I’m not sure if anyone remembers the drama from the last debt limit showdown last August, which ultimately ended in the limit being raised from $14.3T to$16.394, a $2.1T increase. As planned, they managed to get past the election, but now it’s time for round 2. It’s been 15 months, and in that time frame, the debt has increased $1.861T…for a monthly clip of $124B. Per the 11/8 DTS, total outstanding debt is $16.245T, of which $16.206T is subject to the limit. It’s complicated, just note that there is about $40B of debt not subject to the limit…we’ll be using that assumption for now.

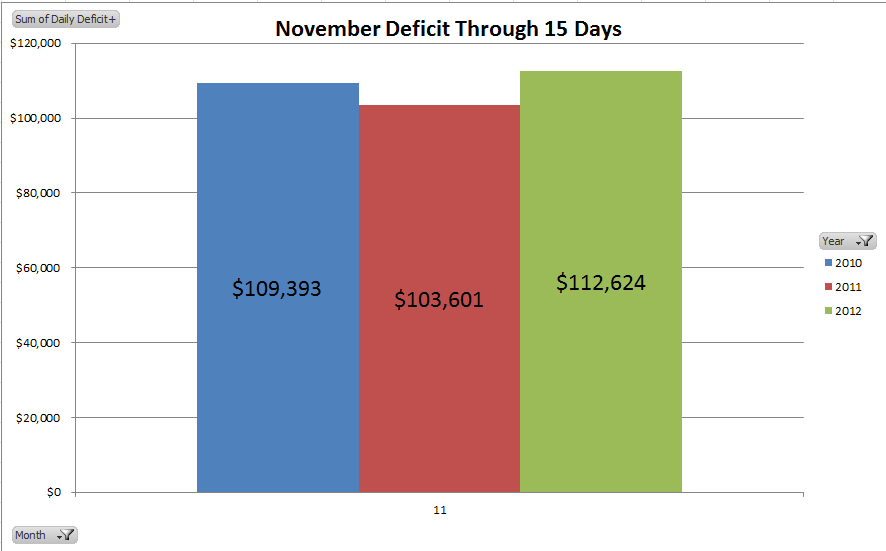

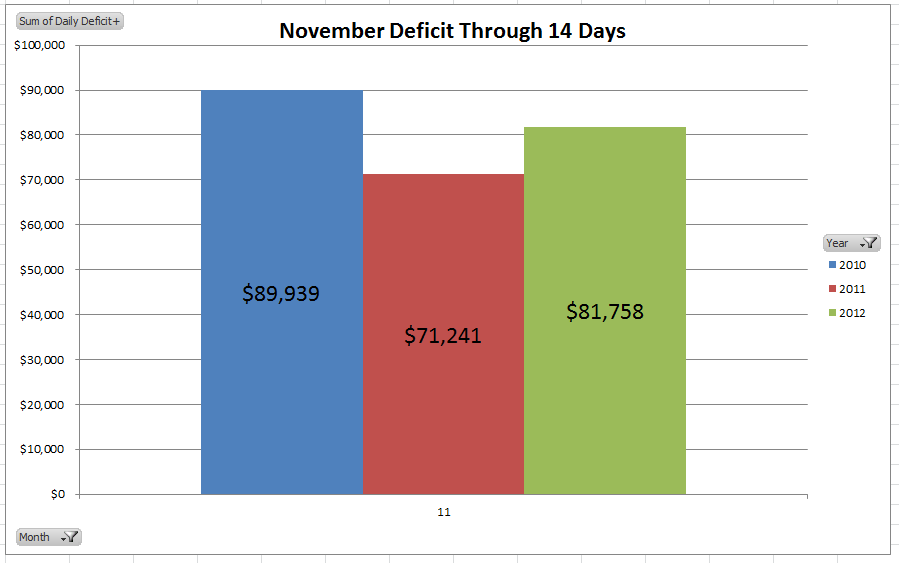

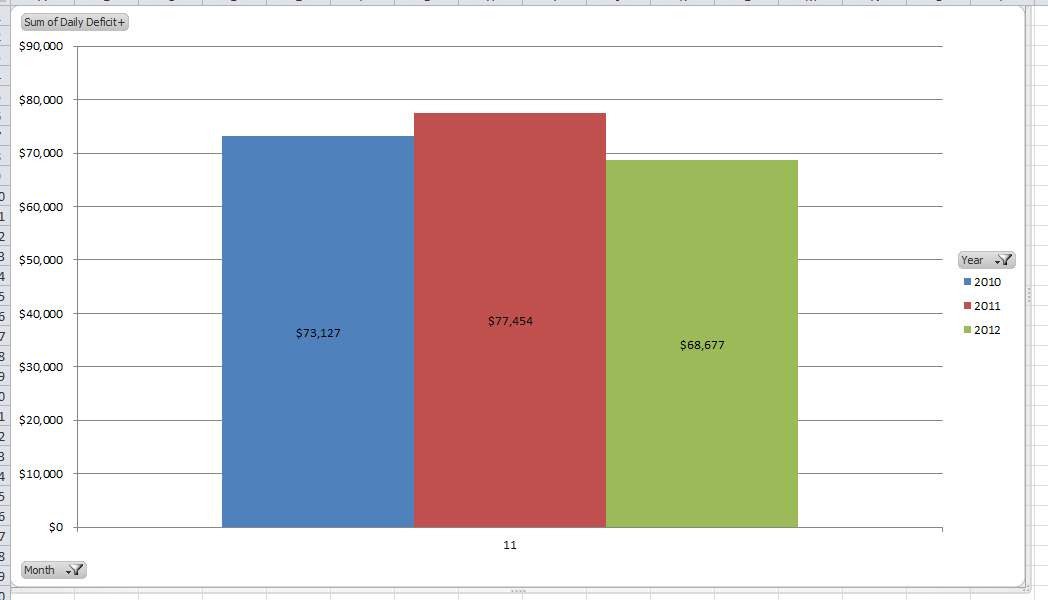

So…We are $188B from the limit. When will that fateful day be? It’s not rocket science, but due to the cyclical nature of both revenues and expenses, it’s not simple algebra either. We’ll start with cash in hand… $45B…and add it to the $188, for a total remaining “cushion” of $233B. Last Year, November and December had a combined deficit of 201B…lets just assume this year will be the same. If this is true, then we would assume another $137B of deficit between now and 12/31, leaving us with 96B left. However…that is only for external….we need to account for internal debt as well. Looking at Prior Years, We can estimate that at another $50B, leaving us right around $46B remaining on 12/31. Fortunately, Jan is another light month, unfortunately, monthly spending is usually front loaded…getting past 1/15/2013 seems unlikely. I haven’t factored in the so called “Extrordinary” measures Treasury could take to minimize cash outflows. I’ll take a crack at those at a later date. In any case, tax refunds make February the worst month of the year…there is simply no way we make it through February without some big problems. So…throwing my dart not fully understanding the extrordinary measures piece of this…I’m going to say 1/20 is the day of recconing and log out for the day.