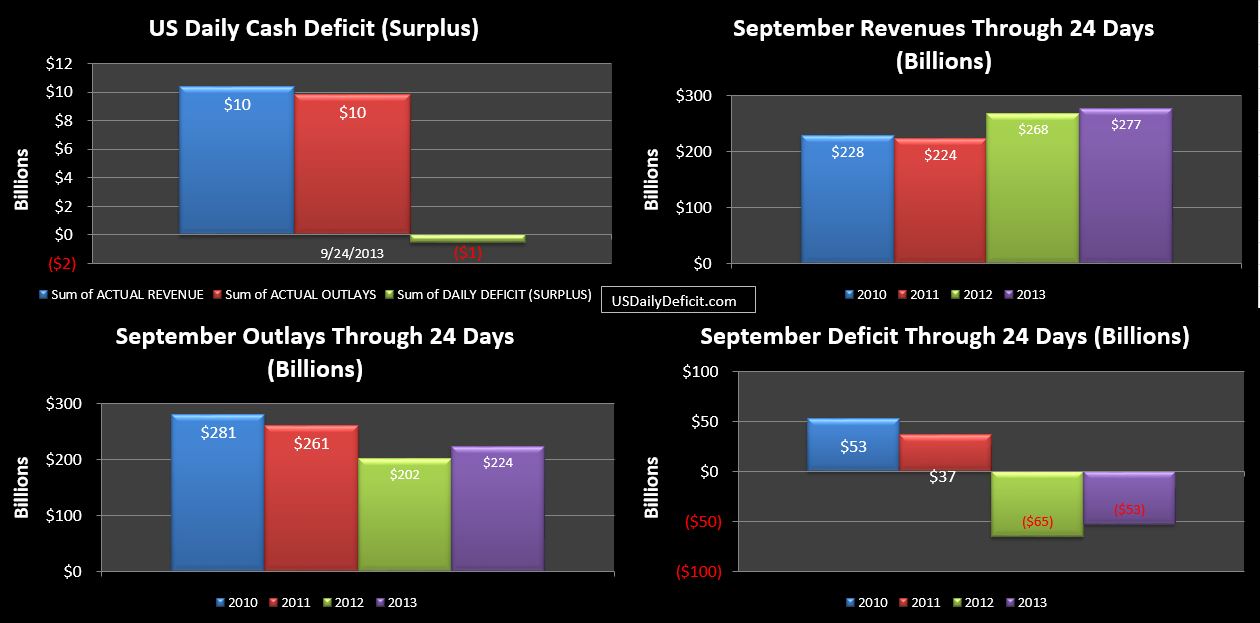

The US Daily Cash Surplus for 9/24/2013 was $0.5B bringing the September Surplus through 24 days to $53B. Revenues from “Taxes Not Withheld” dropped from $9B on 9/23 to $4B on 9/24….stronger than the 2012 amount by $1B, but still indicating these receipts are probably trailing off.

Total cash revenues for the month are now running only 3% over last year but should get a material bump on 9/30, ending somewhere between +5%-10%. Not bad, but we may pay for it with a weak October. Tomorrow, we get the final large SS payment of about $12B which will more than likely force the first deficit over $2B that we’ve had in several weeks.

Cash in hand was $55B, which we will probably see grow by $10-20B by month end, lets just say to $70B absent any “extraordinary measures (EM)”. The first week of the month is typically pretty brutal….assuming the government isn’t shut down, we would probably run a $50B+ deficit in that first week of October alone. So Treasuries 10/17 date looks good on paper. However, the CBO also came out with an estimate stating between 10/22 and 10/31. About a month ago, I had guessed early to mid November…citing the difficulty of forecasting without fully understanding what EM magic tricks Treasury had left up their sleeve. Regardless of who is correct, it does seem clear that within the next 6 weeks, either the debt limit will be raised, or we will be in for one hell of a show….maybe even both 🙂