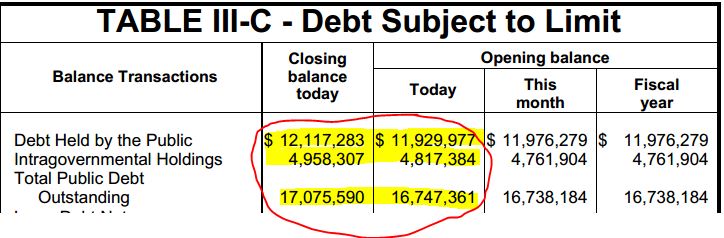

As most expected, it appears the debt limit was raised and the government has reopened…at least for now. I’m not sure how they got to these dates, but apparently the government will reopen and be funded through for 3 more months expiring 1/15/2014. The debt limit will be raised, being frozen at wherever it ends up on 2/07/2014. I’ll have a better guess at that after they true up the missing “extraordinary measures” , but I’m thinking it will pencil out to somewhere between a $400B-$500B increase ending up between $17.1T and $17.2T.

At that point, they will once again be able to employ EM…effectively adding $200-$300B to the debt limit. Now, I’m not sure why they chose 2/7, but if you are trying to maximize the time you get out of EM….this is about the worst date you could ever choose. The reason is that tax refunds pick up in early February and stay strong through March/April before petering out in May. So while last time we were able to hit the debt limit in mid May and squeeze an additional 5 months out of EM….this time, it might be a challenge to make it into early March. Of course, this assumes they don’t take the approach I would if I were Obama…which would be to issue about $3T of debt on 2/6, banking the cash, and making it all the way to 2016 without ever having to talk about this subject again. (not saying that’s what’s right for the country).

So…here we are, the day after a supposedly epic battle. Gotta say, not much has changed. Ok…maybe nothing has changed. I’m still not entirely sure what it was all about. At first it was about delaying Obamacare…which was never going to happen, and then, it was supposedly about balancing the budget…but the thing is, neither party really wants a balanced budget. Balancing the budget means cutting $800B of spending, which means cutting social security right here right now….which is politically impossible for either party. So either this was all about something they were never going to get, or it was about something nobody really wants….

Honestly, the end of this story has been pretty clear for a few years now. The US will default on it’s $17T (and growing) debt sooner or later, it’s just a matter of time. Furthermore, the US will default on the $100T+ of political promises…including SS, Medicare, Medicaid, Obamacare, Food Stamps ect… The math on this is extremely simple folks…it’s just a matter of time before the game is over. It is more apparent than ever that the political will to do the right thing simply does not exist within our democracy.