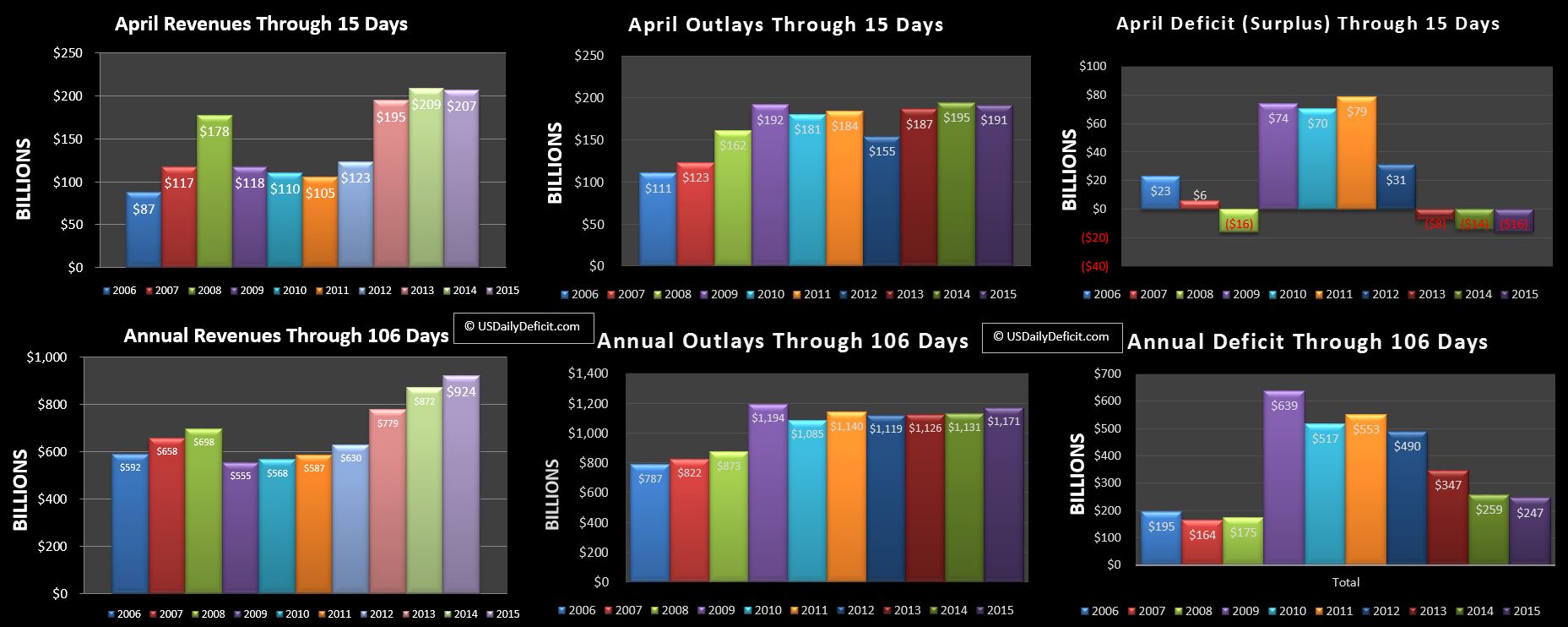

No surprises here….driven by $33B of corporate taxes and $23B of individual income taxes, Wednesday 4/15/2015 posted a $46.8B surplus, pushing April 2015 to a $16B surplus through 15 days.

Now, for starters, we are not completely in sync, as is practice around here, we are synced on day of the week comparing 2015 through Wednesday 4/15 to 2014 through Wednesday 4/16/2014. So 2014 has an extra day, and given the huge taxes flowing in Mid April….this gives it a big advantage…likely at least $20B. Because of this timing issue, our chart shows revenues more or less flat at -$2B. Don’t panic yet….there is a lot of month left, and these timing issues should start washing out by the end of next week. There is still a lot of uncertainty, but if I had to guess I’d say we are still on track for 5%-8% growth…. however…. there are some areas for concern to watch out for.

First off, corporate tax deposits are more or less done for the month, and are tied up with last year at $42B. Corporate Taxes are only ~10% of total expected revenues for the month, but it’s going to make it that much harder to post a good growth %. Second, unwithheld tax deposits look a little light so far, but it could just be timing. They came in at $7B 4/15, and will likely build up to next Tuesday at $40B+, before sliding back under $1B by the end of the month. This is a crucial category…last April it brought in $192B of revenue, 45% of the total. If we have a miss here, the month it going to look pretty crappy. On the other hand, withheld taxes are looking good, and tax refunds are down, but it’s really going to come down to unwithheld taxes over the next 5-6 days. As always…stay tuned.