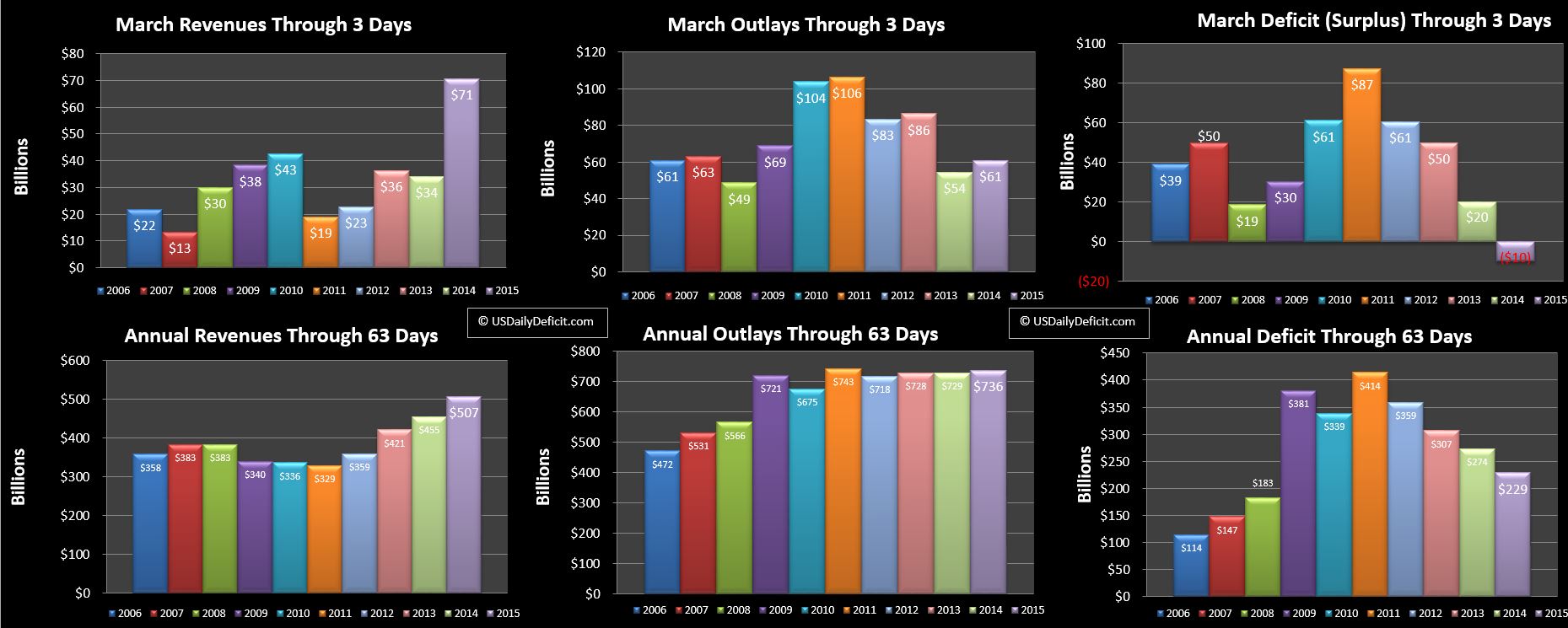

The US Daily Cash Deficit for Tuesday 3/3/2015 was $32.0B, following Monday’s surprise $41.7B surplus, bringing the March Surplus through 3 days to $10B.

We start the month off with a pleasant revenue surprise…$31.6B of cold hard cash from the FCC. A quick search brings a news story I missed…the FCC had an auction of wireless spectrum back in January, setting a record with 44.9B of sales. What happened to the balance (44.9-31.6=$13.3B)??…hell if I know, but we’ll take it and book it as revenue. I have to say…this is a really big number. To put it in perspective, the total YOY gain in revenues I reported just yesterday was about $15B for the first 2 months of the year. In a single day, we’ve doubled that, and now have the year looking at 11.5% YOY revenue gains instead of 3.7%. To be sure…absent real +10% gains….this % will wither away as the year goes on, but this is definitely a material one time event. The timing is actually quite nice….it should more than offset the apparently collapsing revenues from Fannie/Freddie, which could be just a few billion this quarter compared to nearly $18B in 1Q 2014.

Moving along, Outlays are at +7B, most of which can be explained by the $6.3B interest payment that slipped from February into March, syncing up the YTD, but throwing off the monthly YOY. Nothing terribly interesting here, though this does push the YOY outlays growth rate to 1% from flat at the end of February.

March, is likely the least interesting of the quarter end months as individual taxes, usually high in a quarter end get pushed to April 15. There are corporate taxes, but only ~35B or so. This March happens to have an additional business day over last year, which should add some marginal revenue and outlays. Refunds should remain strong, coming in between $60-70B.

For February, my initial forecast of $210B was only $1B off the actual at $211B…which as I have explained isn’t nearly impressive as it sounds. For March, I’m going to guess a $5B surplus…. Last March had a $25B deficit, but between this surprise revenue, and moderate baseline revenue growth, offset by some outlay timing, $5B surplus seems to me like as good of a guess as I can muster.