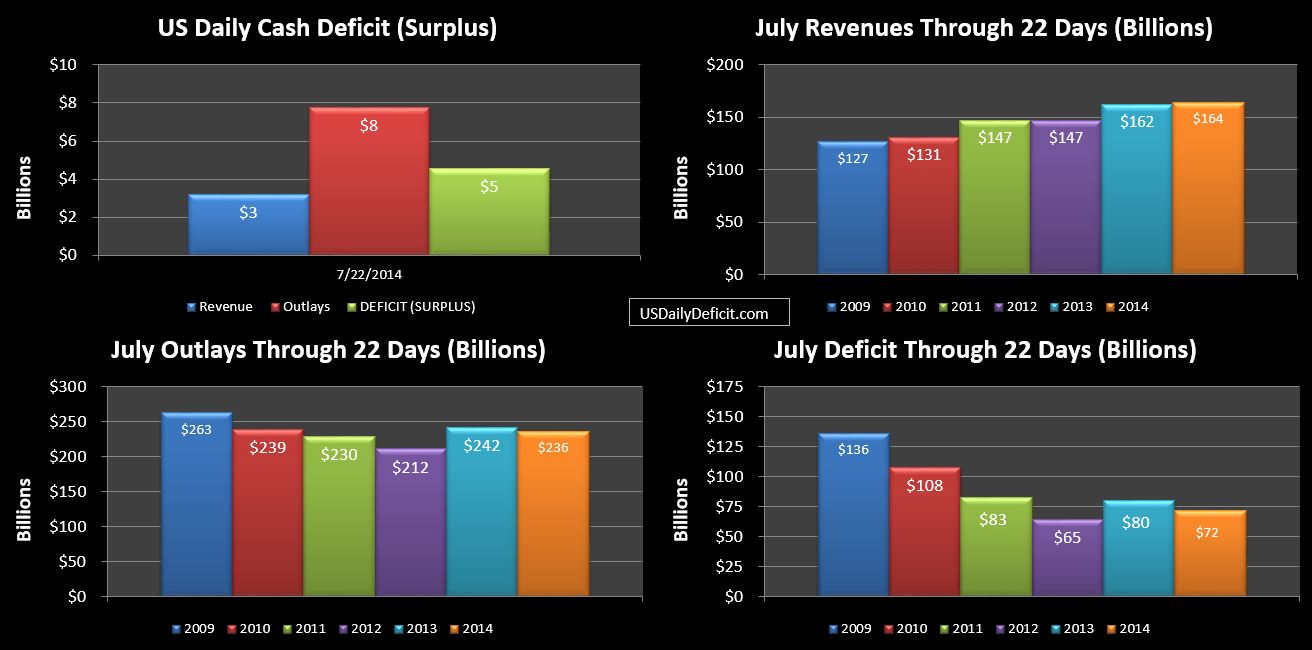

The US Daily Cash Deficit for Tuesday 7/22/2014 was $4.6B bringing the July 2014 deficit through 22 days to $72B.

Revenue takes a step back YOY….about $1.5B, but it looks like timing to me, so we should pick it back up soon. Outlays continue to edge up….it is starting to look quite likely that July 2014 outlays exceed July 2013…despite a $6B timing benefit. it’s nothing especially alarming…but I would guess we are getting close to a point where total outlays start to grow again after being on a plateau at ~$3.8T for the last 4-5 years. Over that time, we have seen growth in SS/Medicare/Medicaid being offset by cuts elsewhere. Sooner or later…those “cuts” are going to bottom out/plateau…and the growth in SS/Medicare/Medicaid is going to start pulling is back toward $4T. If/when revenue growth starts to falter….we will quickly see a reversal in the deficit improvement we have seen for 5 years now. just a recap…the trailing twelve month (TTM) deficit topped out at $1.8T in 9/2009….and has steadily fallen ever since sitting at ~$600B as of the end of last month. That’s still a huge unsustainable number, but at least it’s not $1.8T….baby steps right?