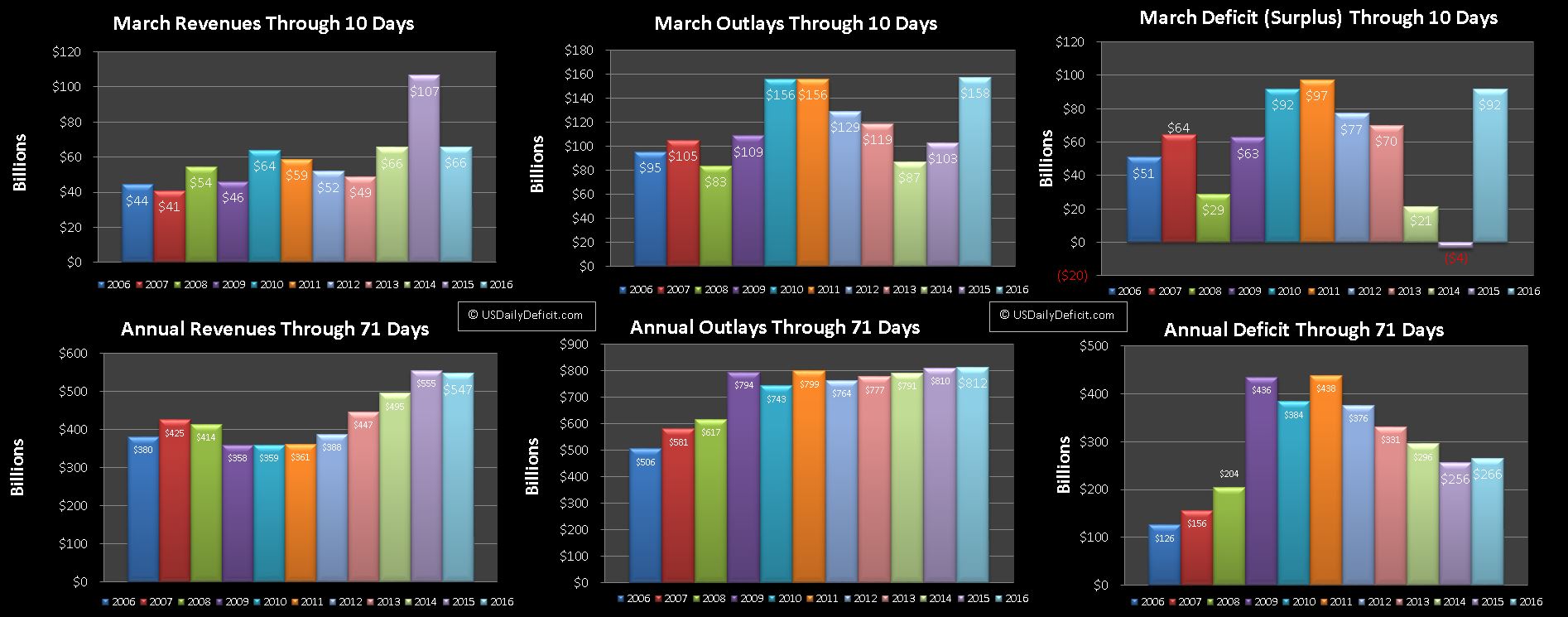

The US Daily Cash Deficit for Thursday 3/10/2016 was $5.9B bringing the March 2016 deficit through 10 days to $92B.

Revenue looks down big….you may recall that last March received about $35B of additional revenue thanks to the FCC wireless spectrum auction. There is another one planned in 2016 at the end of the month, but it is unlikely the cash will be in hand until a few months after that. I saw one article that forecasted this auction will be even larger….in the $60B ballpark….guess we’ll just have to wait and see. Regardless, March 2016 is likely to come up short of last year by a large margin unless Treasury can pull a $35B rabbit out of their hat. In fact, without that FCC revenue, 2016 is currently down for the full year, but by less that $35B so there is at least some baseline growth for now. Outlays, with timing mostly flushed out are back over 2015 levels despite the ~35B YOY timing…suggesting healthy baseline growth here as well. When we kicked off the year, I assumed we would see 3% growth in both revenue and outlays. For now…it is looking like revenue is running a little under this and outlays are a little over. That’s not exactly a recipe for budgetary success, but it’s been way worse. Stay tuned…April could get interesting.