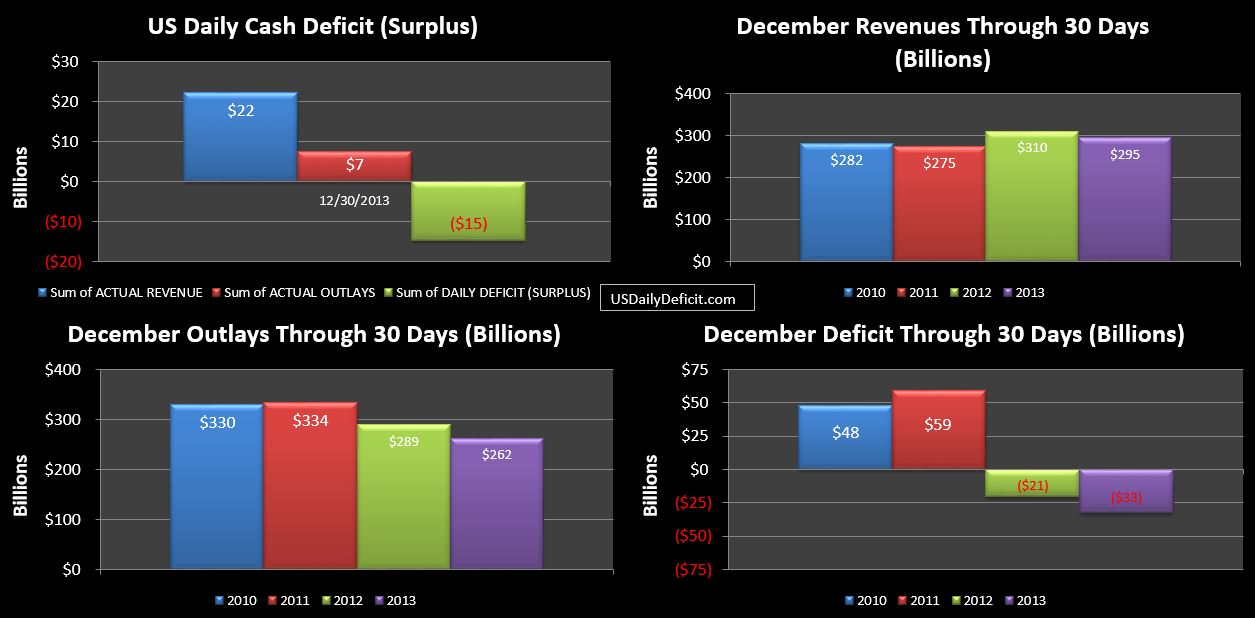

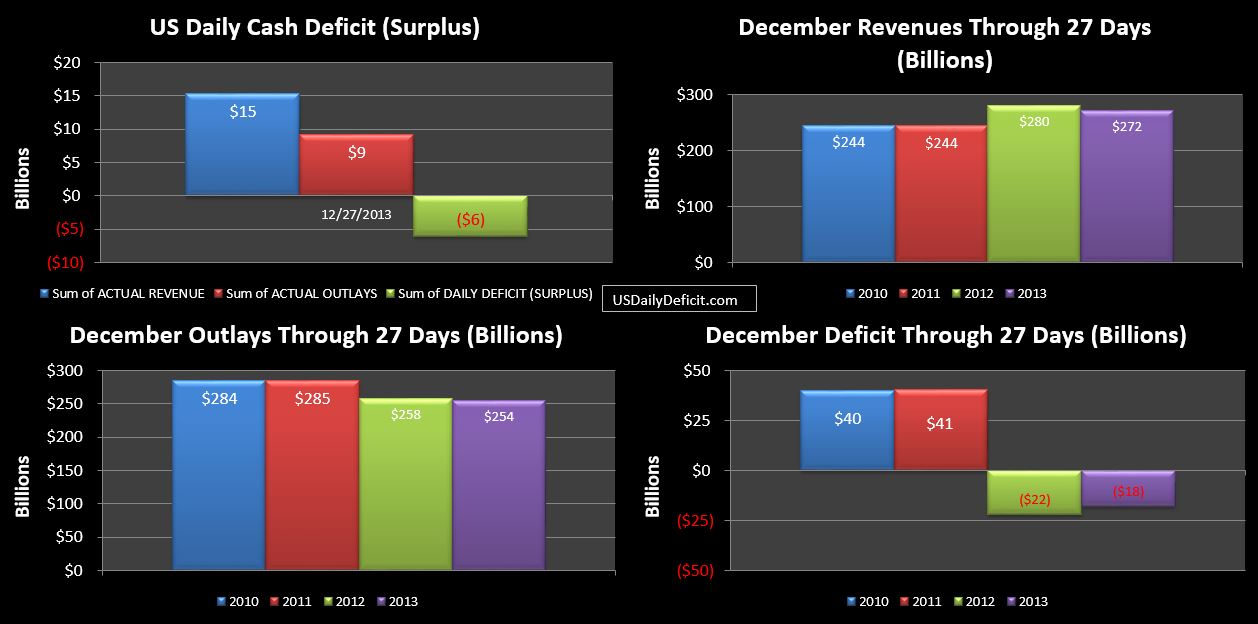

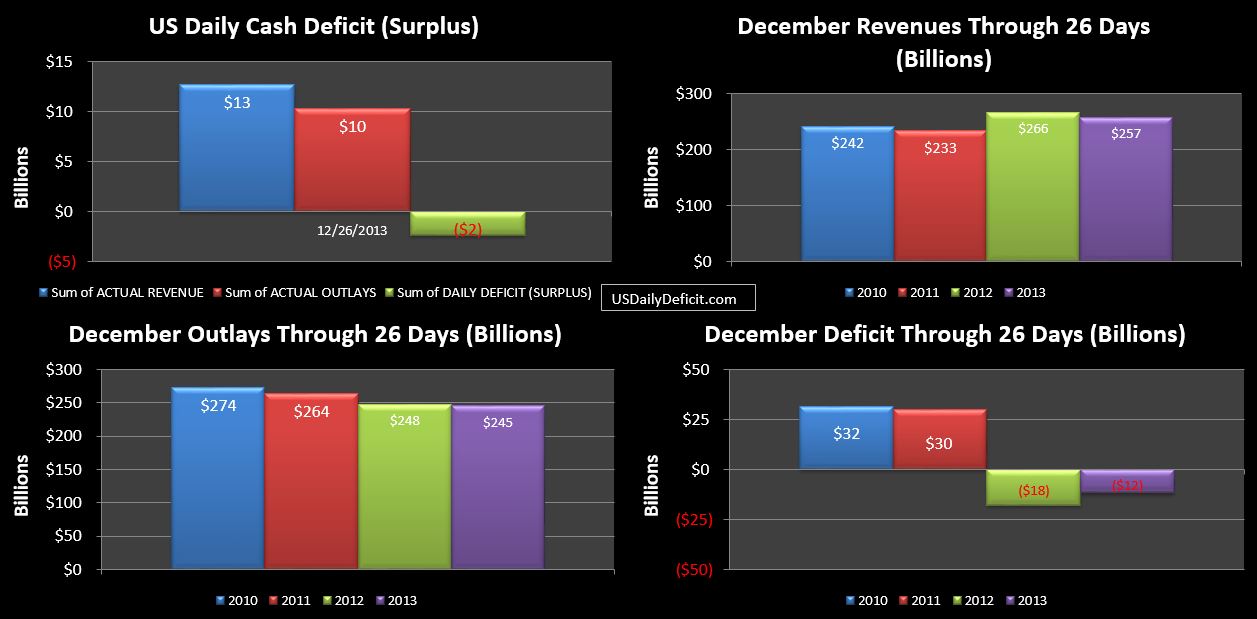

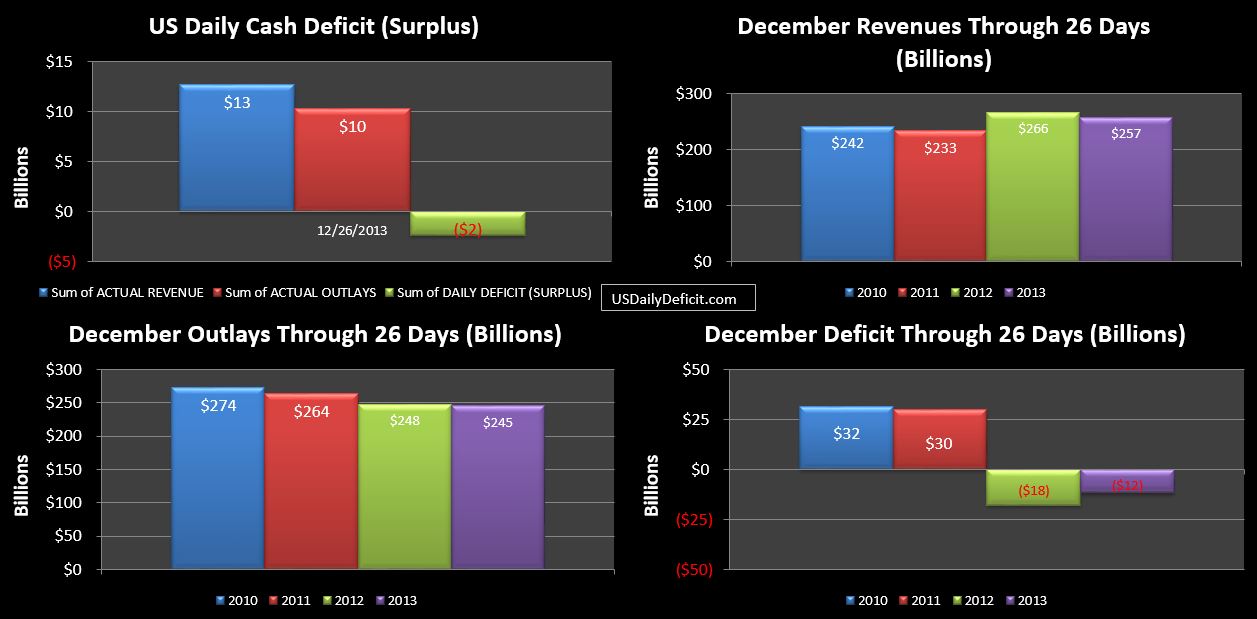

The US Daily Cash Surplus for 12/26/2013 was $2.4B bringing the December 2013 surplus with 3 business days remaining to $12B.

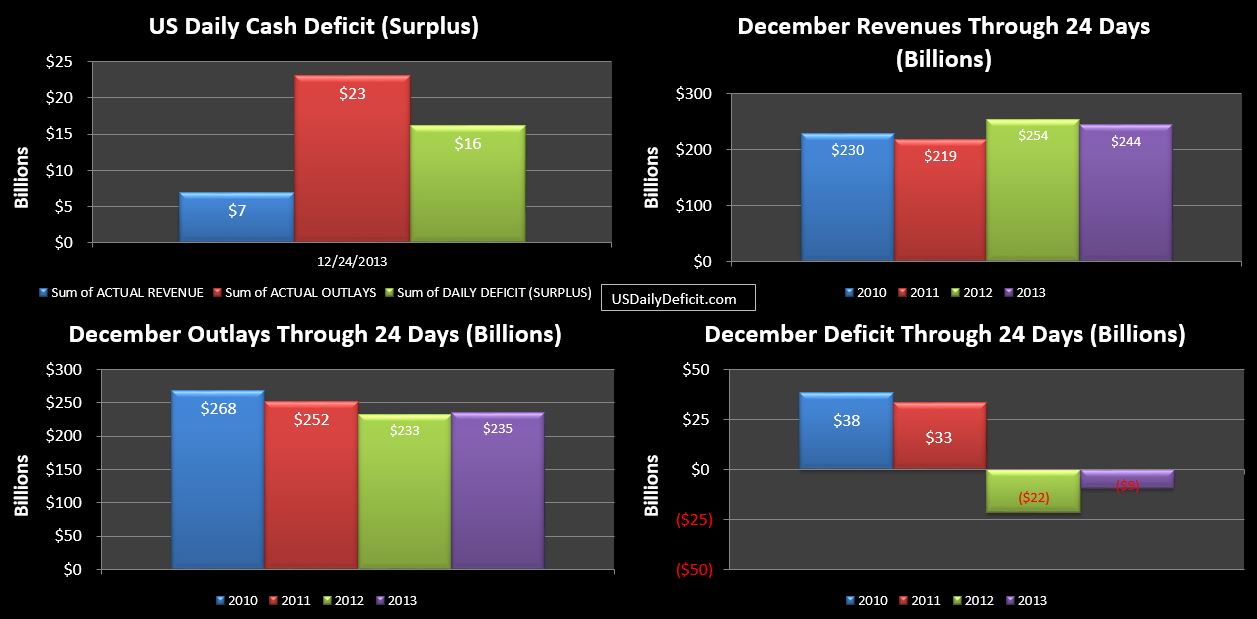

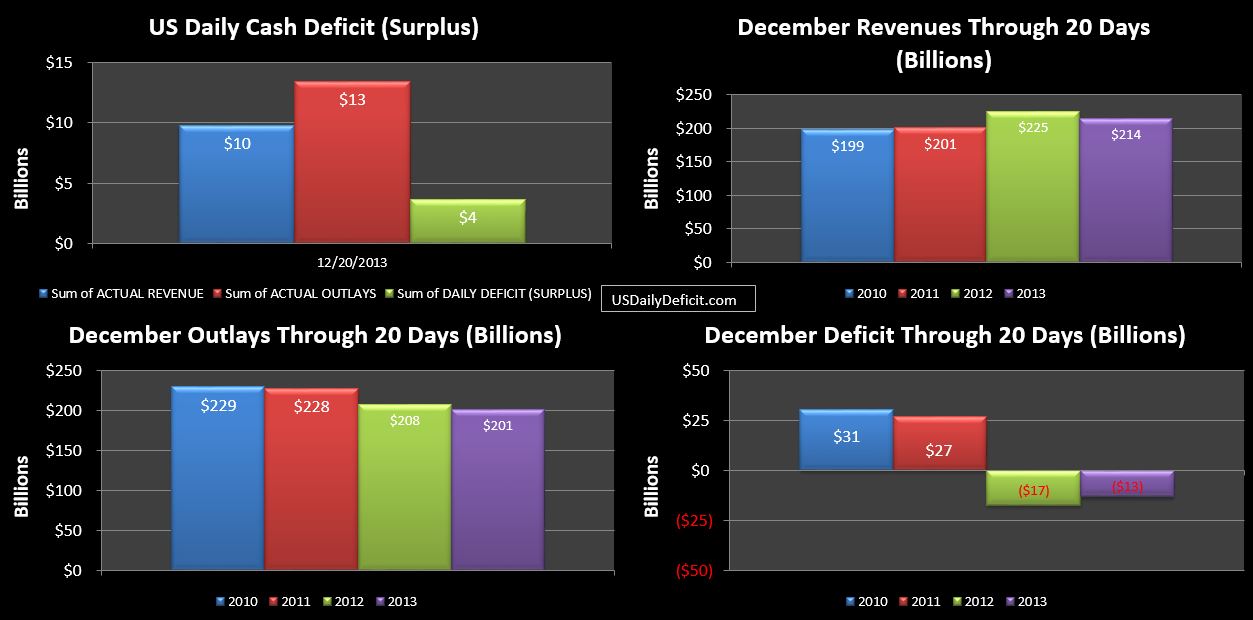

No real changes to note….revenues gain a bit of ground and outlays give a little back. This is about the cleanest true YOY comparison we are going to get with the upcoming Freddie Mac “dividend” tainting the true revenue stream. So as of today,with all the SS expenditures done and all of the holidays behind us, we are showing a surplus, but there’s really nothing to like here with revenues down 3% and outlays down 1%.

Recall…we are starting in a huge hole…$17T+ of debt…and while the digging has slowed a bit from the ~1.6T per year pace in 2009 to the ~$700B we will likely end 2013….$700B is still a huge number. If we ever to balance the budget…..and I’m on record as highly doubtful….we are going to need to string together another 3-5 years of solid revenue gains….just to get to zero. Without a doubt 2013 has been an impressive year…with ~+13% YOY revenue gains and a ~1% decrease in outlays for a $400B+ YOY improvement.

But…if December through 26 days is a sneak peak of what’s to come in 2014 and 10%+ revenue growth is over…we’re pretty much screwed (but we already knew that right). Now…maybe it’s not….maybe it’s an anomaly….we really won’t know until April-2014. If at that point, revenues are up another8-10% over 2013’s record showing…perhaps some sliver of hope will remain. But if instead we are in the low single digits, you can kiss….those rosy CBO estimates of a $382B 2015 deficit (and the 2023 $985B deficit) goodbye.

There are already signs that the fed is on the cusp of losing control of rates with the 10 year breaking 3%…nearly doubling from a year ago. and the 30 year inching up pretty close to 4%…up over 1% from just earlier this year. That, on top of SS, medicare, Medicaid, and whatever happens with Obamacare….there are huge cost pressures that are likely unstoppable…If we don’t get revenue gains to offset them the deficit blows up… debt continues skyrocketing, and sooner or later rates spike, or people just aren’t willing to lend the crackheads (that would be us) any more cash. And that’s when it gets really interesting. This is likely inevitable….but the unknown is when? Anybody who says they know is a liar…I could envision scenarios where it gets real ugly real fast…..I could also envision scenarios where this juggling act going on far longer than would seem mathematically possible. That’s what makes it interesting, and that’s why I’m still paying attention….