A while back I wrote a post titled Uncle Madoff Sam’s “Social Security Trust Fund” which was a tongue in cheek look at Social Securities Ponzi beginnings… excerpt below

Bernie Madoff Sr. 1935 (BM) : Ok everybody step right up. Have I got a deal for you today!! All you have to do is give me 15% of your paycheck from the day you turn 18 until the day you turn 62, 65, 67, 70?? In exchange for this modest contribution, I will, at my sole discretion, give you a meager monthly benefit until the day you die.

To back up a bit, it has been a hypothesis of mine that Social Security was invented not as a program to help the all the poor widows living in poverty like the history books say, but instead, as a disguise to pass a broad income tax that would (at least temporarily) bring in far more revenue than outlays, allowing the government to spend that revenue wherever they wanted, leaving future elected officials to worry about the promises being made.

The story line kind of fits….right in the middle of the depression, people are generally unhappy with the government and probably not in the mood for a tax hike. However, revenues are depressed, and outlays are surging….what to do? Create a fake program to help widows and the elderly and a broad based tax to pay for it. Then…set the retirement age so high…most people will die before they are old enough to collect and voila!! It’s not like the public could download the data into excel and crunch the numbers themselves back then, who was gonna know the difference?

So that has been my hypothesis, but I never had any raw data to correlate with it…until now. Over at SSA.gov I found a neat little table showing Social Security’s annual cash inflows and outflows…all the way back to 1937. Then, at findthedata.org I found the total US government historical revenues and outlays. Put them together, and the evidence is pretty convincing.

First, lets set the backdrop…From 1920 to 1930, the government ran 11 consecutive surpluses averaging $4.3B in revenues and $3.5B in outlays. Just scaling that up to 2012, that would have been like pulling in $4.7T of revenues on 3.9T of outlays…good for a $900B annual surplus….instead of the $1.1T deficit we actually recorded. Then…just do that 11 years in a row.

Then…the Depression hits. Revenues fall more than half from $4.1B in 2030 to $2.0B in 2032. Outlays…$3.3B in 2030 grow 40% to 4.7B by 2032, on their way to 8.2B in 1936. All of a sudden, after more than a decade of healthy surpluses, the government is spending more than twice what it brings in. By the end of 1934, the surpluses of 1920-1930 have been more than wiped out, with nothing but huge deficits on the horizon. They can only issue so much debt (Quantitative Easing hadn’t been invented yet)…they desperately need a new revenue stream, but raising taxes on a pissed off population doesn’t always end well. Enter Social Security. Passed in 1935….implemented in 1937.

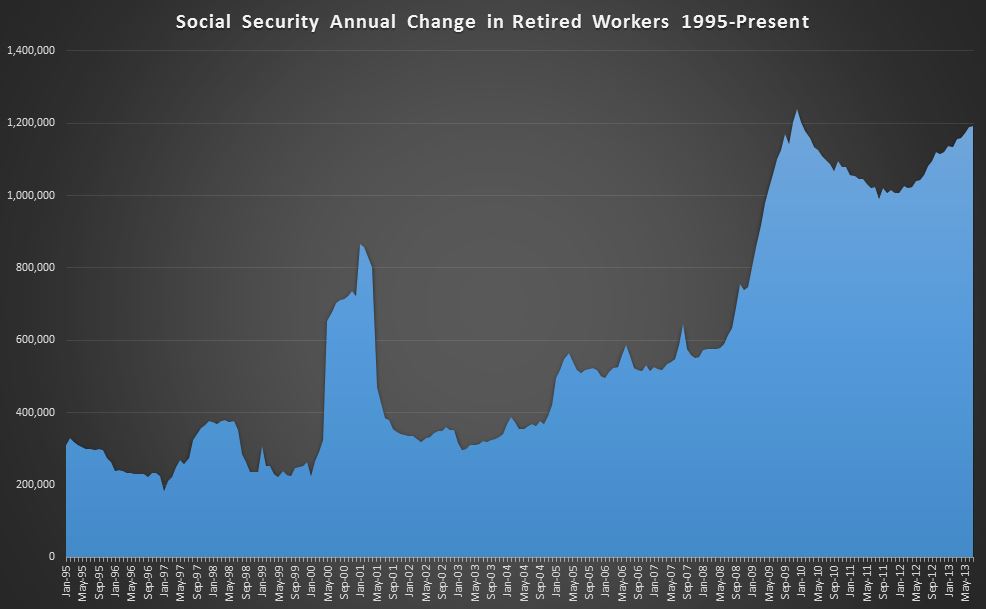

So…anyone want to guess what the payout in year one was? Today it’s roughly 1:1. in 1937, according to the SSA, the SS tax brought in $737M of revenue..a full 14% of the federal government’s $5.4B total revenues in 1937. That would be equivalent to today, a $420B per year tax hike. Does anyone think Obama could get that passed? Total Social Security outlays that year… $1M. That’s right…they brought in 737M, and paid out $1M.

Ok…maybe it was just a fluke, maybe you had to wait a year or something, and Y1 only had admin expenses. Let’s look at Y2. $10M paid out on $375M of revenues…2.3% payout. Between 1937 and 1950, SS brought in $18.1B of revenues, and paid out $4.4B…paying out less than 25% of revenues. Not exactly what you expect from a Ponzi pay as you go program to help widows. No…Social security was designed from the start to be a broad based income tax to fund general government, and on the side (as a cover)… they would use a very small % of proceeds to take care of the few who managed to live to retirement age and fill out the right paperwork (typically before dying a few months later)

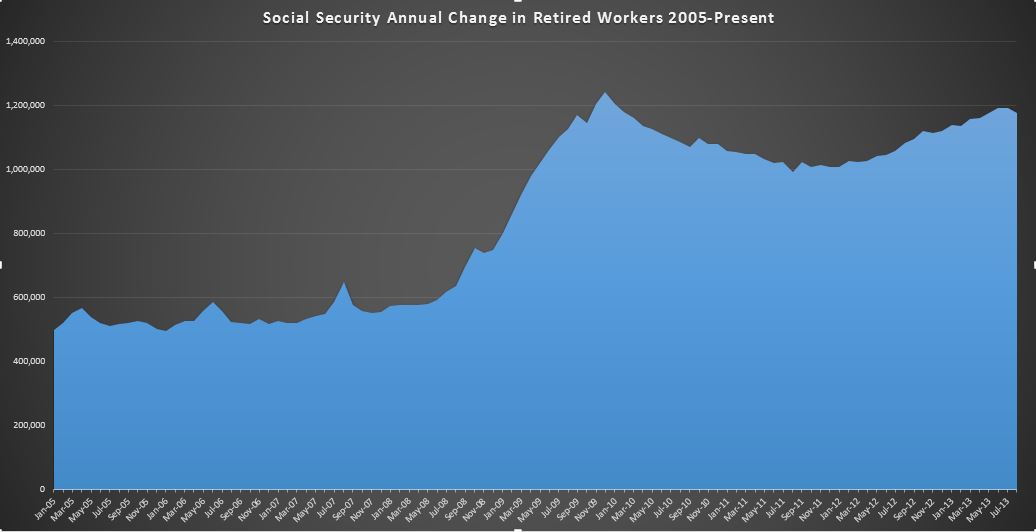

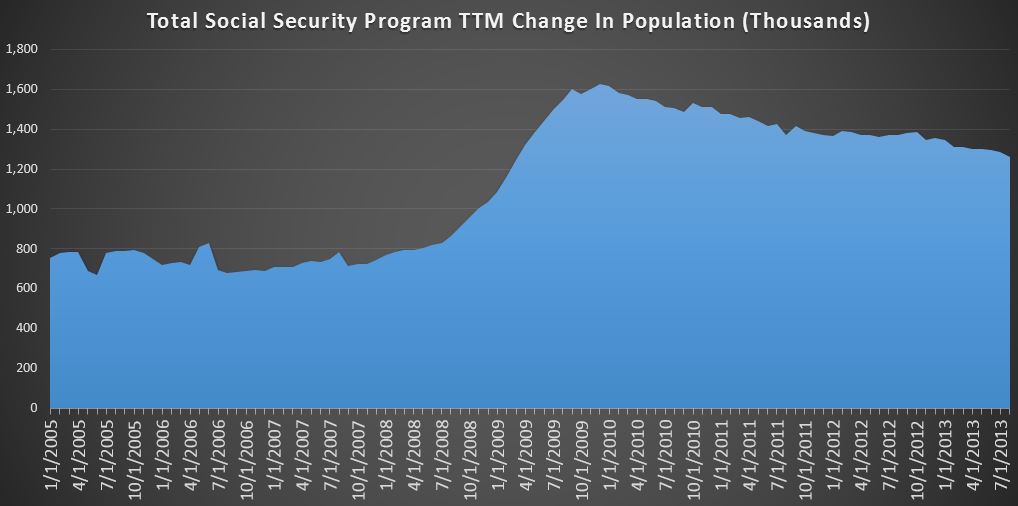

After a great start… by 1957 (Damn you FDR!!!), the math was starting to catch up and Social Security was running a deficit. And so it started. Taxes were raised… problem solved for a few years, until the math caught up again. Rinse, repeat, and here we are again… What will we do with the “Little Ponzi Scheme That Could”?

Hell if I know!! How do you tell 40M voting seniors and 60M near retirement Boomers they’ve been paying into a Ponzi scheme 10,000X bigger than Bernie Madoff’s for their entire lives. The money is gone, and the only way to continue it is to screw over the younger generation even more than they already did with Obamacare. Also…they(the young) are young and stupid…you are old and frail…. (so it’s even right 🙂 ) I don’t know how it ends, but I am sure it’s gonna be bad for someone.