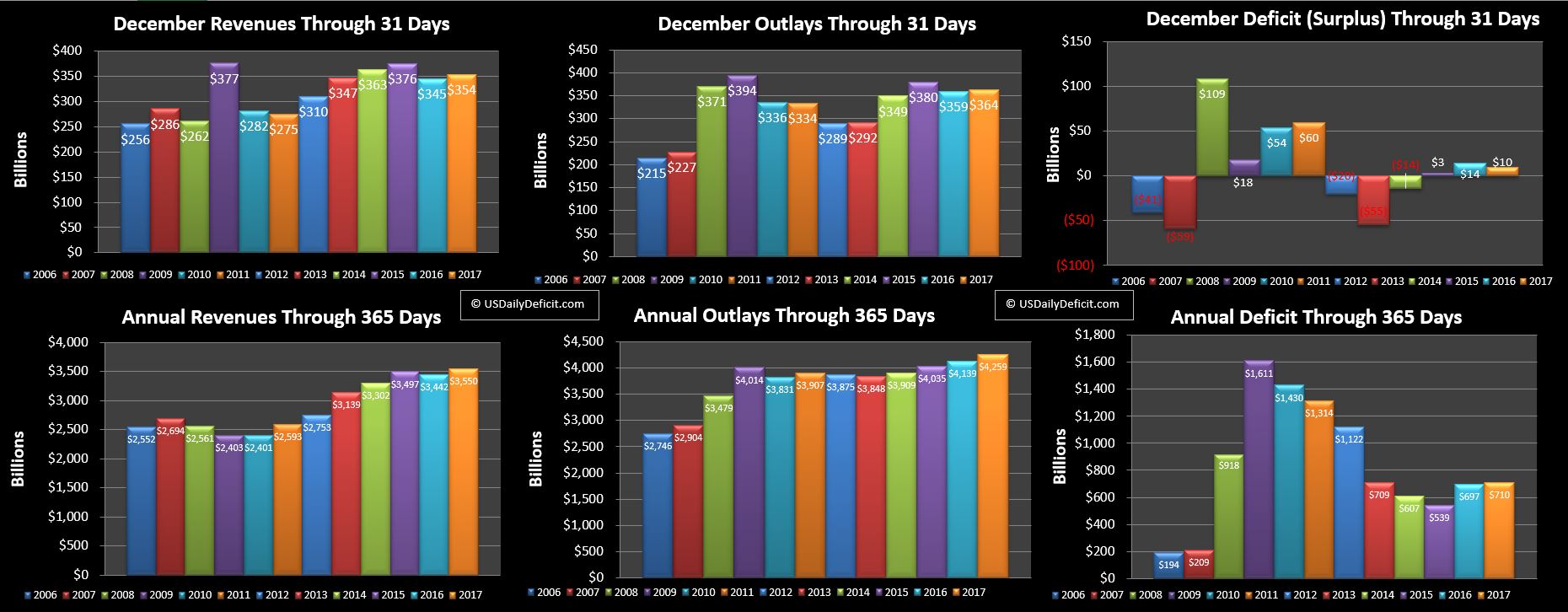

Nothing really interesting about December’s $10B deficit, but we now have a total for 2017 which rang up at $710B, $13B higher than 2016’s $697B deficit. This is the highest annual deficit since 2012 topping 2013’s deficit by just $1B and is the second year in a row of increases.

Digging in a bit, revenues were up a solid 3.1% while outlays were up 2.9%, more or less cancelling each other out, leaving us with just a 2% increase in the deficit. Looking at the Wayback machine, it looks like last January I eyeballed 2017 with a 4% increase in outlays and a 2% increase in revenues, which penciled out to an $800B deficit. Not a great estimate, but good enough I suppose. It’s hard to be happy about a $710B/Y deficit, but looking forward, it’s hard to imagine it gets any better from here.

2018 Forecast

We don’t want to think too hard about it, so on the outlays side, I’ll go back to the +4% growth, which is $170B for the year or $14B/month. Now the biggy…tax cuts. While they go into effect January 1, it’s not quite that simple…2017 taxes will still be flowing in through April 15th, and the withholding tables are unlikely to be updated before February, so calendar 2018 won’t quite get a full year of tax cuts showing up in the cash receipts. I’ve seen quite a few estimates all over the place, so lacking any data to do real analysis…I’ll just pick a nice round, and conservative number, and say cash receipts in 2018 will decrease by $100B, pulling revenue down from $3.55T in 2017 to $3.45T in 2018. Following the logic, this will be weighted in the second half of the year, and overall pencils out to about a 3% YOY decrease.

So…quick math…+170B outlays and -100B revenues puts the 2018 cash deficit at around $980B, $270B higher than 2017 and right back to knocking on $1T. Yikes!!that didn’t take long…maybe we should be happy it took them a year? Nah…I mean once you have $20T of debt, do another few hundred billion really even matter? I doubt it.

Default Near?

When will the US default and how? The truth is that this can continue as long as Treasury can continue to issue a trillion dollars of new debt annually at ~2% rates to new fools, the Fed, algos etc… Don’t get me wrong…this debt can never be repaid…it will either be inflated away or officially defaulted on. Maybe that’s what the stock and housing markets are telling us….maybe they aren’t at high’s…the USD is just worth that much less and people are hedging against it’s decline by bidding up the price of tangible assets and companies that own them. Just a thought that’s been rolling around in the back of my head for a whle. Whenever it happens…I for one will not feel sorry for the blind fools who even for a second believed US debt was risk free.