And…We’re back!! Sorry for the late report….

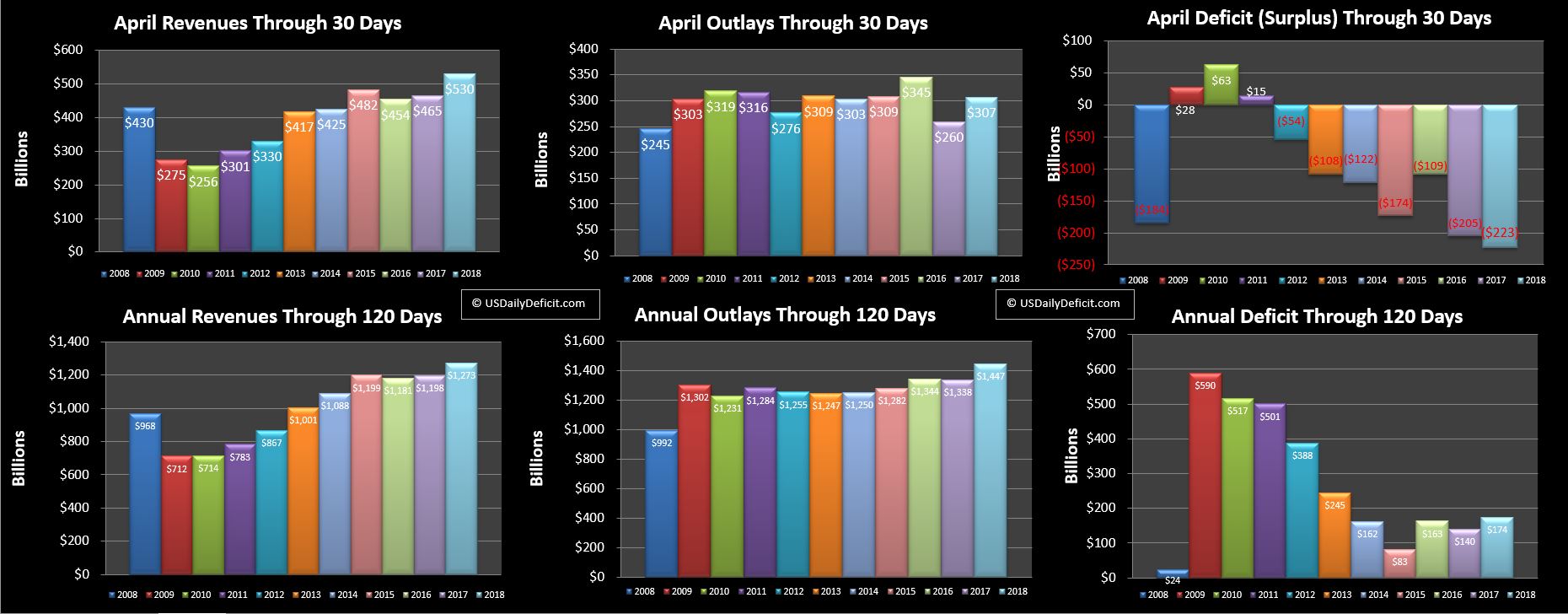

Running a surplus in April isn’t exactly a surprise but hey, we’ll take it…$223B cash surplus…the biggest ever as far as my records go back.

Revenue:

After 3 months of anemic 1% growth (and falling) April looks like a grand slam with +65B of revenue good for a 14% YOY gain. That’s a big number folks!!….through 3 months we were at +$10B, and with one swing we are +$75B….from +1% to +6%.

But….there’s a catch….These admittedly impressive numbers represent the final deposit of 2017 taxes…with big stock gains and higher pre tax cut rates. Enjoy it….savor it….but don’t bet a lot of money expecting it to stick around. From here on out, we’ll be getting 2018 taxes, and halfway into May they aren’t looking so good. I’m not predicting a collapse, but even a decline of a few percent will start causing big cracks in the foundation of a system that requires exponential growth to hold off collapse.

Outlays:

Unfortunately…that hugely impressive revenue number was cut off at the knees by a +$47B and +18% YOY increase in outlays. Yeah…some of it was timing…we’ll never get away from that but looking at the YTD 1/3 of the way through the year and our spending is sitting at +109B…good for an 8% YOY spend. I am still sifting through the details but about half of that looks like the usual suspects…social security, medicare, medicaid, and defense. There’s also about $10B of some oddities from the debt limit… I suspect government employees shifting a lot of their Thrift Savings Plan balances (401k equivalent) out of US government bonds in the lead up to the debt limit hike. The rest is increased interest…both in payments and a big uptick in what I calculate as unamortized discounts…I’ll dig into that deeper someday, but I suspect this is what it looks like when you start refinancing your old 0.25% debt into new 2%+ rates….

Deficit:

$174B through 4 months is the highest since 2013…we are clearly going in the wrong direction…April was overall a good month and it helped a lot but it won’t be nearly enough if the other 11 months stink.

Looking Forward to May:

May 2017 posted a $108B deficit… With over half of the month already booked, May 2018 is looking more like a $150B deficit on timing, reduced tax reciepts, and a one time $19B payment last year related to the FCC spectrum auction that doesn’t look like we’ll see again this year..

Looking Forward to 2018+:

April’s revenues were huge… I said last month that anything can happen in April and put a wide +/-50B disclaimer on my estimate and still missed it….April Revenue came in at $+65B. But then…that huge good news was nearly wiped out by an increase in spending….If the rest of the year reverts to ~1% revenue growth or worse, and spending sticks at around +7%-8%…we are going to have some big problems by about this time next year, especially if April 2019 falls short of this year’s revenue boom. There is a lot of uncertainty, but 2017 posted a $710B cash deficit….2018 is zeroing in on the $800B-$900B range, and as noted we could have a run rate over $1T by about this time next year if not sooner. If we get a few more bad months confirming what we saw in January-March…it might be time to get the red siren out. Stay tuned!!