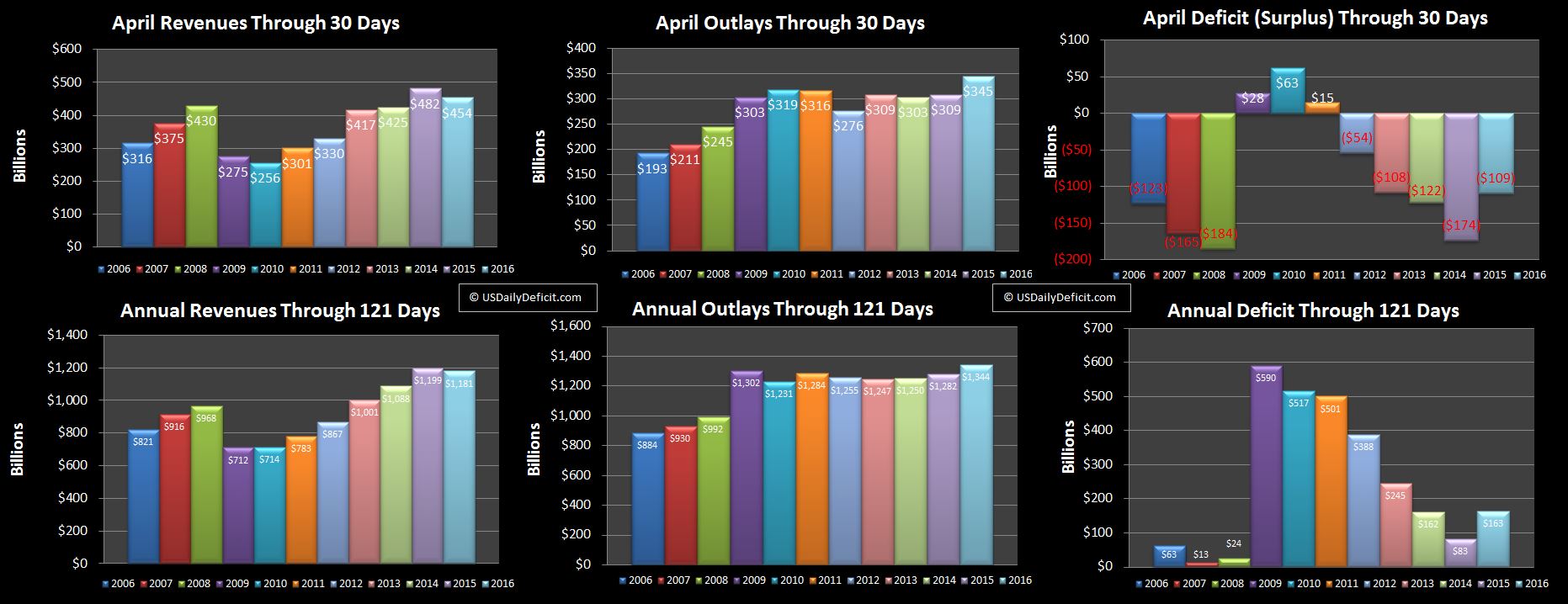

The US Cash Surplus for April 2016 came in at $109B, far short of last April’s $174B surplus.

Revenues:

April, not surprisingly is the largest month for revenues as most of the refunds have gone out in February and March, and those who owe taxes for the prior year must pay them in April. Revenue this April was still healthy coming in at $454B, but was down $28B compared to April 2015. Most of the variance was in “Taxes Not Withheld” which was down $26B from $219B last year to $193B in 2016. Obviously, a revenue miss isn’t a good sign, and now being down for the year with 1/3 of it in the bank, it is looking increasingly unlikely we will see ~3% YOY gains in 2016 without some help from some one time items. For me, the big question is…was April 2015, with a +13% YOY gain just a one off that was always going to be impossible to repeat, or is this miss just another in a growing string of dissapointments? The one revenue highlight I can point to is that taxes withheld from paychecks is up 3.3% for the year. It’s not going to break any records, but I like seeing a nice solid number in that relatively stable revenue source, even if we are seeing disappointing numbers elsewhere. If nothing else, we have more people working, making more salary compared to last year. I won’t comment on the quality of those jobs, but hey…3%+ growth with 1% population growth and supposedly flat inflation isn’t nothing..

Outlays:

Outlays came in at $345B vs $309 last year, but about $40B of that increase was timing as payments due Sunday May 1 were paid Friday April 29 due to the weekend. So mostly flat for the month if we take that out, but the year is nearly at +5%. That comes down a bit if we take out this timing event, but the truth is thanks to a similar event in December 2015 that pulled $ out of 2016 and into 2015, this is actually a decent YOY comparison point. The increases are where we have come to expect them…Social Security, Medicare, and Medicaid.

Deficit:

We got our healthy surplus in April as expected, even if it was a bit lower than expected. However, for the year, with revenues down about 1.5%, and outlays up nearly 5%, the deficit through 4 months now sits at $163B, $80B higher than 2015 and pretty much on track with 2014. There are 8 months left, and of course anything can happen, but it is starting to look like 2016 is the year that ends the 6 year streak of deficit improvement.

Looking forward, last year May posted a $100B deficit, and this year shouldn’t be too far off of that, though it will have the advantage of dumping $40B of its cost into April. There is one extra business day, so I’ll throw a dart and say $80B deficit for May with June hitting a $50B surplus. Stay tuned!!