TARP, the unloved program that either saved the economy or bailed out the bankers depending on who you talk too will probably be wound down over the next year. According to the latest report, the remaining balance outstanding is a little less than $50B. You may want to hold off the Champaign though, because when TARP is gone, so are the cash inflows it generates. Over FY 2010-2012, TARP contributed almost $300B in cash inflows to the federal coffers, reducing the cash deficit and the need for borrowing over that time period. To understand how, let’s first imagine TARP as a two year program. In year one, $700B of cash goes out, resulting in a $700B reported deficit. However, while there were certainly losses, TARP wasn’t a complete loss, as a majority of the money was eventually paid back. Back to our example, let’s say in Year 2, $600B was paid back and $100B was written off. Thus in year two, we record a $600B surplus. Clearly this is different than how a public company would account for the transactions…welcome to government accounting. Now obviously TARP was not a two year program, but the implications are similar. Reported deficits primarily incurred in 2009 are now being offset in future years as balances are repaid or sold.

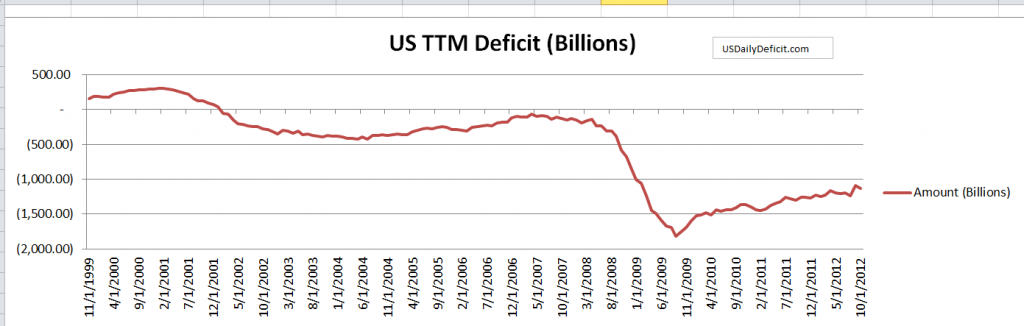

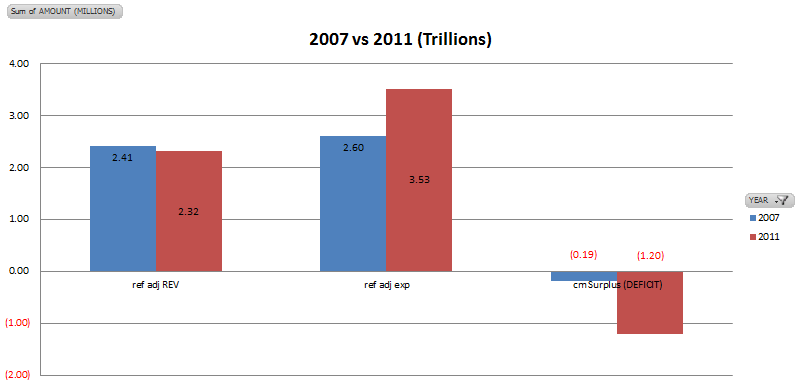

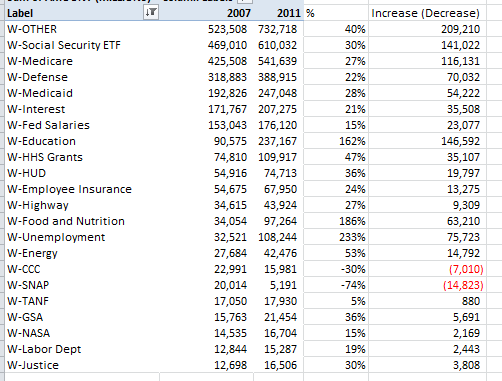

Now at this point you may be thinking, what’s the big deal? So $50-$100B of “revenue” is about to dry up, that’s only around 2% of federal revenues. I bring it up because I just read an article comparing Obama’s tax plan to Boehner’s. According to the Tax Policy center, Obama’s plan would raise taxes on the “rich” by $40-$45B next year, while Boehner’s plan would generate about $20B. So neither comes close to even plugging the hole TARP, an admittedly small revenue source will leave when it is gone next year. The spending side offers little relief either. Next year alone, we can probably expect Medicare and Social Security spending to increase around $100B together, which is around the magnitude of spending cuts being discussed. Using the Daily Treasury Statements as a source, we can see that the trailing twelve month cash deficit as of 11/30/2012 was $1.176T, that’s over one year, not ten. The bottom line is, there is nothing serious about any of the proposals on the table. It is becoming increasingly clear that we as a nation will not voluntarily address this problem. That said, before you bid on that next round of 30 year notes, you might want to ask yourself what the world is going to look like in 30 years when you try to cash it in.