Over the years, I’ve noticed something about most financial journalists….they generally don’t know what the hell they are talking about. Case in point, today I read “The geeky debt fix that might work” by Jeanne Sahadi at CNN Money. The article is about using “Chained CPI” instead of CPI when computing the monthly increases to Social Security, government Pensions ect… Bottom line, Chained CPI typically runs a fraction of a percent under CPI. According to the article:

Social Security payments would continue to grow every year, but by 2030, the median payment would be 3% less than it would be if today’s inflation measure were used.

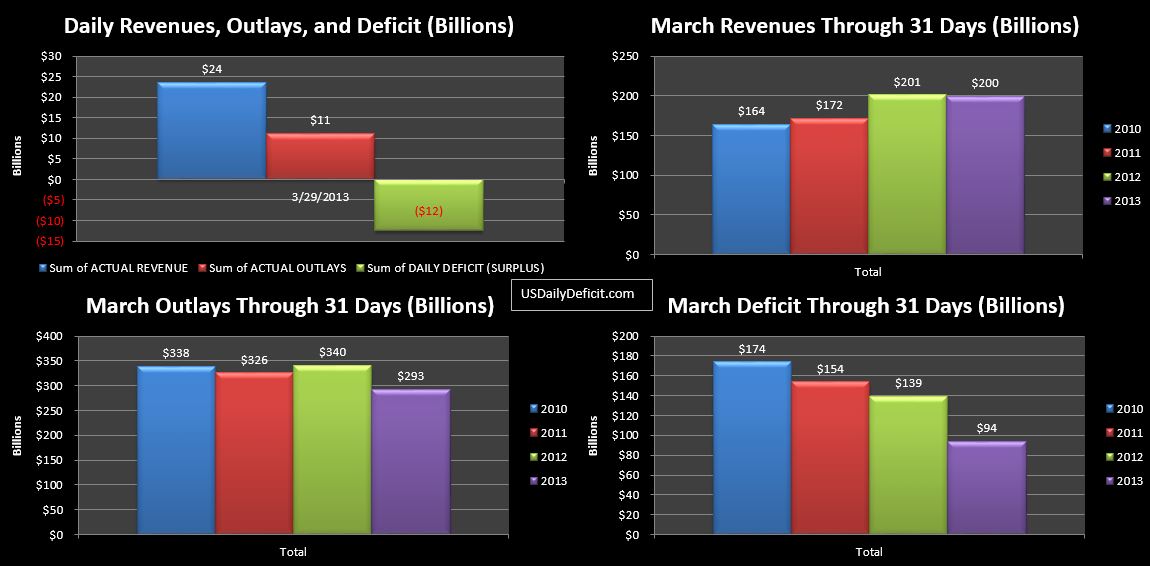

Got that? I thought it was a joke at first. In 17 years…2030, this switch would result in Social Security being 3% less than the current trajectory. So I went to my CBO vs CBO file, and took a look at 9/2030. Using some pretty conservative estimates (6% annual growth through 2023, then 3%), I get annual spending growing to $1.654T. The TTM right now is $689B. So if we adopt this now, we get $50B of annual savings in 2030…$4B per month. News flash…we spent about $ $25B just yesterday on Social Security, with another $35B to go this month. I’d be surprised if this train makes it to 2020, much less 2030, and yet Jeanne says:

It’s dull. It’s controversial. And it might work.

I don’t really mean to pick on Ms. Sahadi, but here is my hypothesis about 95% or so of all journalists…print/TV/radio…whatever. It all starts in college. I didn’t find a bio on Jeanne, but let me take a guess. She’s probably an English major, or a lit major, or a history, or maybe, just maybe, a real journalism major….which is probably worse by the way. Now, I’m a little prejudiced…I do not consider any of these to be real college degrees. These are the degrees you get after you flunk out of a real degree your freshman year. Just sayin… From there, if you know somebody, or have a pretty face, maybe you get on with a small media outlet and work your way up, eventually working your way up through the ranks, ultimately appearing on CNN as an “expert” Notice anything missing? Like…a real job maybe?

I can only speak specifically to accounting/finance, but the only way to really learn about business is jump in and do it….for like a decade. I learned more about accounting in my first 3 months on the job than I learned in 4 years of college. It is quite clear that Jeanne doesn’t have a clue what she is talking about…she just skimmed through a couple government reports, pulled out some talking points, and submitted her piece to a probably even more clueless editor. If she had even the slightest comprehension of what she was talking about….none of this would have made it out of her pretty little head. But it did…and there lies the problem. Think back to 2007…of all the experts crowing about the new market high’s, and of course Bernanke starting off his 0/100 batting streak…how many people said…better watch out because the S&P 500 is going to lose half it’s value and bottom out at 666? I’m sure there were a couple, but they were few and far between. Now we have Jeanne, supposedly a financial journalist who specializes in this topic, buying (and propagating) hook line and sinker the myth that all we have to do is skim a fraction of a percent off CPI calcs and we can fix the deficit. Somebody needs to pull Jeanne out of wardrobe a few minutes early and introduce her to a spreadsheet (and maybe even a calculator)…that’s all I’m saying….can this lady even count??

So I guess my point is, you really shouldn’t trust any of the yokels in the financial media because all they are, for the most part are just entertainers who can read a teleprompter and occasionally pronounce a big word. Can you say “superlative CPI”?? Jeanne can.