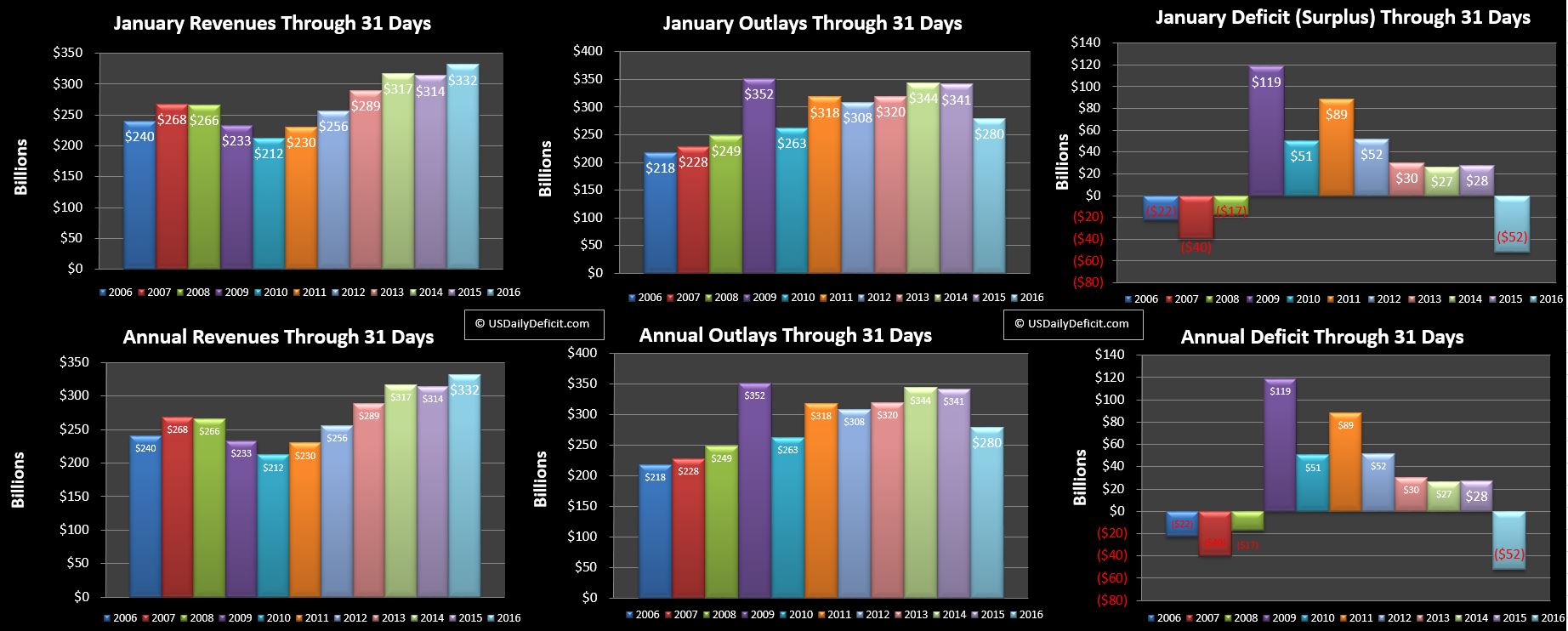

The US Daily Cash Surplus for January 2016 came in at $52B beating January 2015’s $28B deficit by a whopping $80B. However, don’t break out the party hats just yet…There were 3 large timing events that accounted for most of the beat.

Revenues:

At first glance, revenues were up $18B good for a 5.7% YOY gain. Last January about $10B of refunds went out at the end of the month, and since I account for refunds as negative revenue, it reduced reported revenue by that amount. In 2016, those early tax refunds did not go out in January…if we back that benefit out, the YOY gain is $10B lower, good for a 2.5% gain. Still not too shabby considering there was one less business day…my baseline was 3% revenue and spending growth, so no shockers yet. In theory…January’s gain will be offset in February as refunds simply slide right a week or so…assuming everything else stays more or less the same…so look for weak(er) February revenues.

Outlays:

Outlays show an apparent $61B drop…but it turns out it is almost all timing. First up, a lot of payments that would have been due in early January were pulled into December due to the timing of the weekend/holiday. This left January 2016 ~$30 short since this did not happen in 2015. Second, January 2015 had extra cost as payments due in February were pulled forward due to the timing of the weekend…lets call that $30B as well. So at the end of the day, Jan 2015 had $30B of extra cost, and January 2016 is $30B short…causing an apparent $60B delta, when the truth is, everything was more or less the same. I will note that this aside, some cost categories including defense vendors, medicaid, and education were either down or up less than I expected. However, it was just one short, and timing tainted month…I’ll give it a few more before I get excited about any of those misses.

Surplus:

The three timing events noted above combined to give us our first January surplus since 2007….ahhh…the good ‘ol days!! Enjoy it while it lasts…February is refund month so we probably have a $200B+ deficit coming up

Summary:

Even taking into account timing, it was a decent start to 2016. with moderate revenue growth and outlays looking about flat….for now. The next 3 months should be exciting (as far as this topic goes anyway) as refunds pour out, and 2015 taxes pour in. As always….Stay Tuned!!