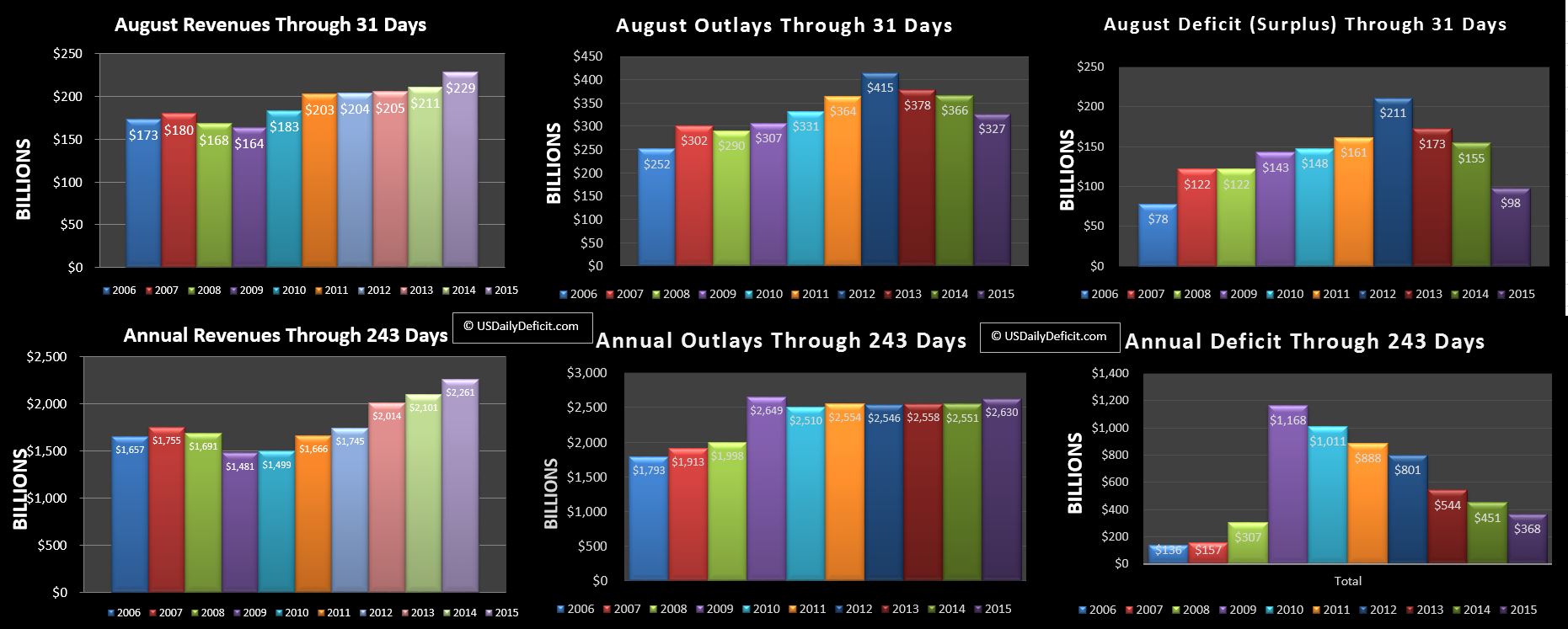

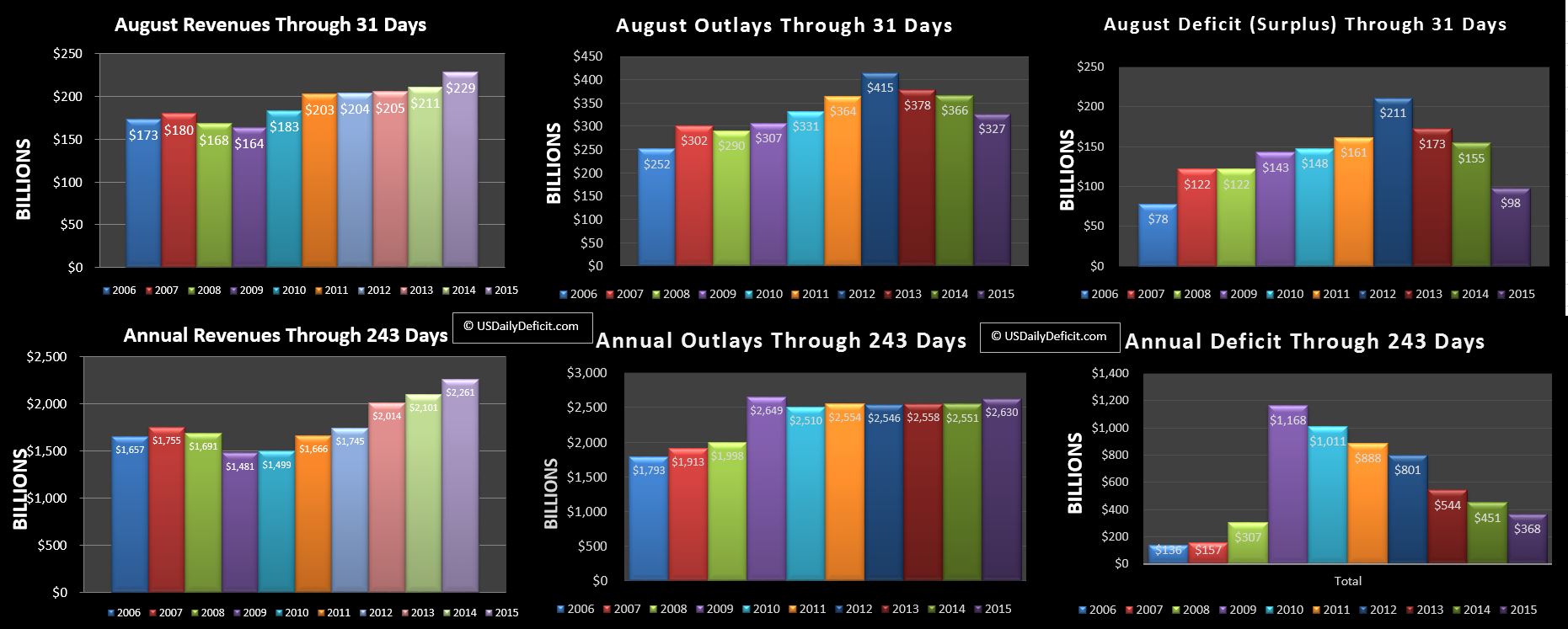

The US Daily Cash Deficit for August 2015 was $98B. This brings the 2015 year to date cash deficit to $368B, an $83B improvement over 2014’s $451B deficit through 8 months.

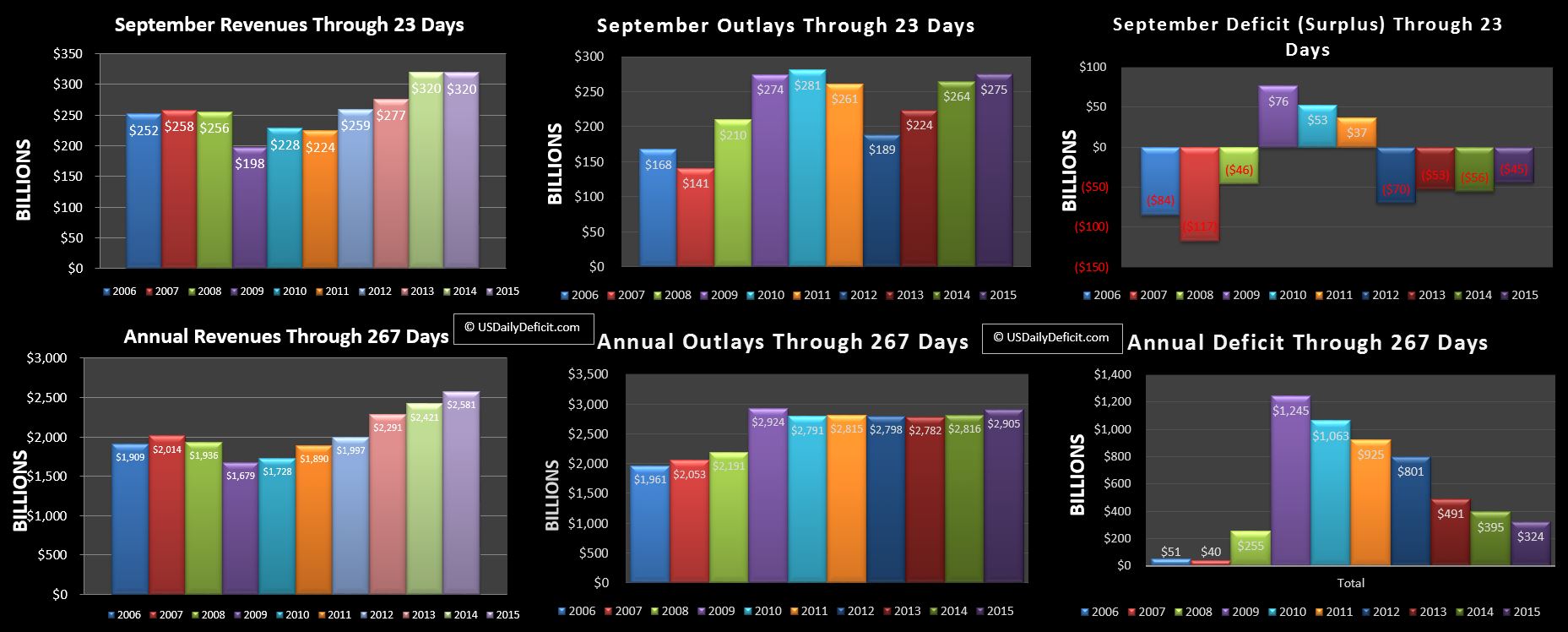

Revenue:

Revenues were strong at +8.4%…the first month since April to break 5% breaking a 3 month streak. The year to date revenue gain stands at +7.6% which is a solid number, but it has been dropping fast. It will be interesting to see if September stays strong at +5% or dives back under and continues to pull down the YTD.

Outlays:

Outlays were down for the month due to timing but the YOY remains at +3%. For most of 2010-2014, we saw increases in outlays for Social Security, Medicare, and Medicaid offset by reductions in spending elsewhere….primarily stimulus, and defense keeping overall spending flat. In 2015, it looks like those other categories have flattened out while the big 3 continue to surge. It may not seem huge, but a 3% baseline increase in outlays adds over $100B a year of spending a year growing exponentially. Just to keep the deficit flat, a 3% increase in outlays needs a little less than 4% revenue growth to cover. Looking at the last 4 months…we’re at +4.9% including a pretty good August.

Deficit:

Through 8 months the deficit stands at $368B as revenue gains of $160B have been offset by a $79B increase in outlays. If current trends hold and we finish out the year with revenue at +5% and outlays at +3% 2015 will end up at $425-$450B for the full year ve $556B in 2014. Do note that the Feds current use of “Extrordinary Measures (EM)” has forced a methodology change and added an extra margin of error that we won’t be able to reconcile until the debt limit is raised again and EM ceases.

Default Day:

As we all know, the debt limit was hit back in March at $18.113T. Since then, Treasury has managed to keep the government going by drawing down the sizable cash stockpile (274B after the April tax haul) and by implementing “Extrordinary Measures” (EM) which allows them to essentially pretend some types of debt do not exist….thus pulling it off the balance sheet and issuing new debt in it’s place. My guess of the amount of total EM available to treasury is $350B, of which they have used about $220B based on some back of the envelope calculations. The balance of $130B plus the current cash balance…$132B at the end of August gives us the cash cushion available to cover future deficits. At the end of August, this amount was ~$262B, down from ~$360B at the end of July. Looking forward using my model, $262B should last until about the middle of February 2016….just as tax refund season begins heating up again. This timeline hasn’t changed much and I don’t really expect it to…we have enough cash to make it to February, but making it through tax refund season is very unlikely, meaning that raising the debt limit will become a very big issue right around the time primaries for the 2016 presidential election are getting started.

September Forecast:

September is a big revenue month as quarterly tax payments will start to flood in mid month. While August had 229B of cash revenues, look for September to come in just under $400B….so you can see that we have big swings in revenue moth to month. I’m going to forecast the September 2015 cash surplus at $60B.