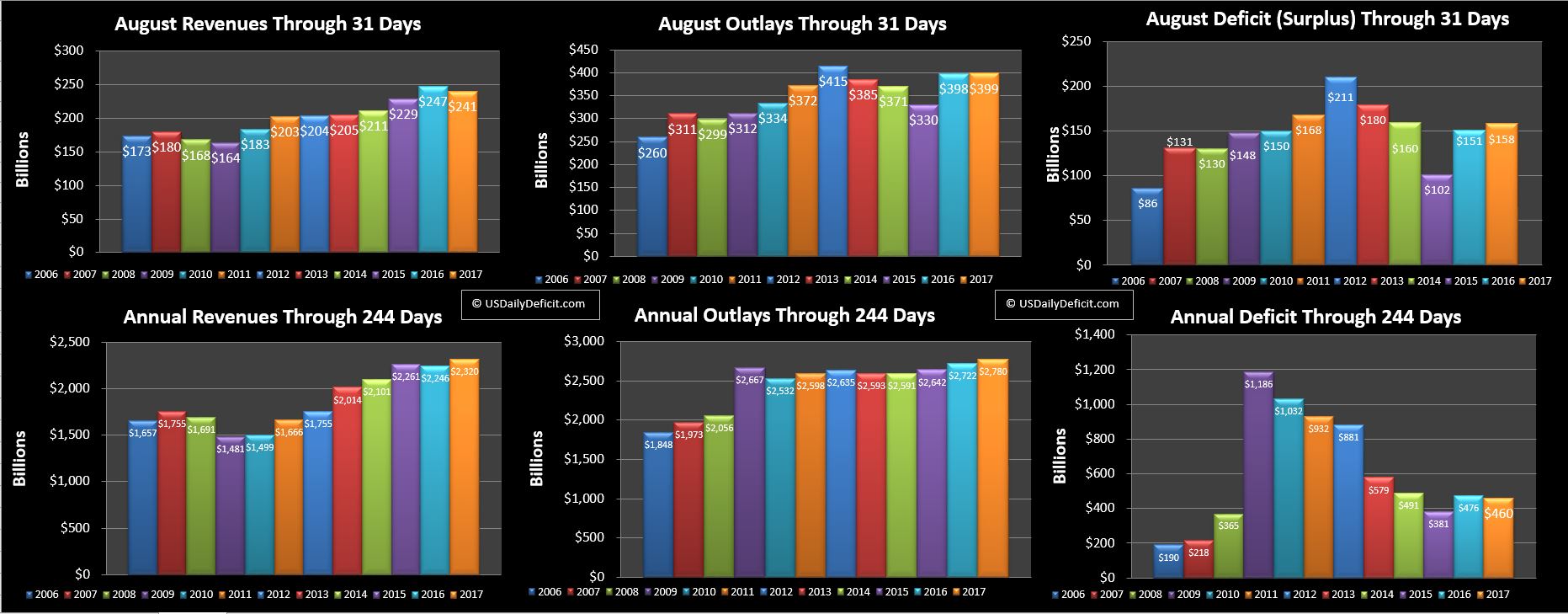

The estimated US Cash Deficit for August 2017 came in at $158B, $7B higher than last August as revenue faltered and outlays were up a smidge. Looking at the YTD revenues are running 3.3% higher while outlays are running 2.1% higher, and at $460B, the deficit through 8 months is 16B under last year’s $476B.

No real surprises here, though I did expect revenue to come in a bit higher than last year even with unfavorable timing of the days this month.

Looking to September, revenues will pick up on the quarter end and lead us to post a solid surplus starting around the 15th when corporate taxes are due. We should end with a $25B-$50B surplus without any surprises.

Debt Limit Update:

On the heavy $158B deficit, cash balances fell from $189B to $55B in August with press releases indicating that cash could run dry by mid October if not sooner unless the debt limit is raised. As I write this 9/7/2017, I see some reports that Trump may be close to making a deal with Democrats to either raise or maybe even permanently get rid of the debt limit. Nothings official, and details are fuzzy and contradictory, but I for one hope they just git rid of the debt limit, which has been a complete and total failure for so long, it’s simply time to eliminate the silly thing. Also… as I have discussed in detail in the past, the Extraordinary Measures (EM) treasury employs to circumvent (legally??) the debt limit nukes my direct cash deficit calculation by hiding debt off the balance sheet, which drives the accountant in me batty.

Stay tuned…if some kind of debt limit deal is reached and EM is reversed, we should see ~350B of debt get pulled back onto the balance sheet, and I should be able to go back and recalculate the cash deficits for March-August with real, rather than estimated numbers. Don’t expect any huge changes, but this has been an odd EM session so who knows……I’ll let you know as soon as I do.