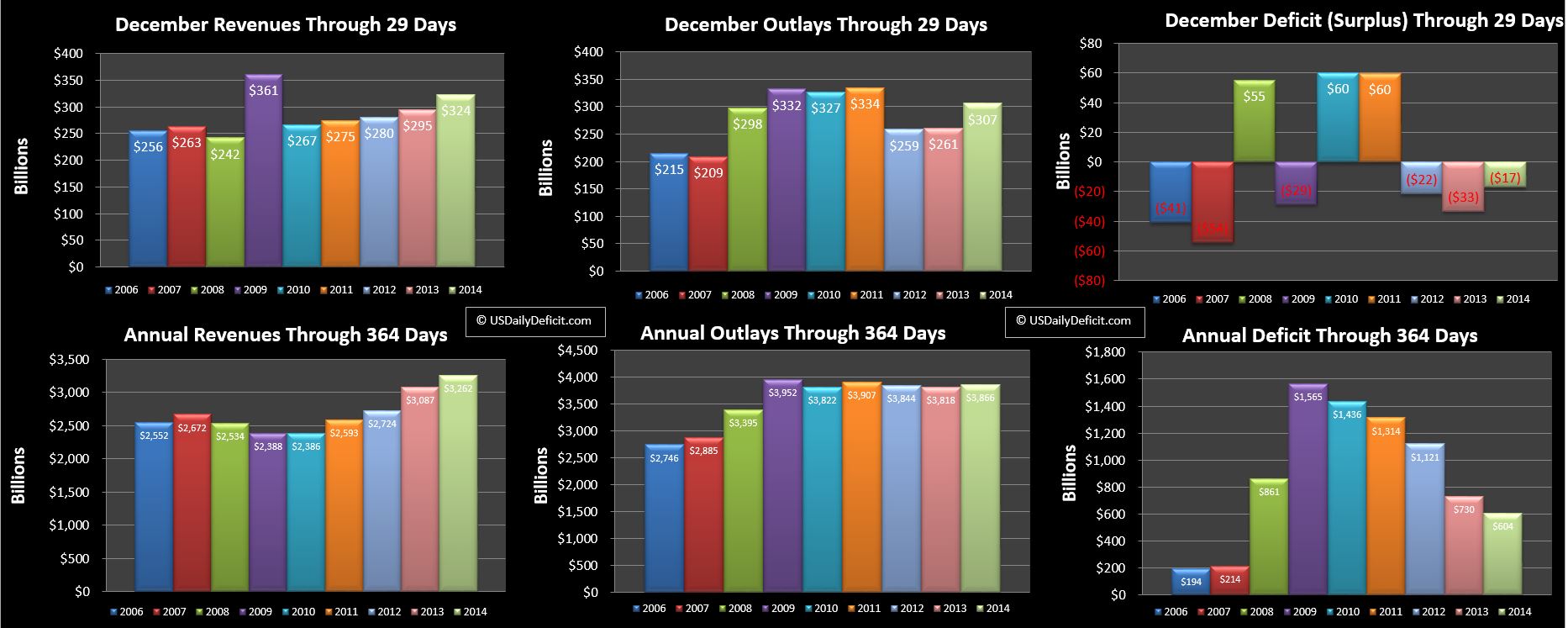

The US Daily Cash Surplus for Monday 12/29/2014 was $14.7B bringing the December 2014 Surplus through 29 days to $17B with just two days remaining.

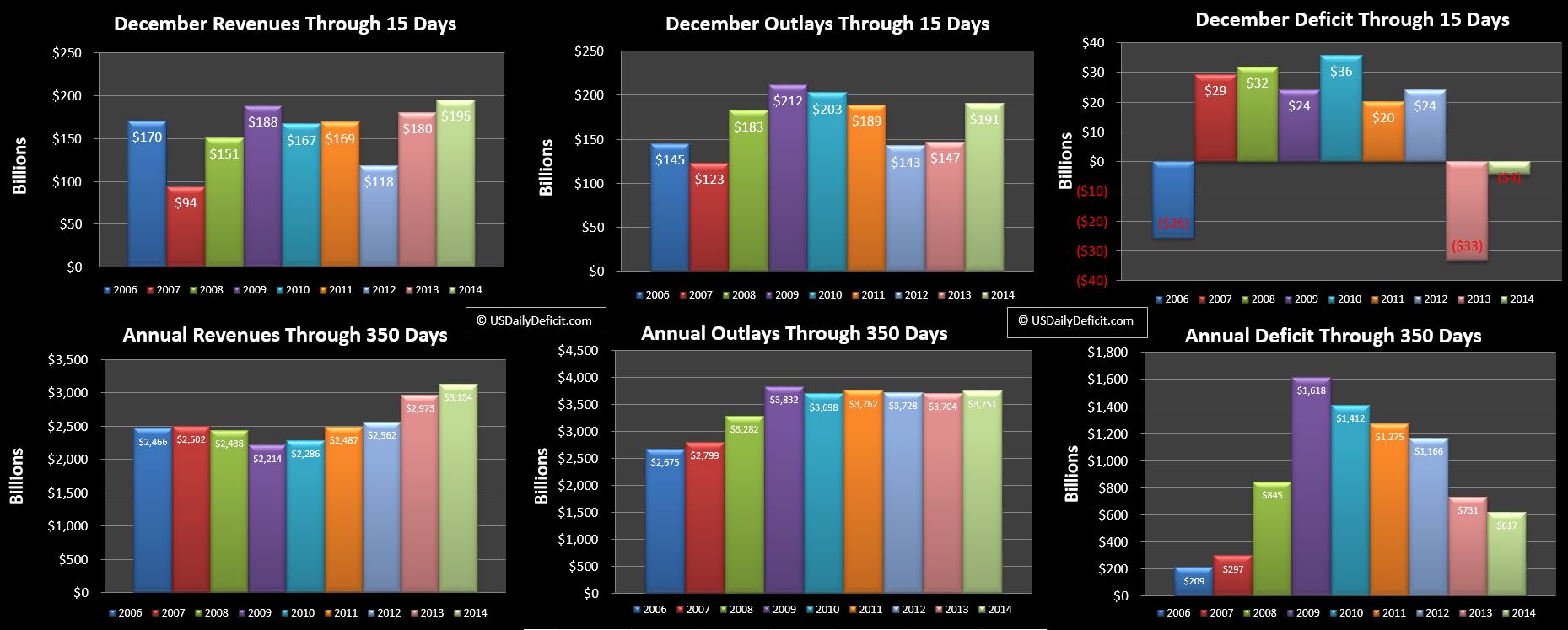

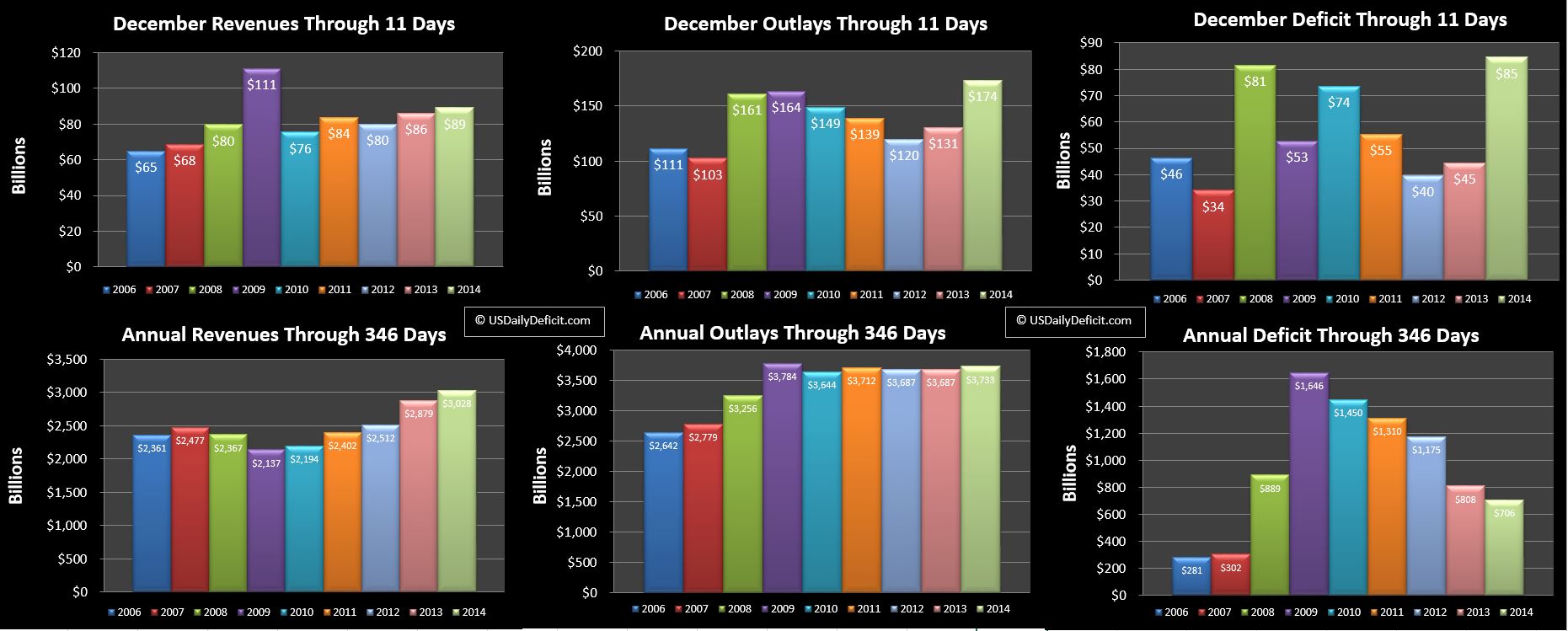

Revenues are more or less back in sync after being disrupted by the holiday timing. They sit at +10%, or $29B, which should be enough to hold onto 2014’s lead over 2013 even as 12/31 Fannie/Freddie payments fall way short of last year. The last two days of the year look to be quite volatile, so I hesitate to guess, but that is what you guys pay me for, so my feeling is that my initial forecast of a $35B surplus is going to be a bit optimistic. Anything is always possible, but tacking on another $18B of surplus in the next two days seems like a bit of a stretch. I’d guess we actually stay fairly close to where we are as elevated revenues should be offset by increased outlays….so maybe only a $10-$20B surplus for the month when all is said and done.

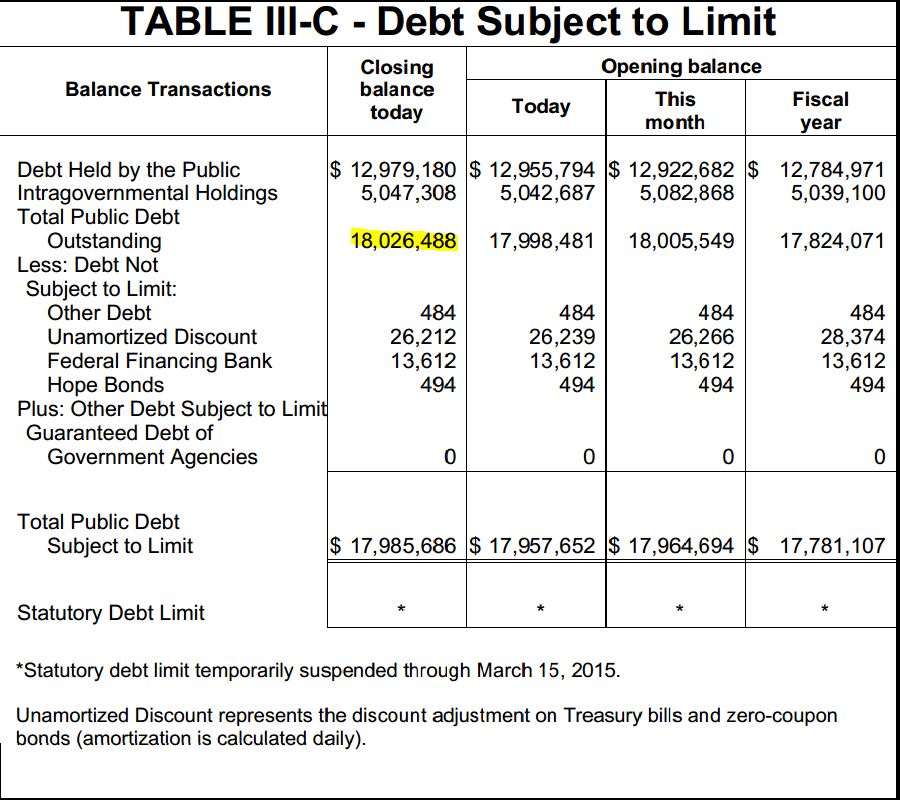

Of course that puts the annual cash deficit at right about $600B for the year, which makes the math easy….perhaps a $130B YOY improvement (**1/2/2015 edit…math fail…please ignore this…should have used 2013 Final at $709B…not FY 2013 through 364 days) vs 2013….down quite a bit from 2013’s nearly $400B improvement on tax increases and the corporate raid of Fannie/Freddie… Still, improvement is improvement…we’ll take it.