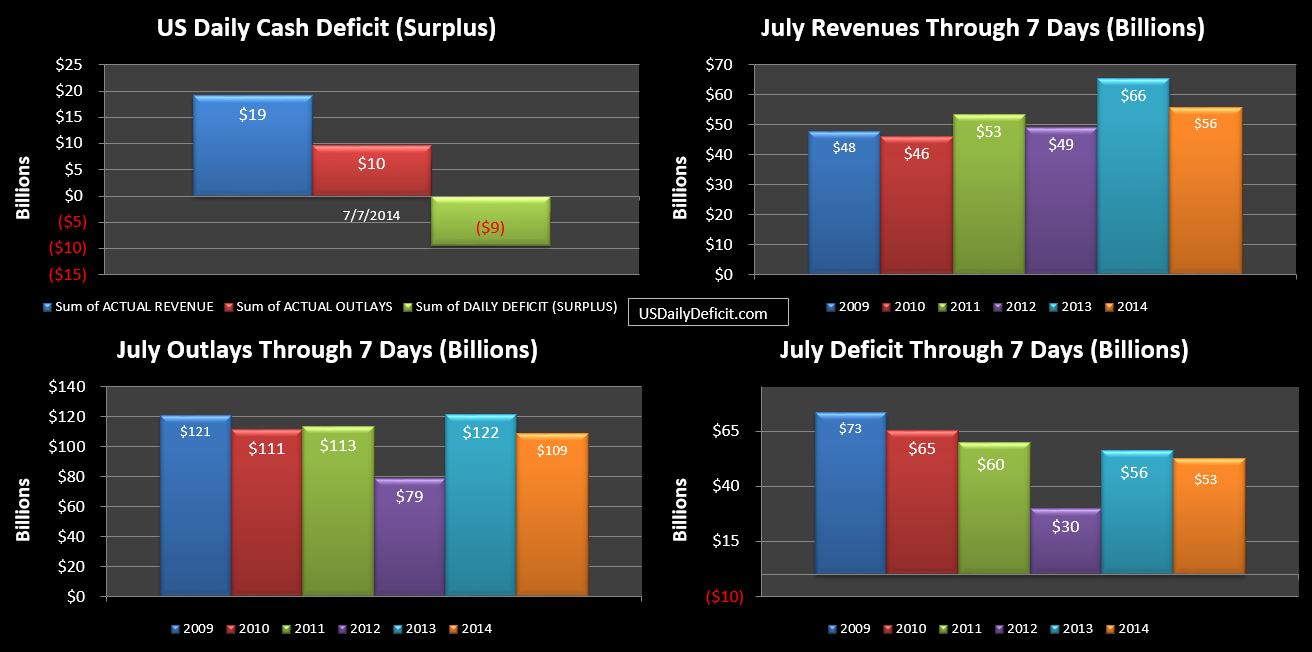

The US Daily Cash Surplus for Monday 7/7/2014 was $9.4B driven by strong revenues…typical following a long holiday weekend. This brings the July 2014 deficit through 7 days to $53B.

Unlike last month, 2013 and 2014 don’t quite line up, so starting with the above chart I am syncing up on day of the week as has become standard practice. So we are comparing July 2014 through Monday 7/7 to July 2013 through Monday 7/8. As it stands, this gives July 2013 one additional business day…which is the primary reason revenues appear down ~$10B and outlays are down ~$13B. Not to worry….2014 gets the day back at the end of the month.

For now…keep your eye on the revenue hole…~$-10B and the pace we dig out of it(or don’t). Ideally, we would be at +$10B or so by the 30th….and whatever we pick up on 7/31 would just be gravy. That said, while I haven’t done any detailed daily analysis, it seems like we typically see our gains in the second half of the month…so if we are still sitting at ~-$10B mid month…we won’t have to panic…yet.