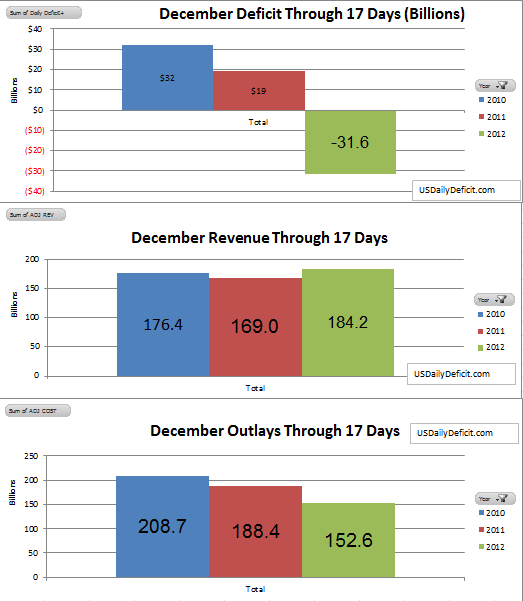

As expected, revenue continues to pour into the federal coffers leading to a $55.6B Surplus for 12/17/2012, bringing December 2012 to a surplus of $31.6B through 17 days. There are still a lot of days left, but with the majority of the corporate taxes in the books, there is a noticable increase in tax revenues over last year. If revenues continue to be strong, and costs stay on trend, we could be very close to a surplus by month end, which would be the first since 2007. I can’t prove this, but It is possible people and companies are making financial moves to pull profits into 2012’s low tax environment and push losses into 2013. Whatever the case, from a daily deficit perspective, the next month or so looks to be fairly smooth waters leading up to February, which will likely be a $200B+ deficit.