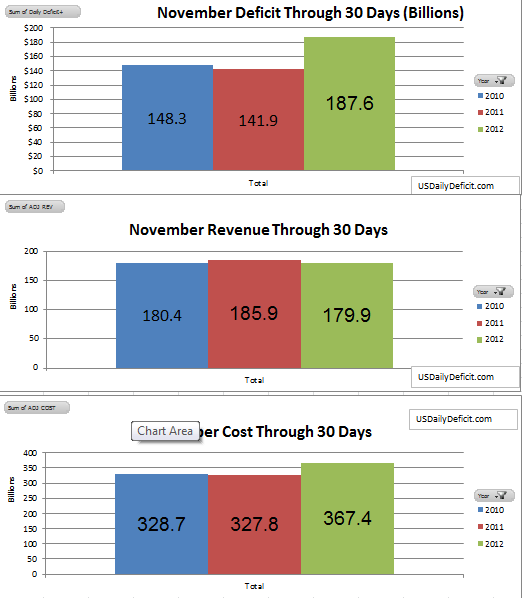

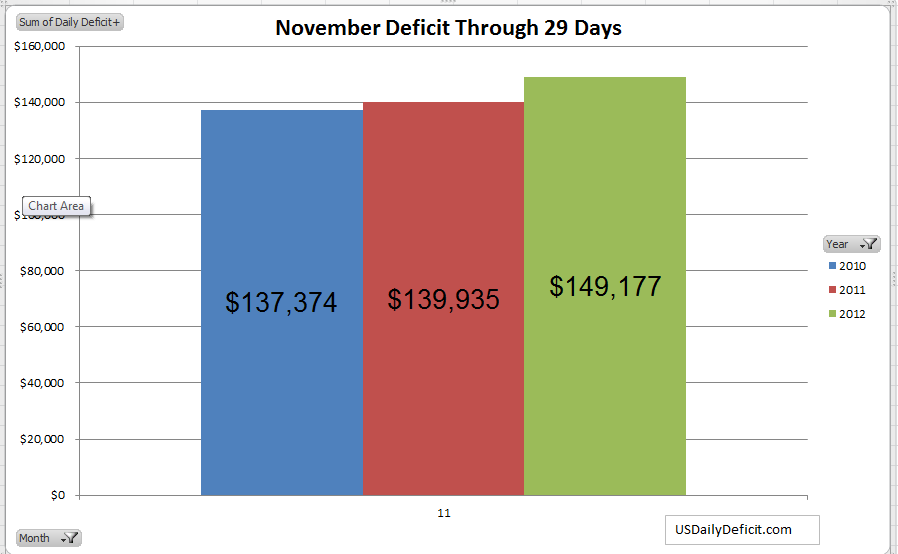

As of 11/30/2012, the US was $63B away from hitting the debt limit of $16.394T and had a cash balance of $49B for a total “cushion” of $112B. Though November’s deficit was $188B, December, being a quarter end should have around $100B of additional revenue over November. December 2011 had a $59B deficit, so we will start this month assuming the same….it will likely be a few weeks before we have any indication of whether December 2012 will be higher or lower than December 2011. If we assume December 2012 and January 2013 will play out exactly like their prior year period did….we get to exactly Jan 31 2013 before hitting the end of our $112B “cushion”.

Note that this assumes no “extraordinary measure” funny business, and no fiscal cliff. At this point, predicting any of that accurately seems impossible, so I’ll stick with the prior estimate of 2/14 at this time. I am quite surprised that I have not heard it mentioned yet, but if the debt ceiling is not increased, tax refunds could very well be in jeopardy…I guess someone is saving this as a trump card, I just don’t know who. Just looking at the numbers….getting through the month of February, much less March, both heavy with tax refunds looks to be impossible without a deal. It will also be interesting to see how fast Treasury moves to increase cash by issuing debt….they have the power to force this issue…or at least get it back in the headlines at will by issuing the entire 63B of debt now.. hitting the debt limit immediately, yet increasing cash to $112B.