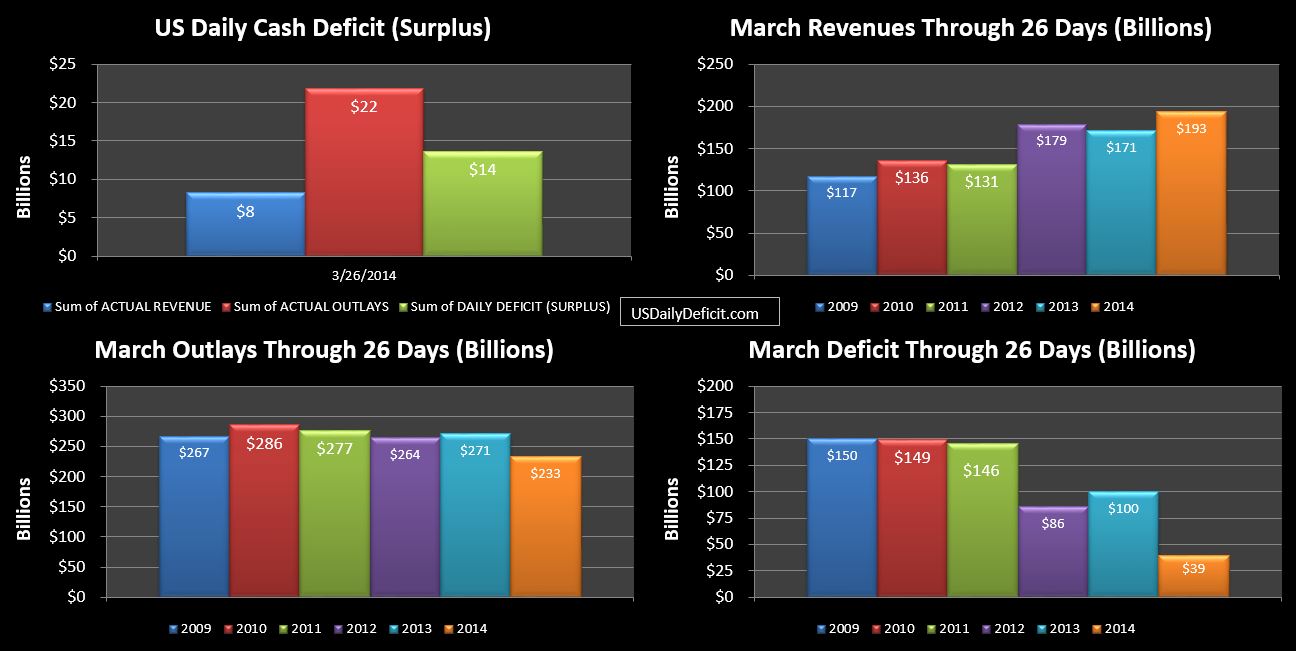

The US Daily Cash deficit for Wednesday 3/26/2014 was $13.7B bringing the March 2013 cash deficit to $39B through 26 days.

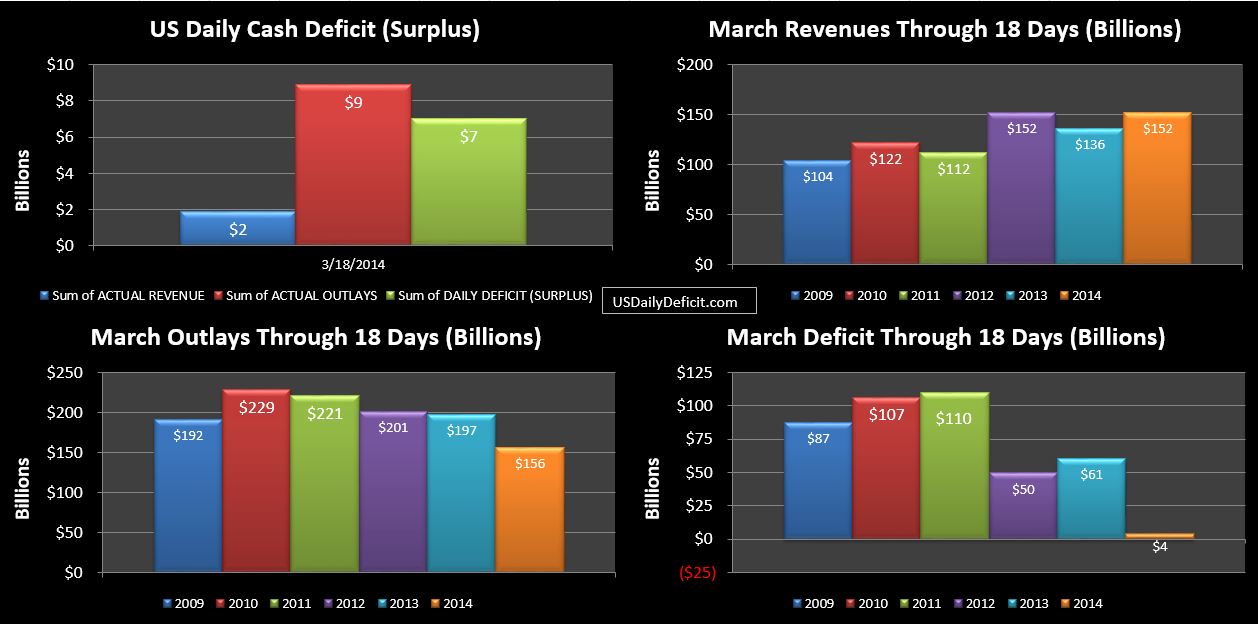

Revenues are up 13% so far and will likely gain a bit more over the next 3 business days. At this point…about half is due to lower tax refunds and the rest higher tax revenues. Outlays are down, but this can almost entirely be explained by the beginning of the month timing that pushed about $35B from March and into February.

The deficit currently sits at $39B with 3 days remaining. Thursday will likely post a moderate deficit, Friday a healthy surplus, and Monday 3/31 a large surplus on end of month payments including Fannie/Freddie payments. It seems likely that the deficit will shrink from here, but making it all the way to surplus seems like a bit of a stretch, though still possible.

Regardless, this is shaping up to be a good month considering last March posted a $94B deficit, and this March is knocking on surplus territory. Sure… a good chunk is timing, but the year is looking good too, with Revenues up about 10% and outlays down 1.5%. One more month of that, and this pessimist may just have to change his tune…at least for the short run. Projecting this trend out puts us at a sub $400B deficit for the calendar year…still a huge deficit, but a huge improvement over where we’ve been.