I read The Queen of Obamaland by Pat Buchanan with great interest as he turned his guns on HHS Kathleen Sebelius who’s disastrous rollout of the Obamacare website has caught the attention of many late night comedians. It’s worth a full read….just like everything Pat writes, but here’s the money quote:

In World War II, FDR brought together the men who made things in America, dollar-a-year industrialists who swiftly took charge and met his immediate demand for 50,000 planes and 1,600 ships.

They built the most awesome military machine the world had ever seen, arming 12 million Americans, Russia and England as well, and smashing two mighty empires on opposite sides of the world.

And these men did it in about as long a time as it took Barack Obama’s regime, captained by Kathleen Sebelius, to flunk a test to create a website. There is something deeply wrong with our republic.

Doesn’t he have a point? Now…I knew that our government sucked at just about everything it touched….but have we sunk this low…we can’t even build a stinking website…even after spending $600M+. And this is likely just the tip of the iceberg….we know damn well that whatever cost estimates and savings they promised to justify this whole thing will turn out to be disastrously wrong as well.

This is one (of many:)) fundamental reasons I could never be a liberal. You see, the liberals for the most part have their hearts in the right place. They want to eliminate poverty, educate everybody, make sure everyone has healthcare….essentially just make the world a better place, and I get that. But then…they go completely off course by making a fundamental assumption….that Governmentt has the capacity to accomplish any of these things. It can’t….and it has a documented record of failure in just about everything it touches. And yet…the liberals just can’t give it up. After his failure…nobody on earth would trust Bernie Madoff today with their retirement accounts today….but here are the liberals….”please Uncle Sam…we have this great idea on how to fix healthcare”…”can you take it from here?”

And it’s not like the Rebublicans are any better….what with the nation building and the department of homeland security ect…

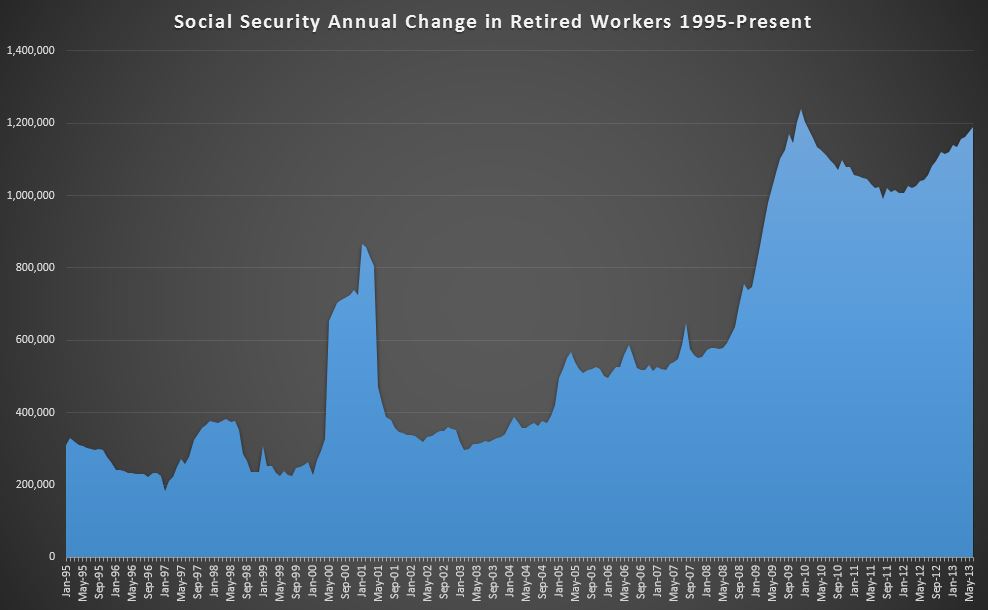

On the same vein of thought…on Meet The Press Sunday, Alex Castellanos-republican strategist made a good point…asking…”name something government can do well”….then went on to name a list of failures…including pointing out that social security was a ponzi scheme…excellent…truth telling on national TV…that never happens.

Enter Neera Tanden-Democrat…who giddily declared after this bit of truth telling..” I think it’s good to know my republican colleagues don’t like social security and medicare”. That’s it….that’s the only thing she heard. Hee hee… now i get to bash republicans…for telling the truth. I watched it about five times…and you could see the sparkle in her eye the second the truth slipped out of Alex’s mouth…it kinda made me sick to my stomach.

And you know what…it will work. All you have to do is accuse a candidate of wanting to cut back…even a tiny % of the SS Ponzi scheme…and 60M+ voters will crush whatever political aspirations they may have had….even if they were the best candidate with the best ideas for the long term.

And this truth….more so than anything else…including the $17T of accumulated debt is why I remain convinced that the collapse of this system is inevitable. I will grant the optimists out there that we are not too far gone to fix this country….solutions exist to put us back on the right track to long term prosperity. However….none of them will ever see the light of day…and it’s our own damn fault. For 30 years we as a society have been making piss poor decisions at the ballot boxes, and the result is profound. The country that not so long ago…as Pat said:

“built the most awesome military machine the world had ever seen, arming 12 million Americans, Russia and England as well, and smashing two mighty empires on opposite sides of the world.”

…is now so friggin incompetent they can’t even build a damn website. In the movie Idiocracy it took 500 years for society to devolve….I’m thinking for us…50 would be a miracle. Democracy…it seems, is simply incapable of fixing this. Thus failure, it would appear is…the only option. With collapse comes the opportunity to rebuild from scratch. Ctrl-Alt-Del