I’ve been watching this develop for a while for a while…Here’s the deal…As of last Friday, Treasury had built up a cash balance of $428B. Now, that might not sound like a lot……Hah!!…just kidding… It’s huge and enormous and completely unnecessary. To put it in perspective, Treasury could stop borrowing today, and not borrow another penny for the next 8-10 months.

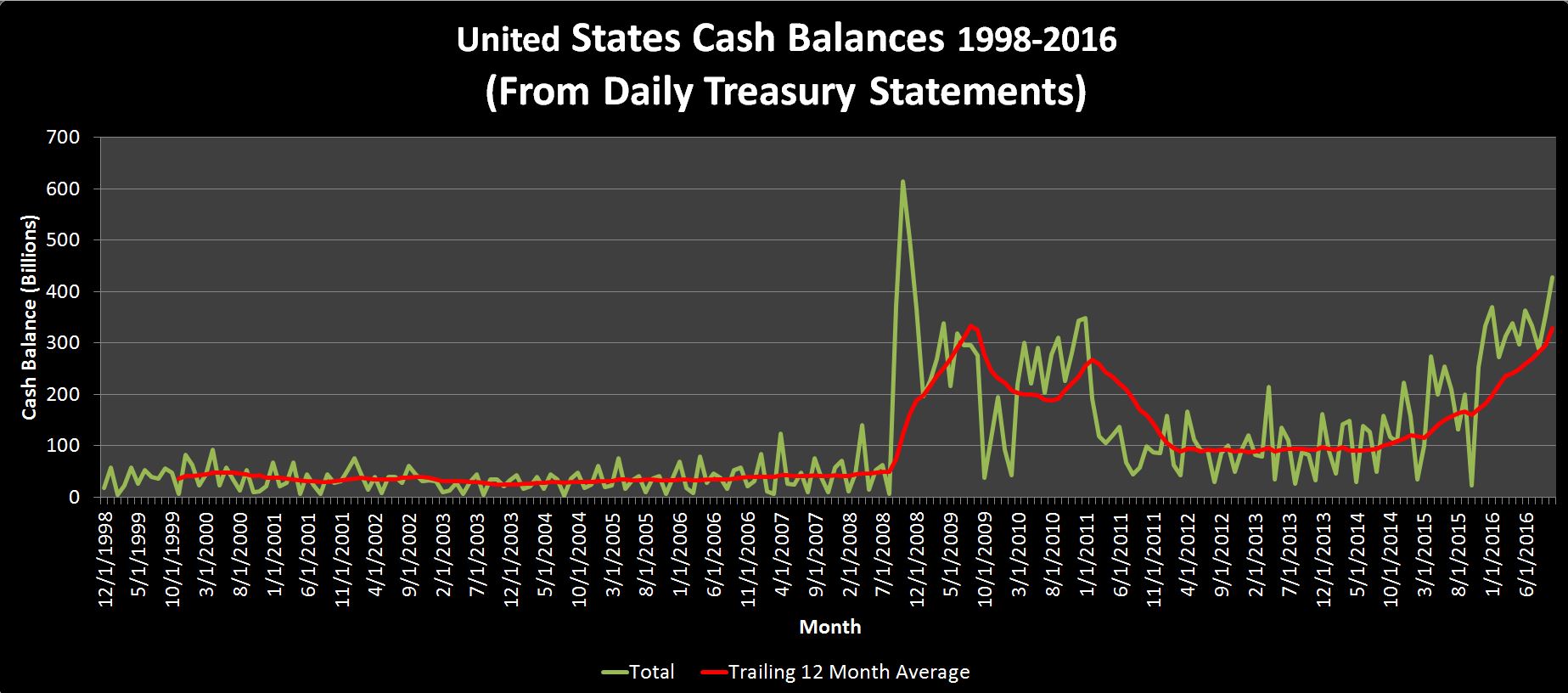

Here is the historical chart:

For the 10 years heading up to the “Great Recession” Treasury maintained an average balance of about $36B. They used this balance, and daily cash inflows to pay for daily expenditures and issued new debt as necessary to fund the deficit. Then, in the second half of 2008, borrowing soared, ending 10/2008 with over $600B cash in the bank as they prepared to…well, we all know what they did with the cash…no need to bring that up again here 🙂 Balances were kept high for a few years before leveling off at about 100B, but have been headed back up lately.

For the 10 years heading up to the “Great Recession” Treasury maintained an average balance of about $36B. They used this balance, and daily cash inflows to pay for daily expenditures and issued new debt as necessary to fund the deficit. Then, in the second half of 2008, borrowing soared, ending 10/2008 with over $600B cash in the bank as they prepared to…well, we all know what they did with the cash…no need to bring that up again here 🙂 Balances were kept high for a few years before leveling off at about 100B, but have been headed back up lately.

So…who cares you may wonder? Well, think of it as a this way. Our good stewards at treasury could take say $400B of “excess” cash, and pay down the debt by that much, assuming an average rate of 2%, and save a cool $8B a year…just by not having a really stupid cash management policy. I know…I know…chump change right?

Debt Limit Avoidance?

This is the most likely answer. After the last debt limit battle ended last November, the debt limit was suspended until 3/15/2017…meaning that they could issue as much debt as they wanted in the meantime. Now I haven’t waded through the specifics of the law, but my thought all along has been…ok…If I were in charge, and I didn’t want to deal with that nonsense again, on 3/14/2017, I would just issue maybe $3-$4T of debt, park the cash in my Federal Reserve bank account, and use that to squeak by the next 4 years. Clearly they don’t think they can pull that off without consequences, but they do seem intent to make sure the next president (I am guessing they are pulling for Clinton) hits the ground running. Back of the envelope, if we hit the debt limit 3/15/2017 with $400B of cash in the bank, the government will likely be able to go a full year without raising the debt limit just by burning down the cash balance and re-deploying “Extraordinary Measures”

I’ll just leave it at that for now….I’ll leave the conspiracy theories to the experts!!

Catch up (June/July 2018 Cash Deficit)