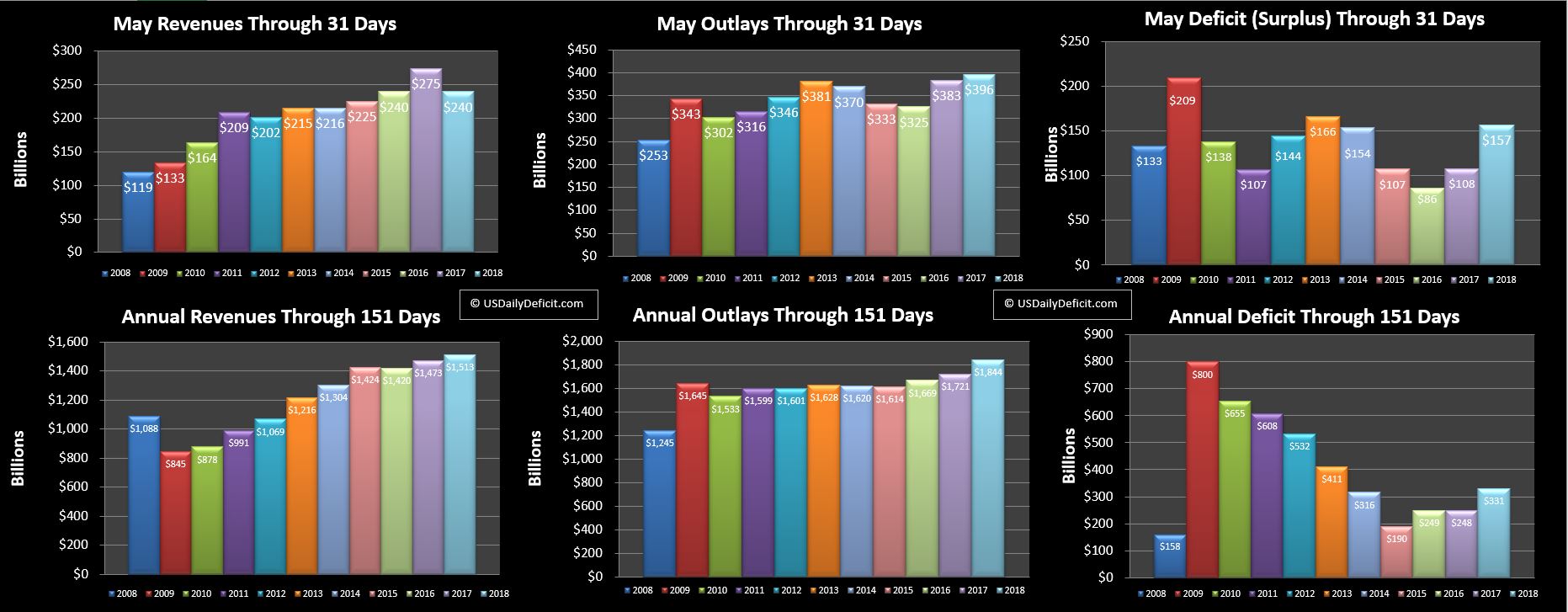

Following April’s blowout $223B surplus comes May’s $157B deficit. They don’t quite zero out but there is plenty of bad news if you dig in.

Revenue:

Revenue was down $35B and 13% compared to last May….providing some validation that April may have been the last Hurrah for revenues. Just a recap on that…2017 taxes, with impressive stock gains and higher rates were by and large paid in full by the end of April….from here on out it’s lower rates….and likely lower tax receipts. If we take just April out of the YTD, revenue would have been down about 25B, and 2.5%… I know that doesn’t sound huge, but it pencils out to about $100B less per year in revenue at the same time outlays are increasing at the fastest rate in years.

Outlays:

Outlays were up $13B and 3% despite some favorable timing on interest payments. Looking at the year through 5 months, outlays are up $123B and 7%. That seems a little high to continue for the full year, but 4-5% seems reasonable.

I need to do a full piece on this at some point but one of the drivers is interest…not so long ago we had about $2T of short term debt at practically zero interest rate we were able to roll….that’s a great deal if you can get it and it really helps pull down your average. This has now changed…..and has recently surpassed 2% for 12 month Bills as of April…. In short…we are paying a lot more more to roll debt into a declining revenue and increasing outlay environment that will soon be adding another 1T of external debt annually…If that sounds like a recipe for disaster it’s because it is.

Deficit:

At $157B this was the highest since 2013 and $49B higher than last year For the year, 2018 is at $331B and looking at the annual we can clearly see a trend…after bottoming out in 2015, the deficit is stair stepping back up….hitting $900B in 2018 is looking quite likely and without a miracle we’ll probably top the $1T annual rate in early 2019.

Looking Forward to June:

June is a quarter end with pretty solid revenues. Usually this would lead to posting a small surplus, but this year, like last, due to July 1 falling on a weekend, a lot of July cost is going to get pulled forward into June. Last June posted a $24B deficit…I currently have June 2018 at about $30B…assuming a moderate 2% reduction in revenue.

Looking Forward to 2018+:

Not looking good is all I can say. April may have brought a breath of fresh air, but May was more like a sucker punch to the gut :)…. The evidence is pretty clear…April’s revenue surge was an anomaly….and for the rest of this year we are likely to see flat or even negative revenue YOY….along with 5%+ increases in outlays. It’s not certain…stay tuned of course but it’s not hard to pencil out how we post a $900B+ deficit in calendar 2018 and surge past $1T TTM just a few months into 2019.

We got away with the last 8 years because with interest rates near 0%…you can technically borrow as much money as you want for free…so long as you can keep rolling it. How will this all shake out and when?? I have no clue…I’m still shocked we made it this far. Perhaps the main thing you can do to protect yourself is to not lend Uncle Sam any of your money….