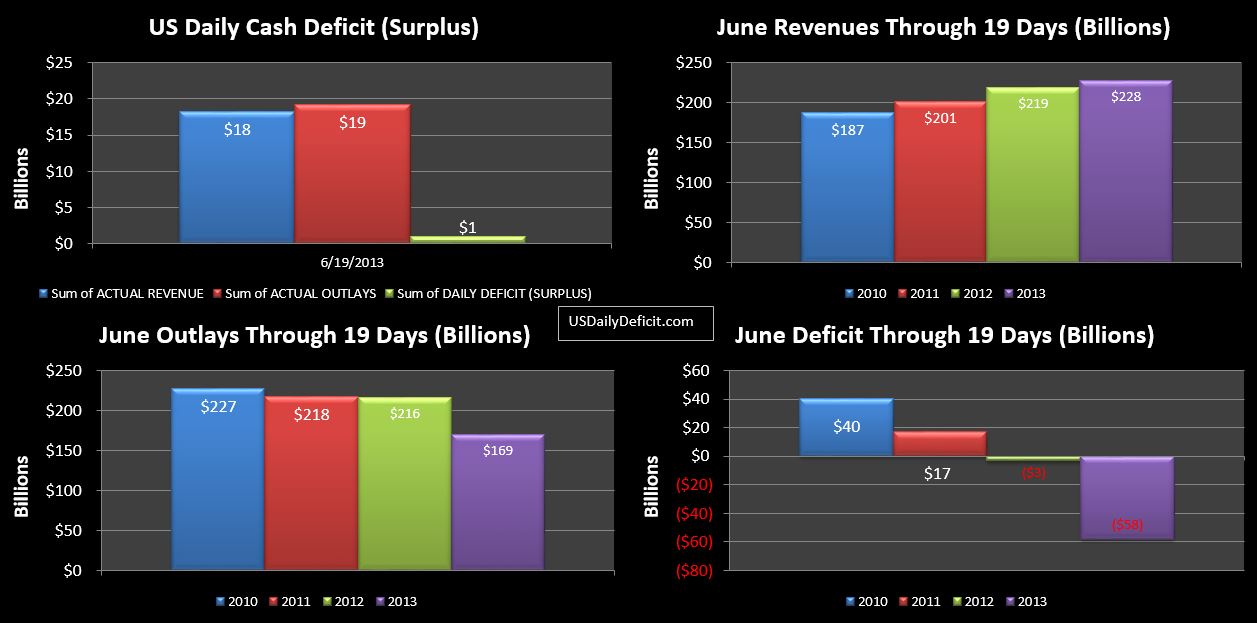

The US Daily cash deficit for 6/19/2013 was $1.1B….marking the first deficit in a few days 🙁

The charts continue to look impressive, but it is mostly an illusion based on the apparent large drop in outlays…. $47B. I want to revise some of the numbers I threw out yesterday, after closer analysis today, I didn’t quite have it right when I pondered that $12B of the improvement was related to social security timing…forgetting that I had already adjusted for that by including an additional day in 2012.

Of the $47B, I am now estimating that $35B, rather than the $30B I have been using all month is a better estimate of the costs that shifted into May. Of the remaining $12B, as of today, I am left to believe these are bonafide decreases in outlays(through 19 days). Just eyeballing it…looks like defense vendor payments are down $4B and education department programs are down $4B, with the rest spread around a dozen smaller categories. I wouldn’t get too excited yet, but facts are facts….lets see what happens.

Revenues continue to disappoint (me at least). Net revenues are up 4% YOY, taxes withheld are up 8%, and taxes not withheld are down 21%. Corporate taxes are still up 9%. The key to any long term budget solution is first holding cost constant….something we have actually been able to do for the last 3 years or so (not for much longer though…thanks to social security). Second…you have to be able to grow revenue…for a sustained period of time at or around 10%. For reference…2010 actually decreased over 2009, but was basically flat. 2011 posted an 8% increase and 2012 posted 6%. For a brief moment in time… the first 4 months of 2013…we were running at 15%…very impressive. Yet…after the tax season…we find ourselves sinking back to the middle single digits.

If you’ve ever modeled exponential growth…you realize that the difference between 5% and 15% in year one can be pretty big by the time you get out to year 10. The CBO is projecting 10-12% growth for the next 3 years….I’ll be surprised if we get half that after 2013. Add a sell off in the stock market, and even a mild recession, and you could go negative in a quarter or two….completely tanking the rosy CBO projections our brilliant politicians are using to make extremely important decisions (not that it really matters)..Ok..enough doom and gloom…I should probably wait a for a few more months of data…after all…we should be getting a cool $60B from Fannie Mae any day now…