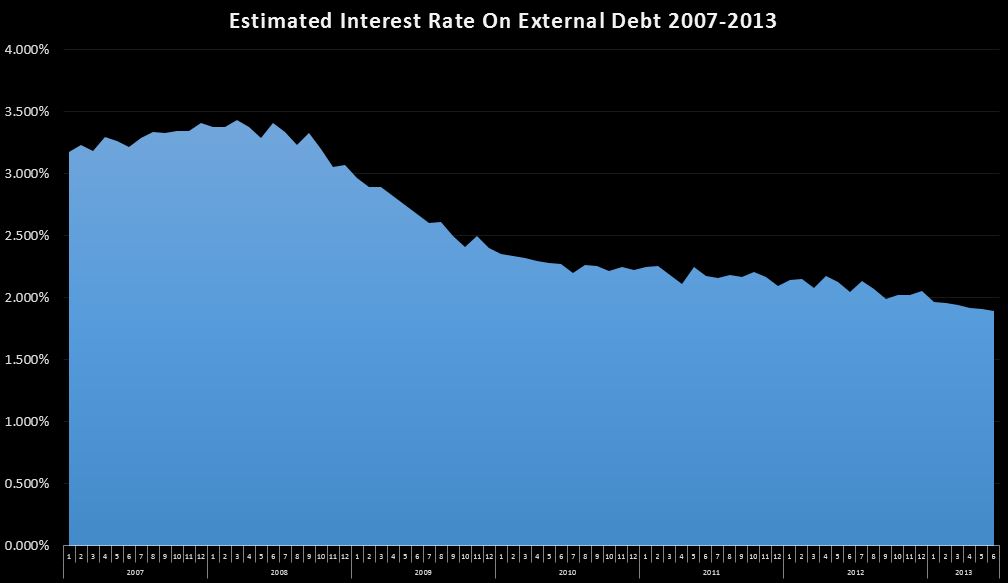

Over the last 12 months, about $220B of cash interest payments have been made on a rough average of 11.6T of external debt(Average of last 12 month ending balances)…for an estimated rate of 1.895%…not too shabby for unsecured debt.

1.895% is the low point in my data series…going all the way back to 2002, and is almost certainly the lowest ever. I’ve mentioned before that this is one of the key metrics I keep an eye on because the only way we as a nation have managed to get this far is the extremely low rates. It is my hypothesis that this is the real reason the Fed has been manipulating rates so low for so long…if they ever go up…the long term deficit goes kaboom. There has been a lot of talk lately about rates going up, in fact I looked at it just a few weeks ago in Interest Rates Rising – What Does It Mean For The Deficit??

In that article, I came to the conclusion that the recent increase in rates, while not a good thing (for the deficit) it was unlikely to have any short term material impact on the deficit. A few days ago, I stumbled upon Treasuries Monthly Statement OF Public Debt (MSPD) which gives us a breakdown of the debt outstanding…by each issuance. This gave me the data I needed to take an even closer look at the internal mechanics of our debt and cash interest expenses.

So let’s first envision a scenario where the national debt is $11.6T, but that it is stable. That debt is made up of hundreds of different issues…each for a unique term, set by the market rates at the time they were issued. For all of these together, we know that the weighted average is about 1.895% at present. So as we chug along in our steady state…each month, old issues come due, so they are paid, and replaced by new issues…at current rates. If the expiring debt is a higher rate than the current rate…the weighted average will continue to decline over time.

The MSPD data set gives us the ability to see what debt is expiring, and this gives us some insight into the direction of rates…at least in the short run. So let’s look at the data. It just so happens that 3 years ago, on 7/15/2010, Treasury issued about $35B of 3 year notes at 1%. Those notes were paid yesterday. So I went over to yahoo, and it looks like the 3 year’s going rate is about 0.6% today…so theoretically…Treasury could have essentially refinanced that $35B…at nearly half the rate. The savings are about $1.4B per year.

Another example is the 30 year bonds issued in Feb of 1985…$10.5B at 11.25%. I don’t know what rates will be in a year and a half, but there is a pretty good chance it’s way under 11.25%. If it’s not….you’ll have bigger concerns. Obviously…this refi will lower the weighted average rate…even if it comes in higher than the 1.895%.

Just glancing at the next 12 months of expiring notes (2-10 years)…there is about $1.3T, and the vast majority of it is at higher rates than it could be rolled at today’s rates. So, while rates seem to have come up a bit off of some extremely low lows….rates are still lower than they have been historically, and this will continue to push the effective rate down…probably for at least a few more years. Rates are still extraordinarily low, and for the sake of the deficit, I expect the fed to keep them here until they no longer can. Even then… given the massive amount of debt outstanding, it will take a few years of rolling from lower rates to higher rates before we start to see material increases in interest expense. All of this of course assumes they can roll debt at any rate…which maybe a bad assumption….I know I wouldn’t loan Uncle Sam any money, but that’s just me:)

So for the time being, I fully expect the effective interest rates to continue a modest decline, roughly keeping interest paid the same, despite debt continuing to grow (at least after the debt limit hike is passed…which it will be) While interest is definitely going to be a huge problem over the long run when the fed loses control of rates and we have to start paying market on ~20T or so of unsecured debt….in the short term, it’s going to take a lot larger swing in rates than we have seen to date to make a material impact on the budget deficit.

Catch up (June/July 2018 Cash Deficit)