The US Daily Cash Surplus for Wednesday September 30 was $20.6B bringing the September full month surplus to $65B, a $2B improvement over 2014’s$63B surplus.

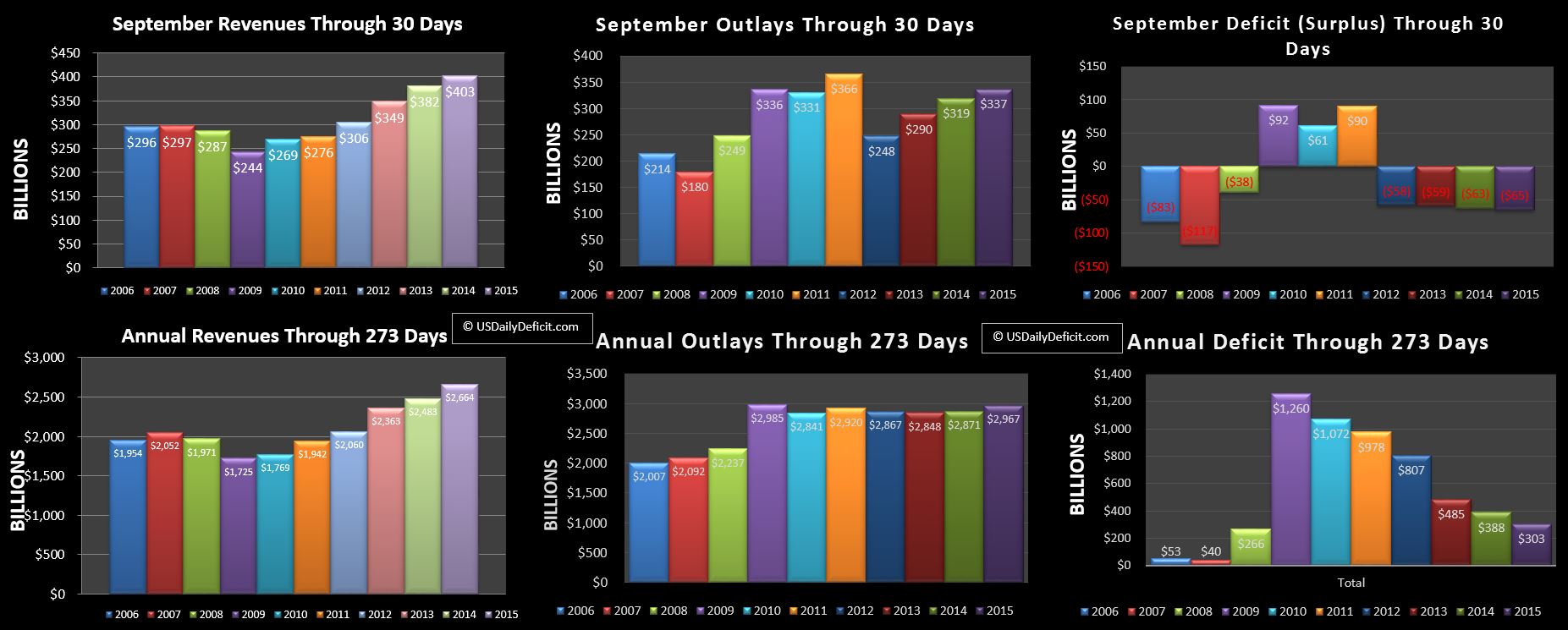

Revenue:

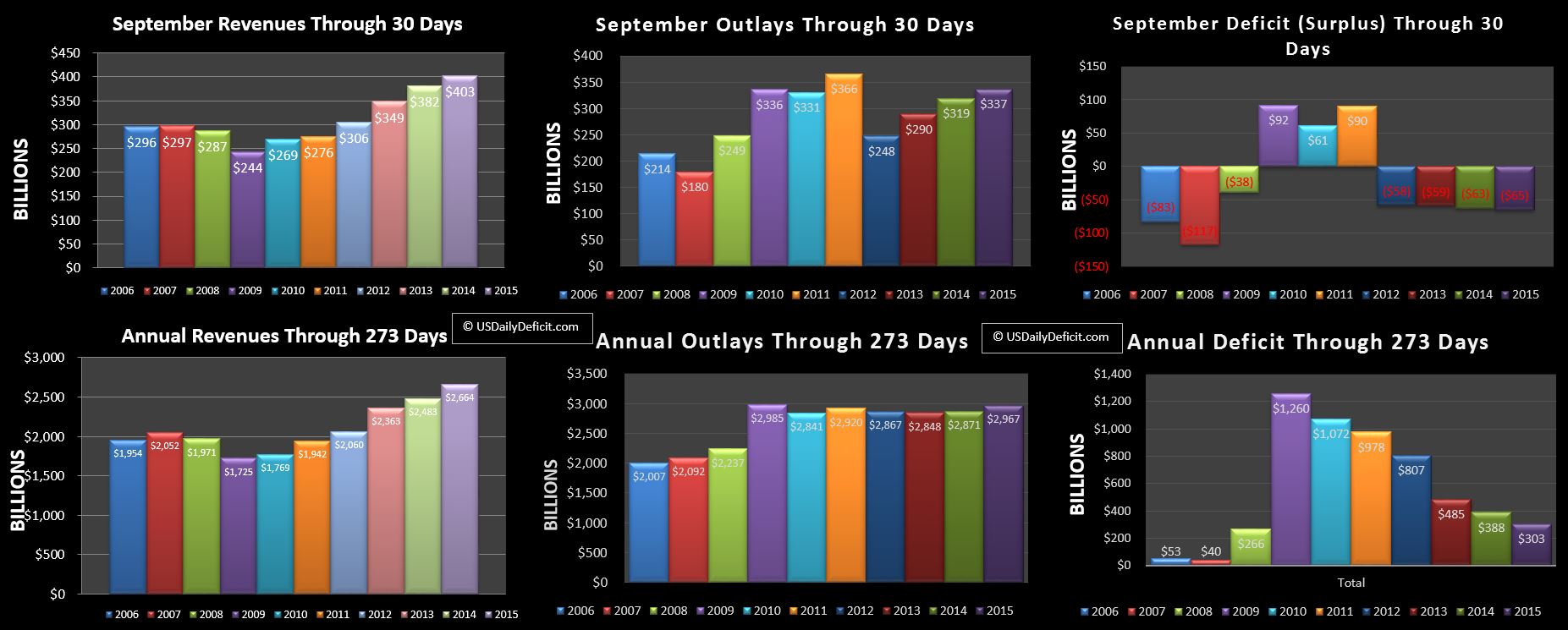

Revenues were surprisingly strong…despite being flat up through 9/29…a surge of excise taxes and perhaps most surprisingly $8.3B of GSE dividends. GSE dividends of course represent the “Profits” from Fannie/Freddie that get handed over quarterly. Recall they peaked at $66B in June of 2013 and have been steadily declining coming in under $3B in the last 2 quarters. I don’t know the full story there, but cash is cash and we’ll take it. This helped push the YOY revenue gain to +5.5% for the month…certainly respectable. Through 9 months, 2015 is at +7.3% over 2014 and trending down.

Outlays:

Outlays, on the other hand were up $18B…good for a a 5.6% YOY gain. No one category jumps out, but the extra business day probably explains most of it. 2015 through 9 months is sitting at +3.3%

Deficit Surplus:

As has become somewhat typical for a quarter end month, we booked a $65B surplus just topping September 2014’s $63B surplus. The full year deficit stands at $303B through 9 months, an $85B improvement over 2014. Of course the government’s fiscal year which runs from October-September concluded 9/30… I’ve long since given up comparing their deficit numbers to my cash based numbers, but they will report the annual deficit in a few weeks. If it were me..I would put the FY2015 deficit at $472B vs FY2014 at 564…good for a $92B improvement.

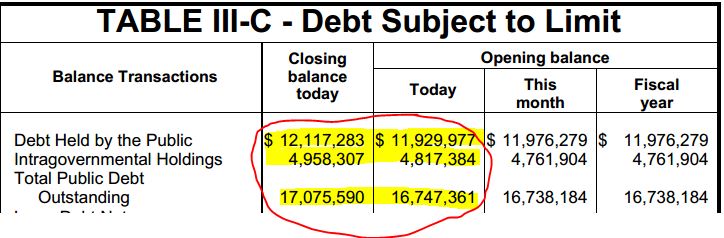

Default-Day:

As we all know, the debt limit was hit back in March at $18.113T. Since then, Treasury has managed to keep the government going by drawing down the sizable cash stockpile (274B after the April tax haul) and by implementing “Extraordinary Measures” (EM) which allows them to essentially pretend some types of debt do not exist….thus pulling it off the balance sheet and issuing new debt in it’s place. When EM available and the cash balance are drawn down to zero, the government will no longer be able to make daily payments above and beyond its daily revenues. We end September with a $199B cash balance. I have been predicting that D-Day will occur in Early February-2016 for quite a while now, so I was a bit surprised when I read Treasury Secretary Lew is now saying that date is November 5. I have a hard time squaring a default day one month out with a $199B cash balance. Assuming EM is completely played out (I doubt it)…I have the cash deficit for October preliminary pegged at $75B. November I have the full month at ~$115B. So if these are in the ballpark….getting all the way through November should be possible. I have December at a $50B surplus, though odds are an early month deficit will be offset by strong revenues in the second half of the month. So 12/5 I could understand but 11/5 seems bogus to me.

What makes more sense is that the White House has simply decided that a November battle is more favorable to them than a February battle and adjusted D-day accordingly. A pre-holiday season battle is going to be a lot easier to win than a battle right in the middle of the presidential primary season and more importantly…tax refund season. Shady??? Yes…but no more shady than the whole premise of Extraordinary Measures in the first place. At the end of the day, the debt limit will be raised….let’s just get it over with and quit with the accounting games….if nothing else, it will make my job a whole lot easier 🙂

Summary:

I was pleasantly surprised by the month…going into the very last day I was expecting to report revenues at +1/2% and outlays at +5/6%. till, while a surprise increase in GSE dividends saved September from being a disaster, for five months now, we appear to just be doing just a little better than treading water with revenues at +5% and outlays at +3%. Over the next few months it is likely the Q3 stock market weakness will put some downward pressure on revenues, and it could get interesting fast.