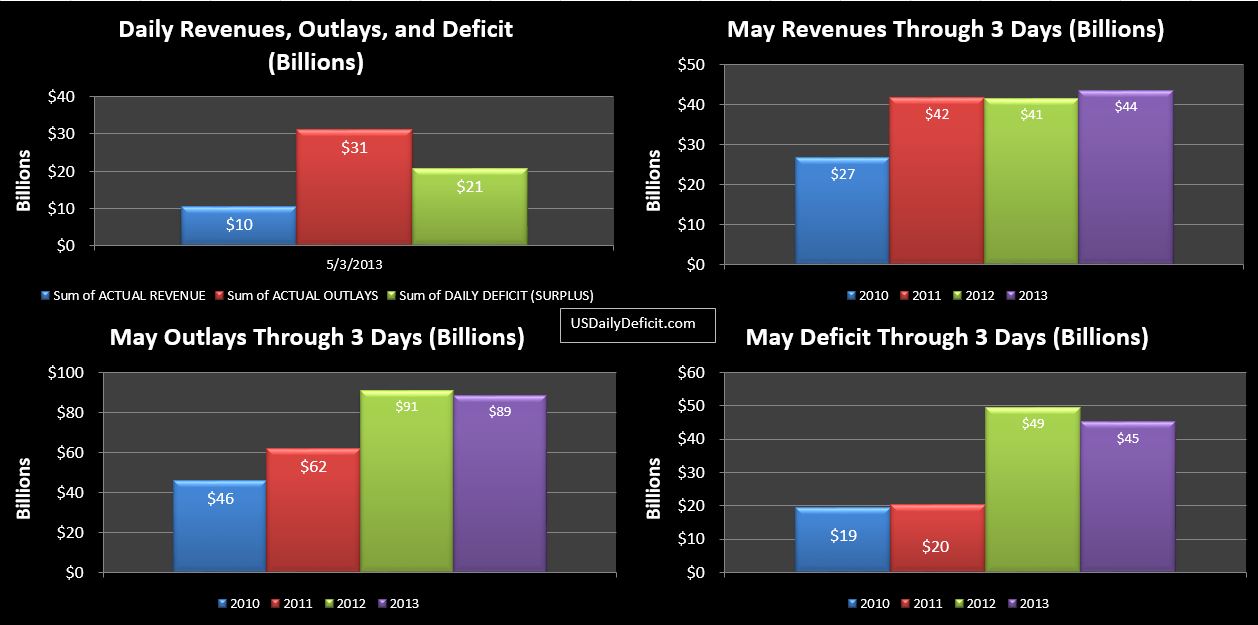

The US Daily Cash Deficit for 5/3/2013 was $20.8B bringing the May 2013 deficit through 3 days to $45B. The large deficit was primarily caused by Social Security payments of $24B… Social Security payments go out in 4 rounds throughout the month. The first and largest at ~$25B goes out the 3rd….but is bumped up if the third falls on a weekend or holiday. The next three rounds go out the 2nd-4th Wednesdays of the month, each at $11-$12B. Because of this, it isn’t surprising that we almost always see a deficit on Wednesdays.

Looking at the charts…through 3 days, all is pretty much in line with last May…..certainly nothing indicating 15%+ revenues, but the month is young. If this month follows last years script, the rest of the month should be a gentle accumulation running up to about $100B…probably more.

Two notable events stand out. On 5/15 a large interest payment around $30B will go out….giving us some insight into how ZIRP manipulation is going. For a few months now, monthly interest paid has actually come in lower YOY, despite having an additional $1T of debt. So savings from lower interest rates are more than offsetting the growing principle….hey…it’s a good deal if you can get it. However, March and April are very light in interest payments anyway…May provides us about $35B or so…twice the last two months combined, so a much better glimpse. I’m not expecting anything, but always on the lookout.

In my data series…which goes back to 2000 (and a few months of 1999) I see a high of 4.639% in 12/2001, and a new low last month at 1.837%. What we are looking for is a bottom, and a new trend back up above 2%….that’s when the trouble starts.

The second notable event will be 5/31…a Friday, when we will probably see about $20B or so of payments due 6/1 be paid out a day early. This may be enough to push the May deficit into the $125-$150B ballpark…but it all depends on what happens with revenue. This same cost shift also makes it likely that June 2013 will run a surplus…we’ll see.

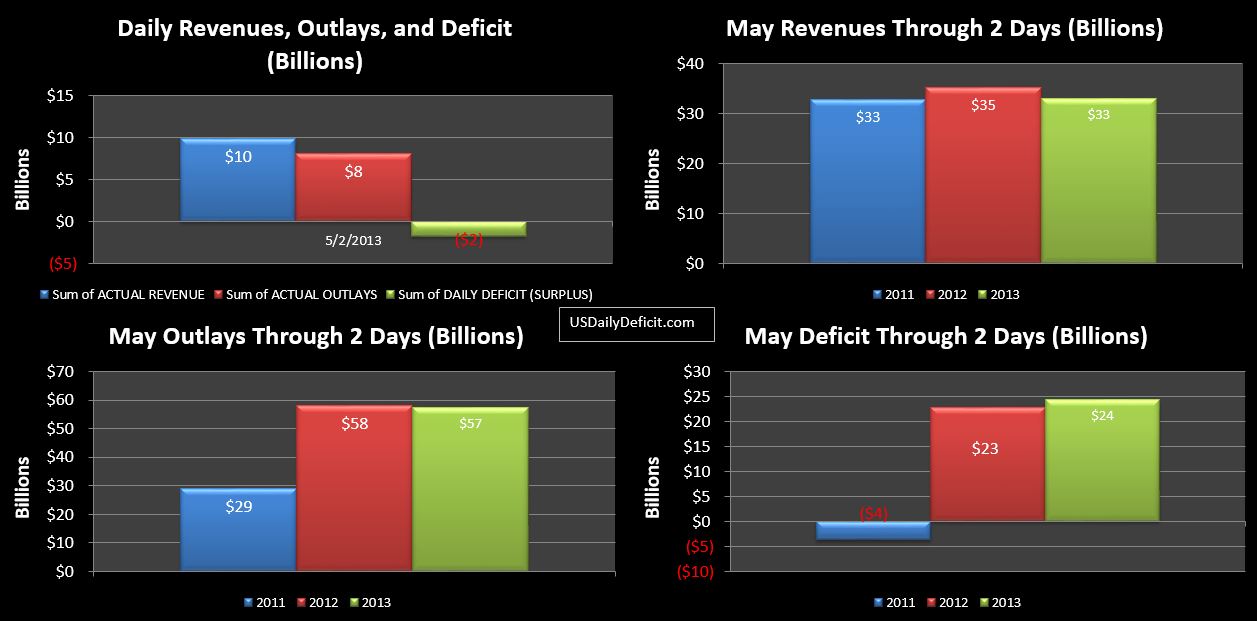

The US Daily Cash Surplus for 5/2/2013 was $1.8B on $9.9B in revenues and $8.1B of outlays leaving the May 2013 deficit through 2 days at $24B.

So far nothing out of the ordinary, but it did occur to me that with 5/31 being on a Friday, we will probably see about $20B of payments due 6/1 instead go out 5/31, essentially increasing the May deficit, and decreasing the June deficit by the same.

As you know, I am keeping a very close eye on revenues to see if what happened last month was a fluke, or an actual shift in the curve. 2 days is way to soon to tell much of anything, but it is worth noting that tax deposits not withheld…which grew 40% in April….have absolutely fallen off a cliff from $6.2B 4/30 to $327M yesterday. A drop off was expected, but I figured it would glide down under $1B over a week or so….not just stop once May came around.

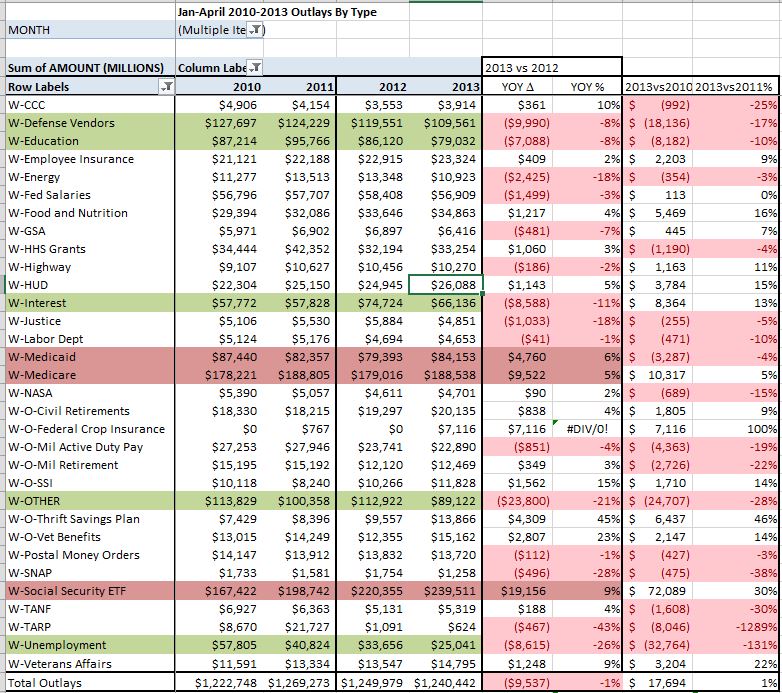

For the last three years now, 2010-2012, Federal cash outlays have more or less stayed the same at $3.8T per year. 2013, it turns out is shaping up to be more of the same…despite all of the talk of cutting spending, furlough’s and sequestration…outlays through 4 months are down by $9.5B compared to 2012 through 4 months…. a 0.76% reduction. Well…at least they technically aren’t lying when they say they cut spending…baby steps right?While entitlement programs, especially Social Security continues its exponential growth, this has been offset by cuts elsewhere…but where?

A few things jump out comparing 2012 to 2013. The big reductions came from defense vendors, education, unemployment, and a bit surprising…interest.(Hooray for ZIRP!!)On the other side…the usual suspects…Social Security, Medicare, Medicaid. Sooner or later…the delicate balance between entitlement gains being offset by cuts elsewhere is going to break….the exponential growth will overpower the linear cuts….throw in the gentle breeze of a mild recession and a mild rise in interest rates and down goes the house of cards

Comparing 2013 to 2010 yields similar results…huge gains from reduction in unemployment, defense vendors, and our good friend “Other”, offset primarily by social security Curiously, Medicaid and medicare are little changed…the Medicaid number appears to be legit…but the Medicare # looks to be skewed a bit by timing where May 2010 cost got pulled into April….a TTM analysis would probably scrub that out, but who has time for that.

So…through 4 complete months of 2013….outlays truly are down…at least for now. Say…is that a breeze I feel?

Oh…one more thing…The daily cash deficit for 5/1 was $26.1B….so we’re back in familiar territory…I haven’t done a detailed analysis yet, but probably looking at a deficit between 100B and 125B….roughly washing out the April Surplus 🙁

I touched on this a bit back in January when the “No Budget No Pay” act was passed…effectively lifting the debt limit to infinity until 5/19/2013. Though I haven’t read the fine print (and have no plans too)…there seems to be a glaring loophole…What is stopping Obama from issuing enough debt 5/18 to make it through the rest of his term…say $4T or so.

The accounting is simple….debit cash $4T…credit liabilities $4T. Rather than hitting 5/19 with a $16.9T debt limit…it would be$20.9T…problem solved right? Well, honestly, I never expected them to be that brazen, and it wouldn’t surprise me if there isn’t some fine print in the law prohibiting such malarkey. However….surely there must be some wiggle room.

So I wasn’t so surprised when I glanced at the 4/30 DTS and saw that despite having a cash balance of $152B as of 4/29, and running a $117B Surplus throughout the month of April (the highest in 72 months)…Treasury issued an additional $60B of public debt on 4/30, bringing cash in hand to nearly $214B….the highest since February 2011.

As I discussed in the run up to the last debt limit battle…it’s not when you hit the debt limit that matters…it’s when you run out of cash. Obviously…the more cash in the bank come 5/19, the longer we will make it before hitting that point.

Now the timing of the January debt fight was precocious for all involved given its proximity to the tax refund season…tax refunds literally would not have gone out in February…along with a lot of other things…. revolution would have quickly ensued. No…if you are going to have a prolonged debt fight…summer is by far the best time to do it. While July and August are likely to post substantial deficits, June and September might very well post surpluses, so a $200B+ cash stash aided by “extraordinary measures” could very well get you into October before the coffers start to run dry.

Gentlemen…the game is afoot!! Stock up on popcorn.