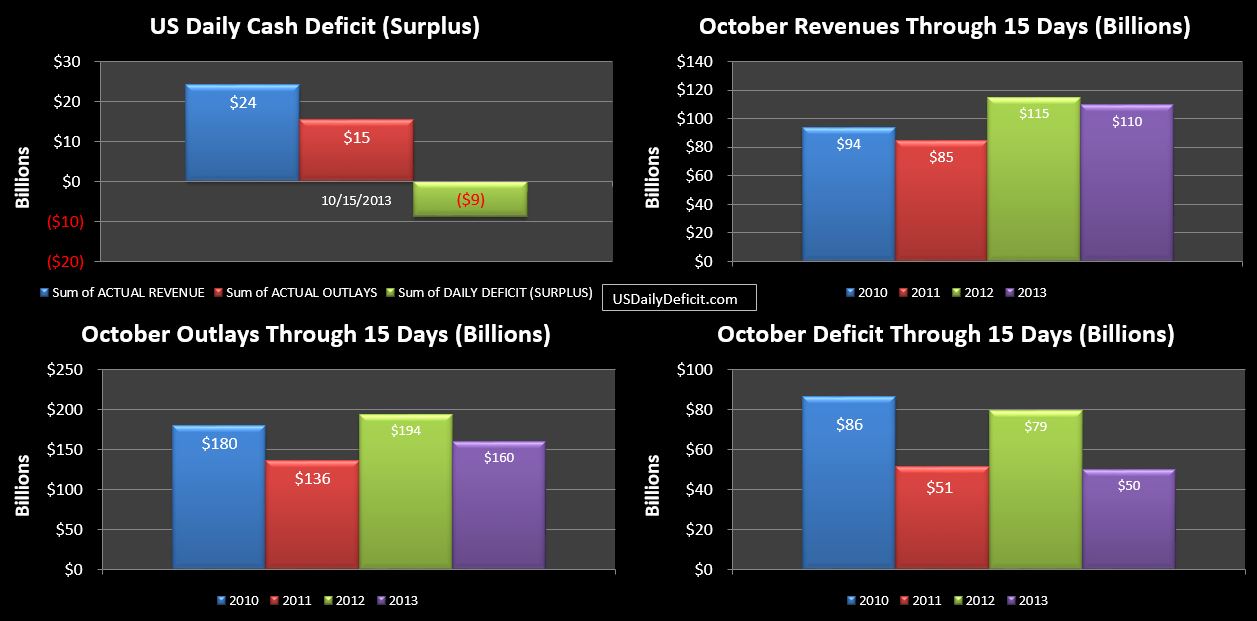

The US Daily Cash Surplus for 10/15/2013 was $8.8B pulling the October 2013 cash deficit through 15 days down to $50B. Contributing to the surplus, $7.4B of corporate taxes were received, a 6% improvement over last year’s 10/15 haul of $6.9B.

With the Columbus Day timing behind us, we are more or less back in sync, with 2013 back to trailing 2012 on revenue by about $5B. Offsetting this…Outlays are down by $34B as the shutdown has apparently slowed a lot of payments down and completely shut off others. Add it all up, and at first glance, we are showing some a fairly impressive spurt of deficit reduction….a $29B improvement over October 2012 through the same period.

However…with a shutdown/debt limit deal rumored as of Wednesday afternoon, it is looking like the government will be back to work in a few days and the debt limit will be raised. It may take more than a few weeks to catch up on all of the delayed payments and tax refunds, but when they do, all of these apparent reductions in outlays should more or less wash out.

Cash in hand is $39B with a $5-10B deficit on deck for 10/16 as $12B of round 3 SS payments will go out. If the rumored deal goes through, this will all be a moot point, but it does look like Treasuries $30B estimate for 10/17 will be right on the mark. What I am most interested in seeing is how much the debt increases on day one as Treasury brings all of those hidden “Extraordinary Measures” debts back onto the balance sheet. Last time we had this debate, $238B of debt showed back up on 8/2/2011. That sounds about right to me, so I’ll go ahead and guess $250B and keep my fingers crossed….it will probably be next week before we find out though.