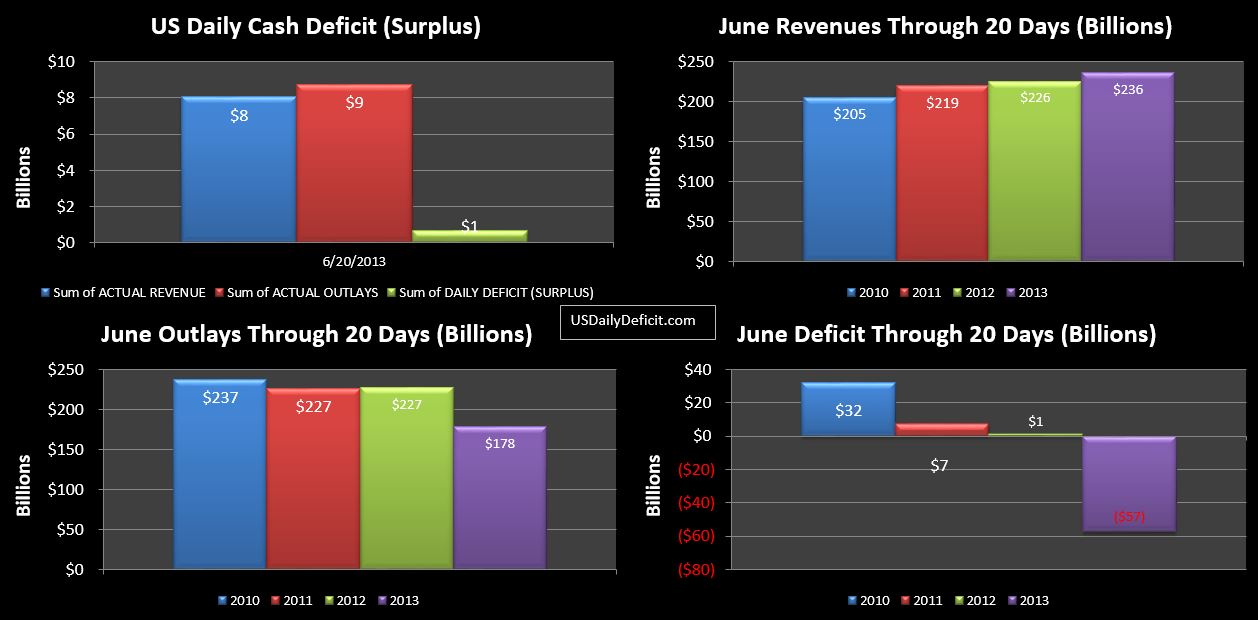

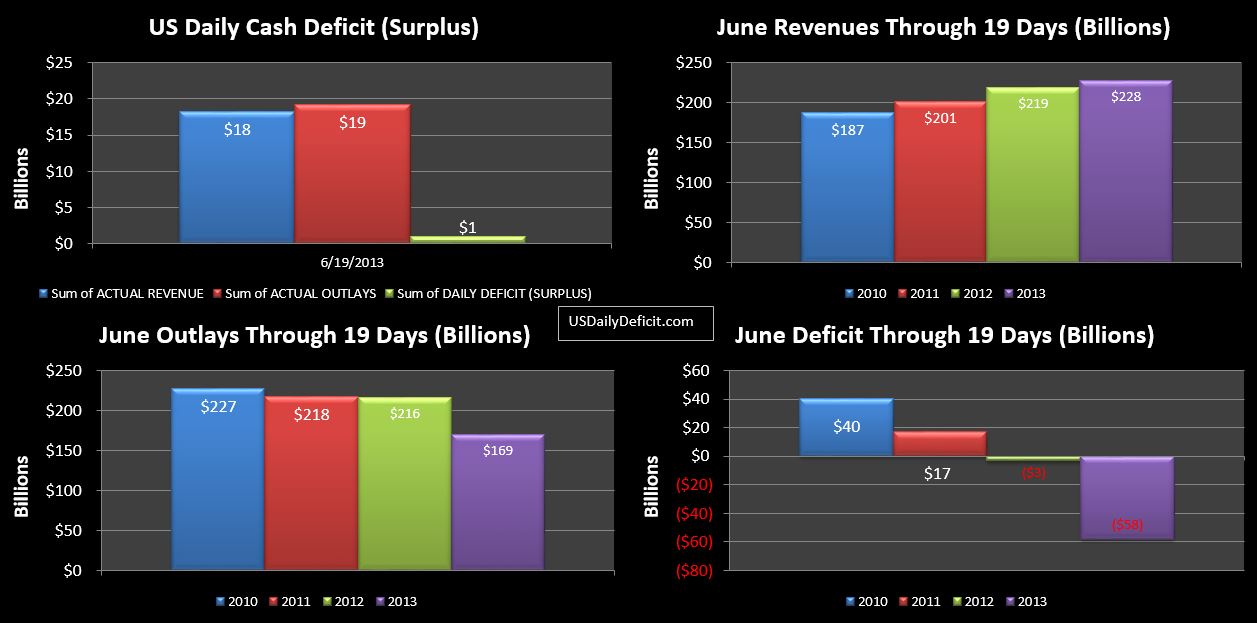

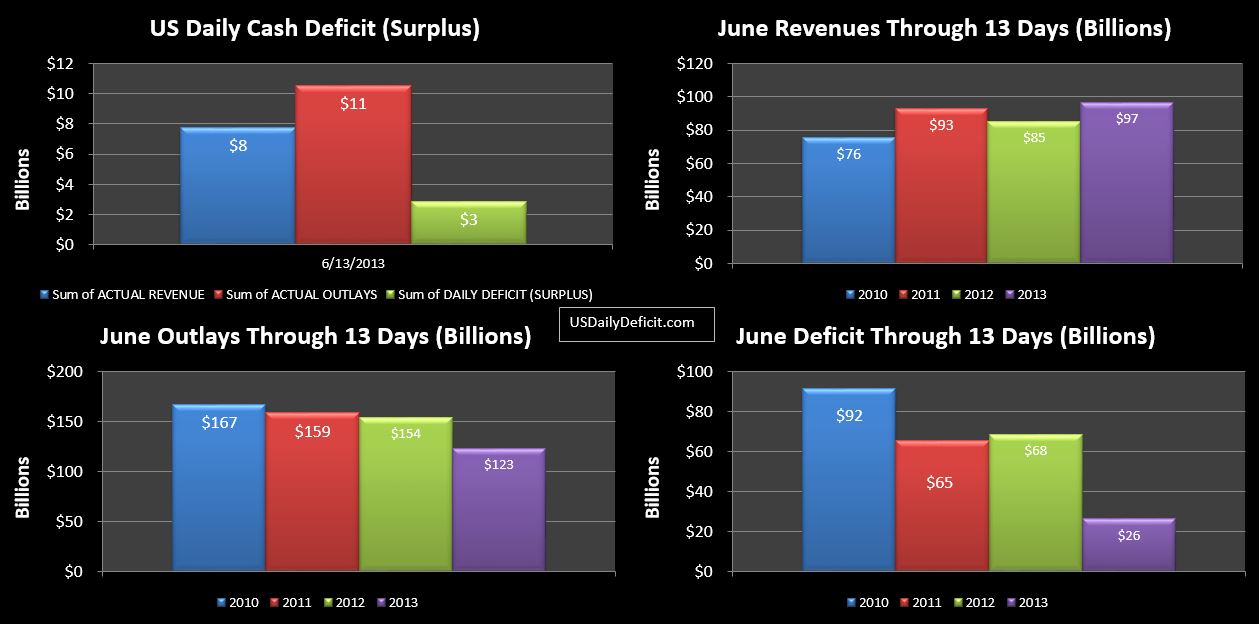

The US Daily Cash Deficit for 6/20/2013 was $0.7B bringing the June 2013 Surplus through 20 days to $57B. While declining, tax deposits “not withheld” did not drop off as steep as they did last year, putting a $2B dent in the YOY gap, and pushing the 21% decline we had through yesterday down to 15%. With a $6B gap remaining, it doesn’t look like we will come close to posting a 32% YOY gain like we saw with the first four months of the year. While obviously anything could happen…a second month of actual declines from this revenue category seems likely at this point.

With six days left…I’ll go ahead and forecast the June deficit, if for no other reason than to see how much I can miss it by 🙂 Flipping back a few weeks, I think my last estimate was $105B surplus. As it sits, we are at $57B. I’ll add $60B for the rumored Fannie Mae payment….though I find it odd that I have not been able to find any recent news stories on this. That gets us to $117B surplus. I’d actually be happy staying with $105…assuming that we’ll run a $12B deficit (excluding Fannie) over the next 6 days, but that seems a little light, so I’ll bump it down $5 and just guess and even $100. If Fannie doesn’t come through, or we get some other surprise revenue…like from Tarp or Freddie….I could miss big, but I don’t really have a good way to guess those…we’ll just have to wait and see.