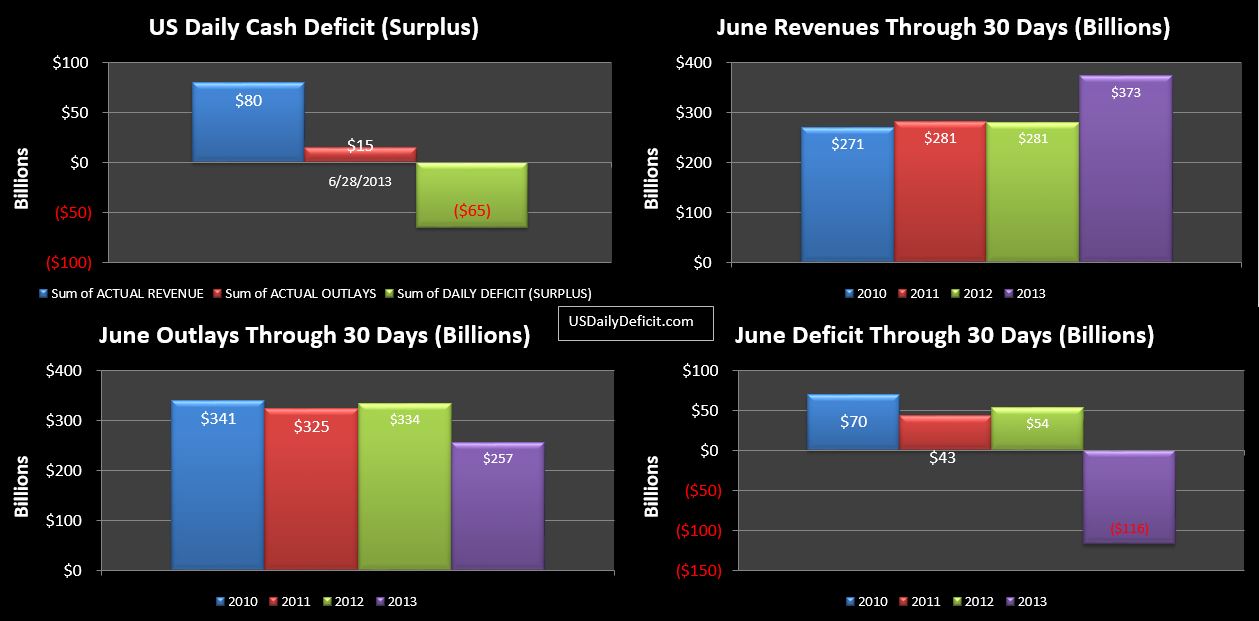

I’m running a bit behind schedule…what with the real job and everything 🙂 so I haven’t had a chance to put together a detailed write up for June, but I wanted to get the finals out there. So…The US Daily Surplus on 6/28 was $65.1B…thanks to the $66B “payday loan” from Fannie Mae. This brought the Monthly Surplus to $116B, a vast improvement over June 2012’s $54B deficit. Revenue up, cost down…pretty simple math. No doubt, it was a good month, but as we have been discussing all month…take out Fannie and about $65B of timing related to cost….and while it was still a good month….it wasn’t that good. Still…we’ll take it!!

Key takeaways…Tax deposits were up 9.5%. Taxes not withheld were up 16%. Corporate taxes were up 10%. Two months after the close of the January-April Tax season, excluding the Fannie Mae silliness, we see growth in net revenues stabilizing around 9% – 10%. Still…a very good number…pretty much in line with what you would expect after you raise taxes. But it does represent a material step down from the 15% we saw in the first four months of the year…recall my hypothesis…that the tax hikes drove many to pull income into 2012 to take advantage of lower rates….then they paid taxes on those gains in the first 4 months of 2013. If that is the case….rather than the 10-12% gains being expected by the CBO, 2014 could actually show declines over the first 4 months.

In any case…charts below, I’ll try to get out a more detailed analysis as time permits.