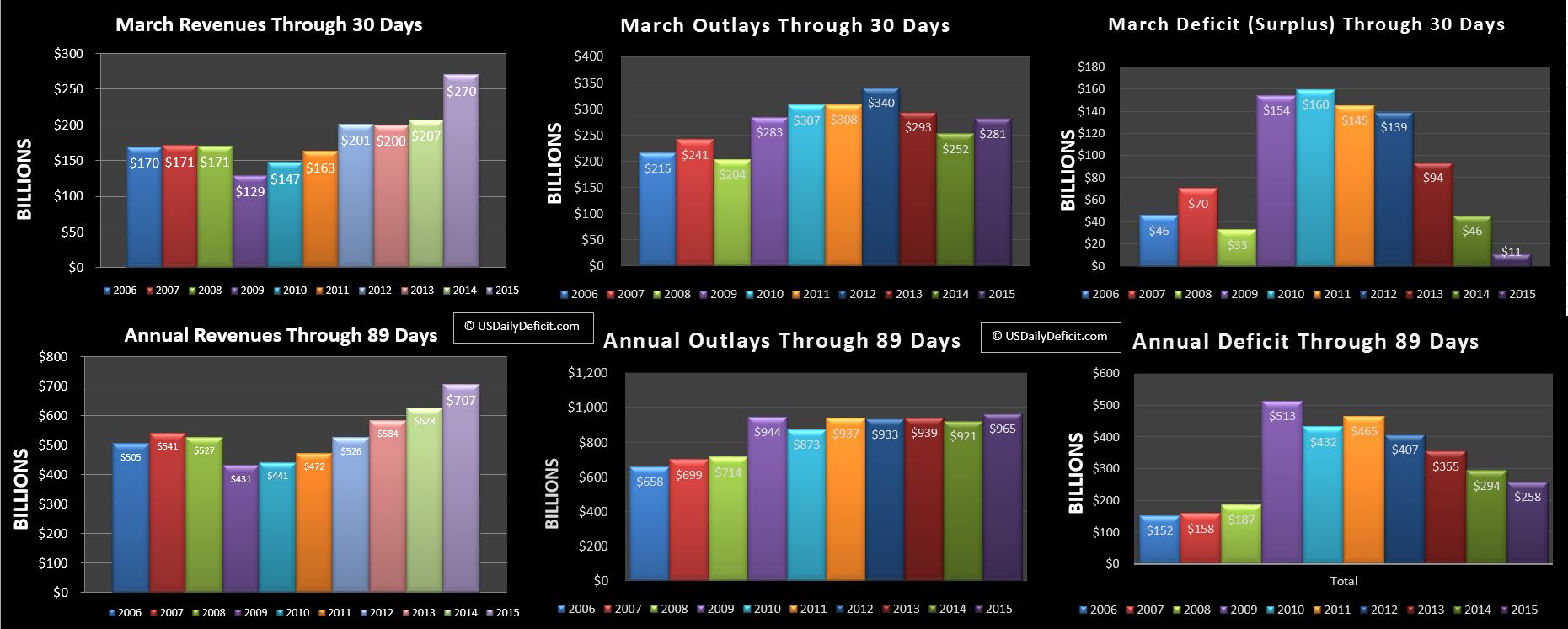

The US Daily Cash Surplus for Monday 3/30/2015 was $6.6B bringing the March 2015 Deficit through 30 days to $11B

I finally had a chance to rig up some new charts….let’s walk through the disclaimers. First off…as discussed in earlier posts….Treasury deploying “Extrordinary Measures”(EM) nukes my old process. Essentially…they take debt off of the balance sheet and pretend like it doesn’t exist. So…what happens when they use their magic want to make say $10B disappear? Well…every accounting entry has an offsetting entry, and this one pops up as a $10B surplus….except that it’s fake. I can roughly back out this effect, but will need to true it up once the debt limit is raised and EM are all brought back on the balance sheet. I would guess this adds a $5-10B margin of error per month…probably on the lower end, but who knows..

So here we go. Revenues look great…+$63B and +30%. Of course…$35B of that was from the FCC spectrum auction. Still…not too shabby, though I think 3/31 revenue will be down quite a bit YOY on dissapointing Freddie/Fannie payments….pulling us back down a bit for the full month from where we are today, but it will still go down as a great revenue month.

Outlays are sitting at $+29B. $6B of this is interest timing, and another $10B is the extra day March 2015 has over March 2014. That leaves $13B of bonafide growth….$8B or so looks like Medicaid, which ended 2014 at $23B but looks to end March 2015 at around $31B. If that sticks, Medicaid growth for the first quarter of 2015 is going to be up about 22% over 1Q 2014, and 40% over 1Q 2013. I had expected that growth rate to temper a bit this year, but it’s actually a little higher than last year.

And finally, the deficit at $11B is more or less in line with expectations, but a little worse than my initial forecast at a $5B surplus. Last March ended up with a $31B deficit, so we will definitely end up better than that….if that’s a victory, we’ll take it.