Bernie Madoff Sr. 1935 (BM) : Ok everybody step right up. Have I got a deal for you today!! All you have to do is give me 15% of your paycheck from the day you turn 18 until the day you turn 62, 65, 67, 70?? In exchange for this modest contribution, I will, at my sole discretion, give you a meager monthly benefit until the day you die.

(Kid): What if I die at 60…do my heirs get anything? Can I take out a 401k loan against it?

(BM): No and No.

(Kid): Ok…it’s 1935 and life expectancy is only 58. Are you sure this is a good deal?

(BM): Oh yes…absolutely. I’ll post a spreadsheet on Facebook that proves it out.

(Kid): Well…what will you do with my money for the next 50 years until I need it?

(BM): Well, I’ll probably lend it to the government, who will spend it on a lot of stupid things, but don’t worry, I will be sure to get the IOU’s notarized.

(Kid): But congress is just a bunch of no good crooks and thieves. I wouldn’t trust a congressman as far as I could throw him…

Ok…enough fun. It never ceases to amaze me that we as a nation trust our government, run by universally despised politicians with our personal wellbeing in retirement. You would probably think pretty hard before letting your brother in law borrow $1k so he can make his mortgage this month, but if you are an average worker, making $50k per year, you are sending uncle Sam right about $7500 per year (15%) for this promise, that just about all of us know is BS. What could the average worker do with an additional $625 per month, $1250 if you are a couple? Pay off their house in 10 years? Pay cash for a car instead of financing? Maybe…just maybe fund their own darn retirement?

Let’s take that average worker, and assume that over his career, his average annual salary is $50k, and that over his 49 year career (18-67) he thus pays in $367k. Furthermore, we are going to just ignore compound growth ect….we are just going to assume that investment return equals inflation…ie if inflation is 3% in a given year, then investment returns are 3%. Regardless of the real number, this employee gets to 67 with an equivalent of $368k in the bank. It’s not a huge nut, to be sure….the average retiree gets about $15k per year from Social Security…so again assuming no real returns, this nut will last 24 years, to the ripe old age of 91. After that…he has to move in with his kids, grandkids, or great grandkids. We should all be so lucky right?

So this begs the question. If a worker could simply keep that 15% of his paycheck and hide it under his mattress getting no returns for 49 years, and still be better off than he would with social security…why the heck does this program exist? It’s quite simple really…social security isn’t a retirement program…it’s a Ponzi scheme now, and it always has been. Rewind back to 1935. You have a depression going on, the electorate is already a little pissed, and FDR needs money to pay for his programs. Enter Bernie Madoff Sr. (yes..I’m joking)

“Hey Mr. President… I have an idea. The electorate will never go for a new tax…in fact they would probably roast us alive. So instead of calling it a tax, we’ll just change the name and put a bow on it. Those dummies will lap it up. We’ll create a “retirement” program (as he does air quotes) and call it social security. Everybody will have to pay into it, so we get a steady revenue stream to spend on whatever we want. Best of all, most of these saps will die long before we have to pay them anything. Sure, it will blow up in the end, but we’ll be long dead by then.”

That’s how I imagine it happened. I could be wrong.

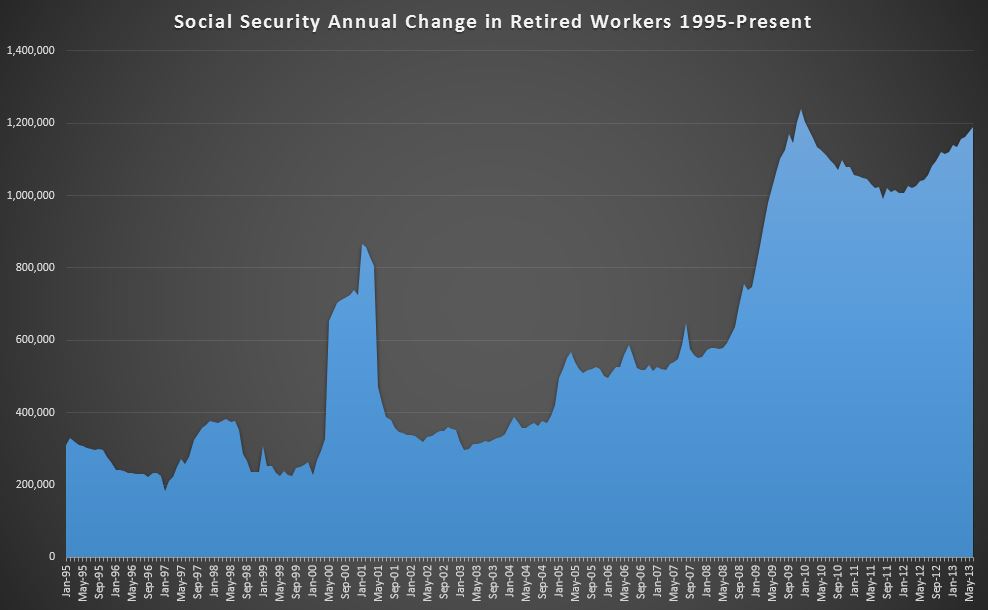

So here we are, 77 years later, and the little Ponzi scheme that could is still chugging along, if not as gracefully as before. No longer much of a cash contributor to the federal coffers, Social security is teetering the other way with a mountain of fake IOU’s ready to be cashed by the senior voting bloc. And now….decision time. When Bernie Madoff’s Ponzi scheme was exposed, some victims lost everything. While we can feel sorry for them, this is how it should be. Imagine the outrage if instead of letting these poor fools suffer, instead the federal government made them whole, and to pay for it, added another line item to your paycheck. $5 a week for the Bernie Madoff Victim’s fund. No Thanks!!. I wasn’t foolish enough to invest in a Ponzi scheme, Why should I pay for your mistakes?

Except….with Social Security, we are all victims. We all got screwed…if you will, and it continues to this day. The only moral solution to this massive injustice is to shut the whole thing down. Why should our youth, or even anyone under 50 pay another nickel into this injustice? Those most responsible for this situation are today’s retirees. They bought the scam hook line and sinker decades ago and kept electing the clowns in congress who perpetuated the scam. Let’s just call it what it really has become. In addition to its Ponzi roots, Social security is just a huge welfare program where the wealthy and powerful elderly voting block essentially robs their children and grandchildren on a monthly basis. If my grandparents can’t make it without their government cheese, I’d be happy to take care of them myself, and I’d bet you would too. Sure…there will be some without family, but I bet it’s a small portion. With all that extra money flowing into workers pockets instead of being lost in the Ponzi scheme, who knows…maybe worthy charities will see an uptick in donations.

But alas…what should happen is rarely what does happen. Instead, the Ponzi will just go on, and the deal will get worse and worse.