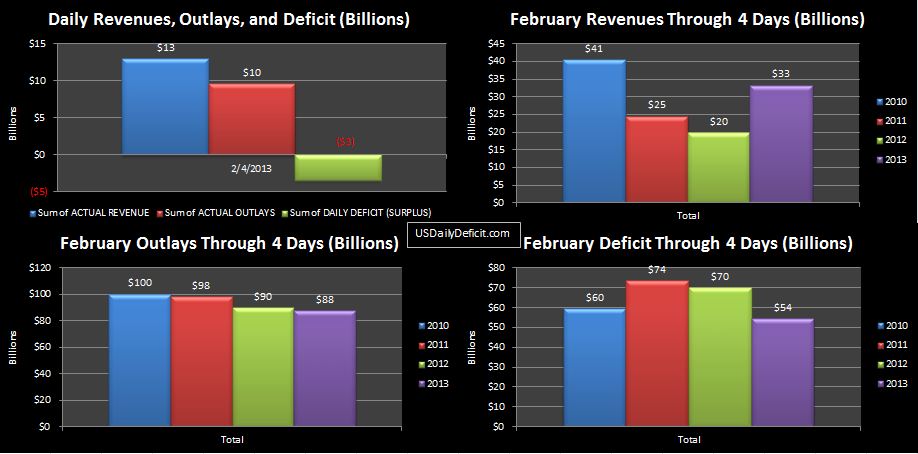

The US Daily Surplus for 2/1/2013 was $3.4B, bringing the monthly deficit down to $54B after last Friday’s $58B blowout. The charts look a little screwey today, but it is early and there are too many timing issues to count battling it out. Perhaps most interesting is that as of yesterday, we have no debt limit… at least until May 19th. I expected a flood of debt to flow back onto the balance sheet…around $100B or so, but debt only increased $41B. I’ll chalk it up to timing for now…we shall see.

In other news, the CBO released an updated 10 year budget outlook today projecting an $845B deficit for fiscal 2013. I have to assume they have much better information and more time than I do. It’s not a crazy number, but it does seem a bit optimistic. With 4 months in the books, we are averaging a $4B per month improvement over last fiscal year’s $1.092T cash deficit. At this pace, they won’t make it, but admittedly, the tax increases that kicked in last month should help. I believe that for the calendar year, I projected $1T, +/- $100B. Just for fun, let’s see who is better at this…a bureaucracy with a huge staff, or a guy with a ruler. I haven’t done a formal fiscal year forecast, but I don’t mind throwing a dart. There are 8 months left, so lets just assume that revenues increase $20B per month and outlays increase $10B over last year. That would give us a $10B pickup per month and land us right under $1T. For what it’s worth, I’m rooting for the CBO.

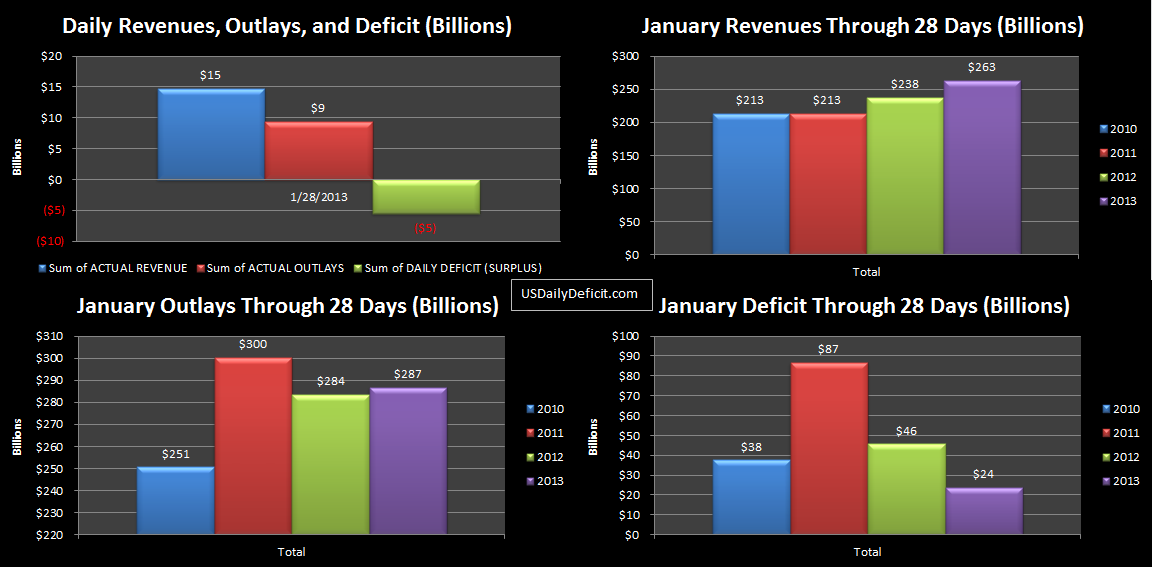

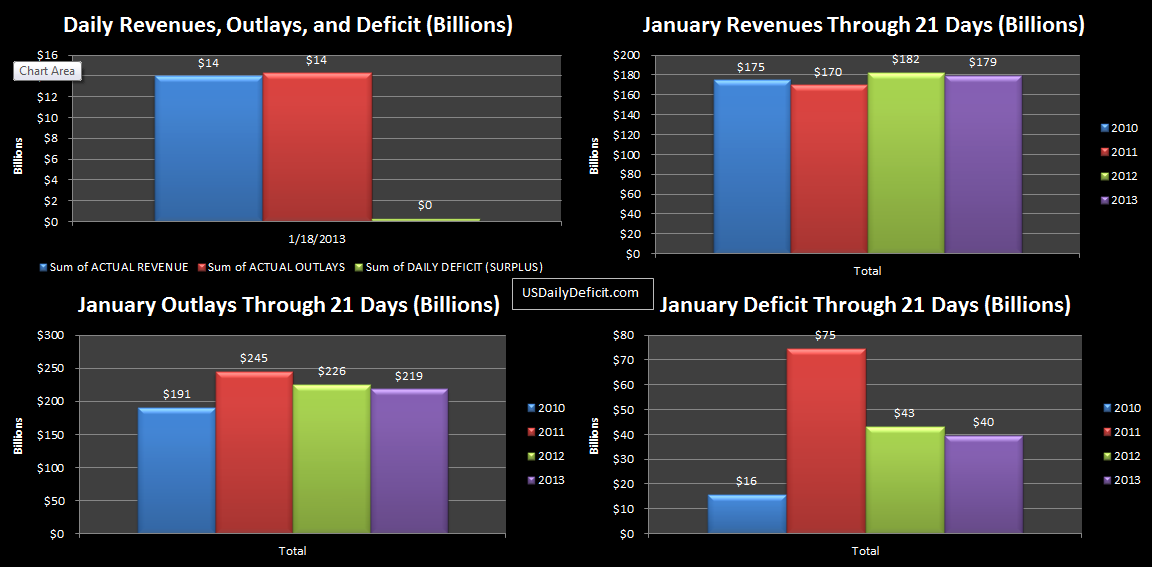

The US Daily Surplus for 1/28/2013 was $5.5B on strong revenues…pretty typical for a Monday. Cash in hand was $75B, and the debt limit is still unchanged. The House has already passed the bill, but the Senate still needs to approve it and Obama needs to sign it. This is expected tomorrow, or at least by week end. I don’t know how long it will take Treasury to unwind their “extrordinary” measures, but I will be keeping an eye in the change in debt once they do. Expect a spike in the $100B range. The last time there was a debt limit battle, debt outstanding spiked $238B the next day as Treasury brought their off balance sheet shenanigans back into the fold. I don’t expect that much…the battle of 2011 went on for a lot longer than this battle…if we can even call it that.

With 3 business days left, Revenues are up a solid 10% over last year and likely to increase a bit more. I expected a ballpark of $20B increase due to tax hikes and the trend. Add some delay to refunds (which we count as “negative” revenues) and possibly some filers pulling some income into 2012 for the lower tax rates, and there is nothing all that surprising about this “improvement”…if we dare call getting taxed more an improvement.

Cost is currently fairly even, but will likely end up $10-15B over last year. We’ll have the finals Friday, but $25B looks like a pretty safe bet for the monthly deficit. I said early on that deficit wise, January was going to be a snoozer, but never fear…February is almost here. Feb 2012 posted a $249B deficit…about a quarter of the yearly total packed into 29 exciting days!!. I have no reason to expect anything different from Feb 2013.