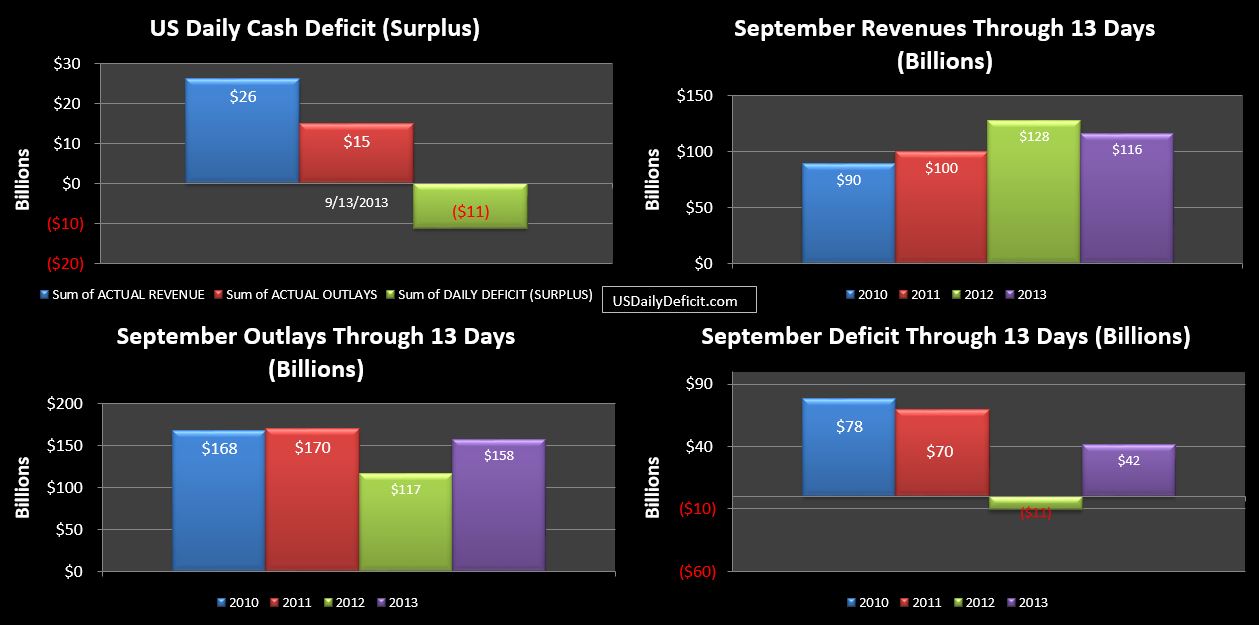

The US Daily Cash Surplus for 9/13/2013 was $11.2B pulling the September 2013 cash deficit through 13 days to $42B.

You may notice that revenue, which had been up about $8B vs 2012 has flipped and is now down $12B. Most of that is due to a $21B TARP payment received a year ago compared to a meager $42M yesterday. TARP “revenue” has more or less slowed to a trickle at around $2B per month and is no longer a material source of revenue. As we have been expecting, we received about $10B of corporate tax revenue Friday compared to $12B a year ago, but given the timing, I would think there is a decent chance we catch back up with Monday’s haul.

On the month, while taxes withheld are up 11%, corporate taxes are down 15%, excise taxes are down 1%, and taxes not withheld are up a meager 4%. This, along with the large reduction in TARP revenue has pushed the YOY revenue down 9%. I don’t expect this to last….I am currently expecting September revenue to come in between +5% and +10%, but that is assuming we see strong gains across the board this week, especially in taxes not withheld and corporate taxes. Through 2 full weeks, we are about where I expected us to be…now we’ll just sit back and see whether the quarterly tax receipts come in. The corresponding Monday from last year ran a $54B surplus, so we would hope to exceed that by $5-10B. We’ll know by 4 pm (E) tomorrow when the DTS is released.