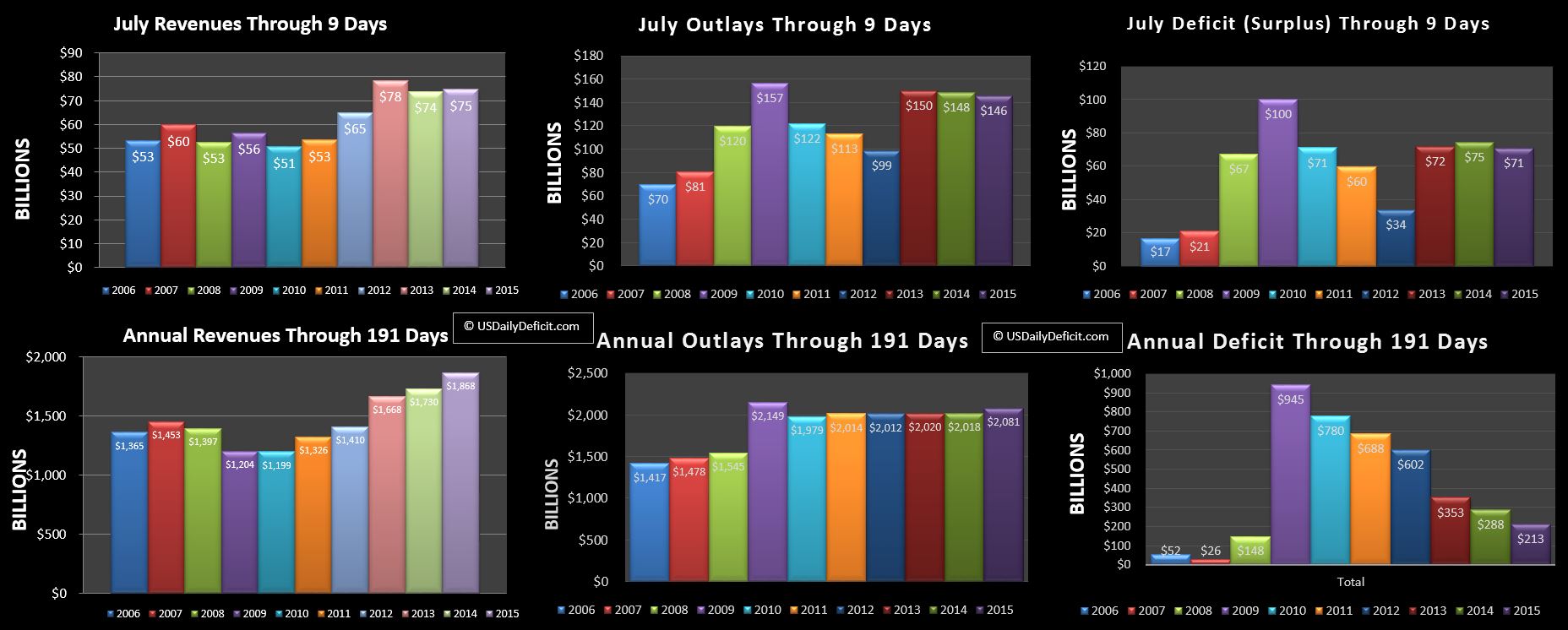

The US Daily Cash Deficit for Thursday 7/9/2015 was $4.8B bringing the July cash deficit through 9 days to $71B.

We don’t really see much YOY change at this point, with revenues up a bit and outlays down a bit, leaving us with a $4B improvement in the deficit. It’s really too early to get excited about anything yet, but just to set the baseline, we really need revenue growth to continue to exceed 5% to keep making material progress in reducing the deficit, so this ~1% isn’t going to cut it. Fortunately, it seems like YOY gains typically show up in the second half of the month, so let’s give it a few weeks before we sound the alarm.

I’m getting a bit of a late start this month, so I’ll take a swing at the July deficit forecast with a bit of an advantage. I’m going to assume overall revenues grow at a base rate of about 5%, offset by about a $4B reduction in deposits from the Justice department we saw last year (bank penalties??) that I don’t think we will see again. On the cost side, most categories will be roughly flat, with the exception of SS, Medicare, and Medicaid which together pull the apparent growth rate to the 3%-4% range. Finally, August 1 is a Saturday, which will pull somewhere between $30B-$40B of cost from August into July. When all is said and done, the July 2015 deficit should end up at about $115B , $29B worse than last July’s $86B deficit. Pull out the timing and we would have shown moderate improvement as revenue gains outpace outlays by a few percent.