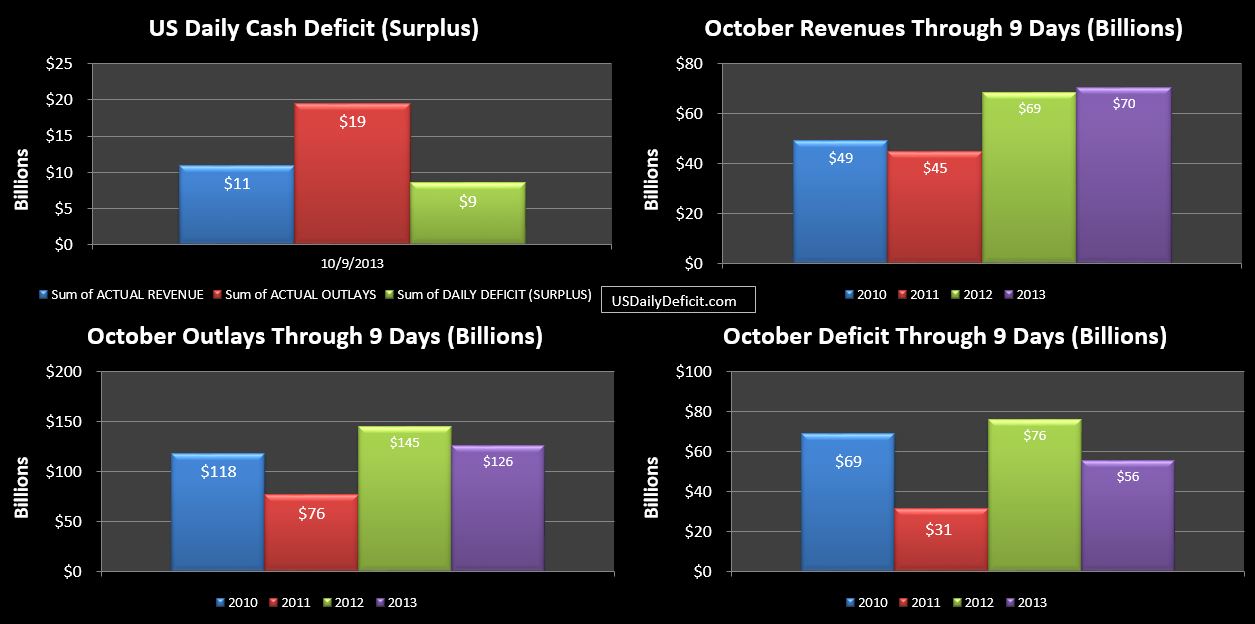

The US Daily Cash Deficit for Wednesday 10/9/2013 was $8.5B bringing the October Deficit through 9 days to $56B.

Revenues look to have caught up with last year….it will be interesting if they hold onto that lead through Columbus Day, but we won’t know until next Wednesday. Outlays continue to look suspiciously slow, including one category….tax refunds which slowed to a trickle this month before apparently stopping altogether today… Now, it isn’t unusual for tax refunds to be low….they averaged about $800M a day last October….but zero….this more or less indicates that the IRS is not processing refunds, which jives with an article I read earlier in the week.

I don’t know if this is a one off….maybe they are processing refunds only on certain days….or if there will be no more refunds until the government is re-opened. For the full month, last October had $18B of refunds. So far this month, we are at $2.8B. I account for refunds as reductions to revenue and outlays(this eliminates double counting)…so if they just stop sending them out….it will give October revenues a nice bump….until they catch up on refunds….when it will get flushed back out. If it ends up crossing periods…it screws up the trends:(

Cash was down to $23B with five business days to go before 10/17 “deadline”. I’d expect moderate deficit 10/10, followed by a moderate surplus 10/11. 11/14 is a holiday, but 11/15 should post a pretty solid surplus on corporate tax payments coupled with the long weekend worth of deposits sitting in the mailbox. Then Wednesday 11/16 will look a lot like today with round 3 of Social Security payments, and another small deficit on 11/17. Lew hasn’t amended his $30B estimate, but that looks reasonable enough to me.

It may not even be an issue….rumor has it a short term debt deal is in the works…I’m curious how that would play out. Will they keep all of the “extraordinary measures” games off the books, and just increase it by $150B or so….or would it be enough to bring all the EM back…say $250B, plus another $150B to get through the next six weeks…..and starting the EM games back up again? I suppose it really doesn’t matter anymore. Right now, outstanding debt as of 10/9/2013 stands at $16.7T. There is a very high probability that on 10/9/2014…debt outstanding is going to be knocking on $17.7T…..any takers on that?