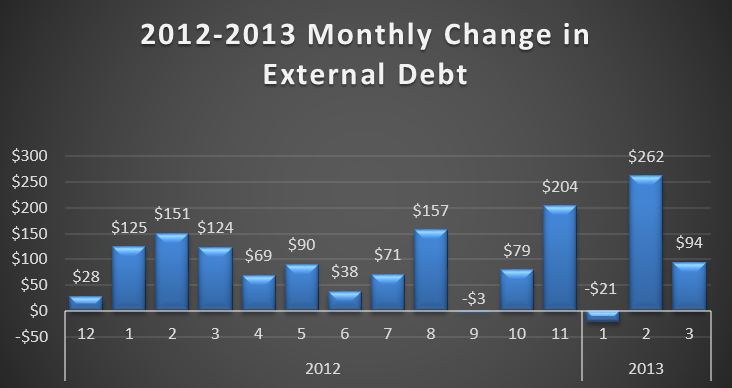

Over the course of March 2013, total debt outstanding increased $84B up from $16.687T to $16.771T. External debt…the only category that really matters was up $94B, but offset by a $10B decrease in the intragovernmental debt category….basically money we are pretending we loaned to ourselves, rather than admitting we already blew it.

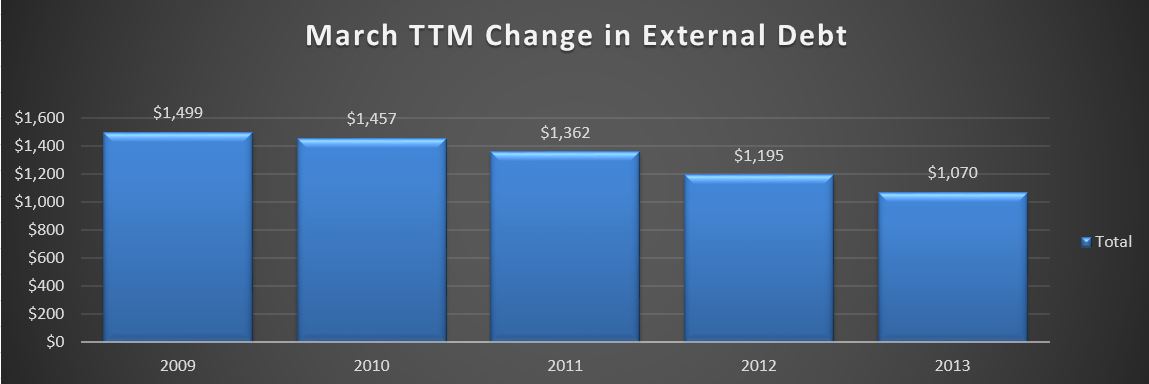

Moving on, the TTM (Trailing Twelve Month) change in debt:

This looks at the TTM change in external debt only for March of 2009-2013. For example, the 2013 amount of $1.070T is the difference between 3/31/2013 and 3/31/2012. …how much debt have we added over the last 12 months. I like TTM when looking at the debt and deficit because there is so much seasonal variation that looking at any one month doesn’t really tell you anything…like this month, April, will likely post a monthly surplus….but that doesn’t really tell you anything about the $1T or so annual deficit.

Looking at the chart (made in Excel 2013…not crazy about the grayish black fade), we can see a $125B improvement…the right direction no doubt, but at a tepid and declining pace…for now. At this pace…we would get to zero in 8.5 years…assuming the pace continued…it will not. What we will likely see is an acceleration through the remainder of the year thanks to the recent tax increases and relatively flat spending. Then, after a year or two of stabilization, it is going to turn the other way as the growth in outlays surpasses any revenue growth, driven primarily by the large welfare programs…Social Security, Medicare, and Medicaid.

Yes…I said it….these are all straight up welfare programs where one large voting block has forced a “generational contract” where the old and wealthy steal from the young and poor. This is justified by..” well, we were screwed too, so now we are gonna get ours.” Maybe so…but it’s not gonna work for much longer. This entire system needs to be abandoned and go back to the old way. Either you save enough on your own in your 40+ year career to sustain the retirement you want…or, your kids/extended family supports you…if they like you.. The end. The average person making $50k puts about $7,500 each year into the social security/medicare pot each year…. What could you do with $7500 per year? Probably pay off your house in 10 or 15 years and start amassing a lifetime supply of benefiber…. Ain’t retirement grand?

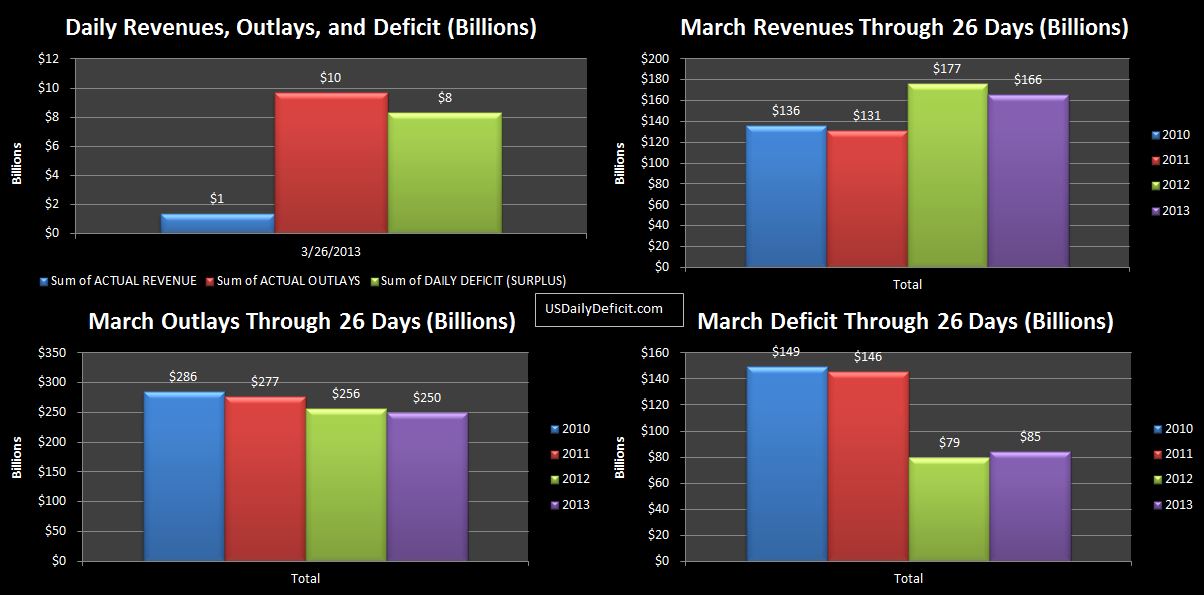

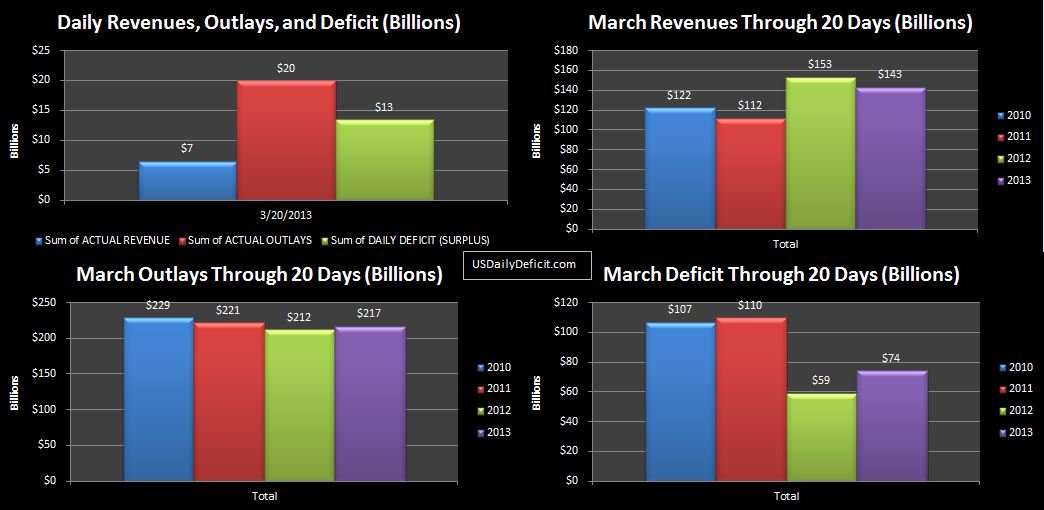

The US Daily Cash Deficit for 3/26/2013 was $8.3B, bringing the March deficit through 26 days to $85B. With 3 business days remaining, it looks like we are zeroing in on $105B or so, with the possibility of a $+15B surprise depending on how Medicare costs flow in.

It Seems that for the first time in four years, the senate has passed a budget. Republicans are bleating that it “has zero real deficit reduction” and “never balances.”…which is probably all true, but as I discussed a few weeks back, neither does Paul Ryan’s Path to Prosperity. You see, any monkey with a free copy of Google Spreadsheets can make a lot of bogus assumptions about revenue growth and cost cutting and squeeze the “projected” deficit down to zero in 10 or 20 years…Just ask the Congressional Budget Office, who in 2000 projected to much acclaim that the US would be more or less debt free by 2010.

In any case, we now have affirmation by both political parties that one of three things is true about each of them.

-

They are a bunch of Lying SOB’s…

-

They aren’t lying, they are just incredibly incompetent.

-

Or…they believe in fairy tales.

I really don’t know which it is…all seem feasible to me. However, it is time for you to decide if you believe in Fairy Tales…or not. The fairy tale they want you to believe…written by the economic high priests of the last century is quite simple. First…deficits don’t matter. Government, led by the infinite wisdom of elected politicians and an army of bureaucrats can borrow and print an infinite amount of money with no consequences. They will save your job, care for you when you are sick, educate your children, and even manage your retirement for you…all you have to do is believe….and maybe tap your shoes together 3 times.

For comparison, let’s think about what might make sense for a typical family budget. It is generally accepted that an ideal state is a surplus…you should be saving, let’s just say 10% of income…. for rainy days, paydown of debt, and hopefully accumulation of enough wealth for the rather modern invention we call “retirement.” We could have a debate over the specifics, I think we can all agree that more or less, this is a pretty good prescription for success.

Imagine if instead of following the above, our family, with a household income of $80k/year, decides to take the prescription advised by modern economic theory. At this point in time, our family, has accumulated debt approaching $500k….not mortgage debt…unsecured credit card debt. Further, they are accumulating debt at the rate of about $40k per year, with no realistic plan to address the annual deficit, much less actually pay down debt accumulated so far. At this point, really should be bankrupt, but fortunately for them, their credit card company keeps increasing their credit limit, and at this point has actually removed the limit altogether.

Do you see this ending well? Is it possible that a financial policy that would so obviously asinine for a household makes sense for a nation? Ben Bernanke, Tim Geithner, Republicans, Democrats, and most modern economic theory thinks it will. That’s what’s in the Fairy Tale, so it must be true…right? You need to decide for yourself what you believe. Is infinite deficit spending the right medicine to heal a sick economy, or is it just another line of cocaine….inching closer to bankruptcy and ultimately…death?