The US Daily Cash Surplus for Monday 3/9/2015 was $9.6B pushing the Surplus through 9 days to $11B. It’s funny…back when I started(and named) this blog near the end of 2012…I would actually put the word Surplus in bold and italics when it happened, which wasn’t a whole lot. At least things aren’t that bad right?

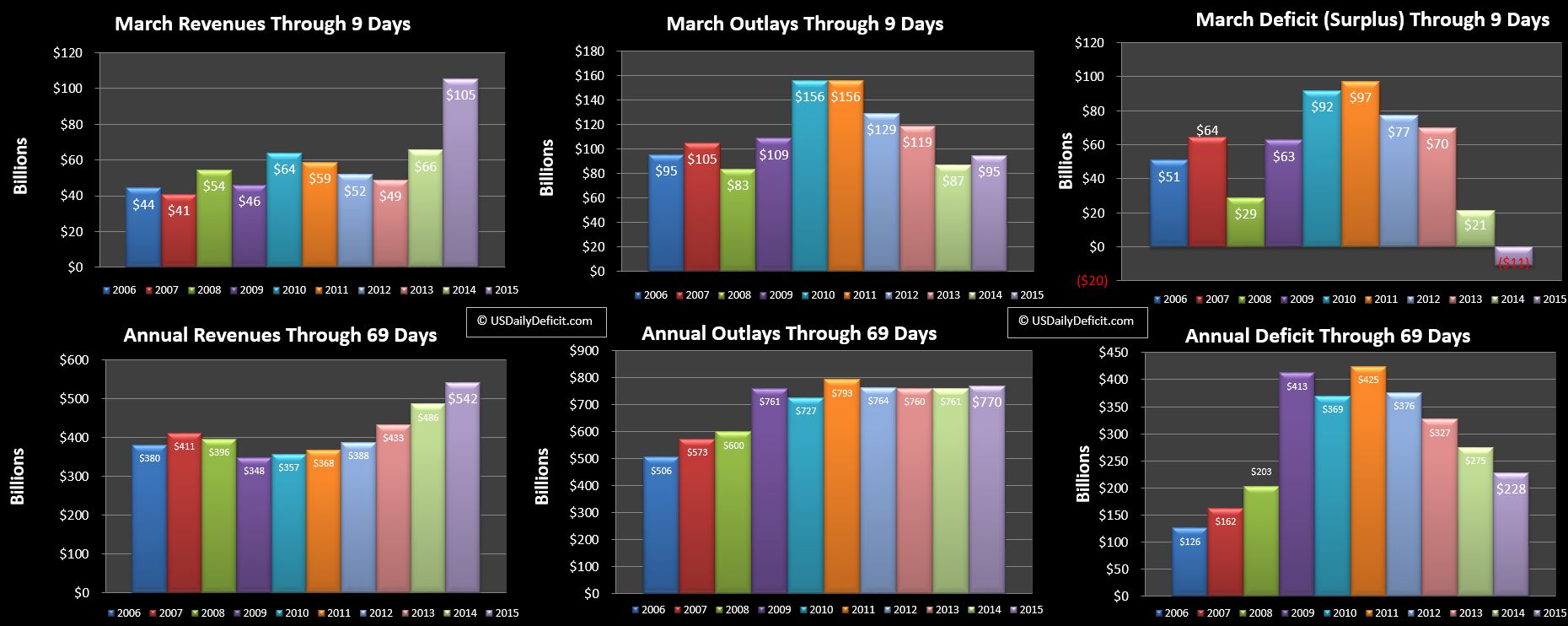

Since my last post, we’ve had another $3B in deposits from the FCC bringing the total for the month to $35B….Still curious that reports peg the haul from the spectrum auction at nearly $45B…maybe they are still awaiting payment on the remaining $10B and we’ll see it over the next few weeks? In any case, primarily due to the FCC deposits, cash revenues are at +$39B through 9 days, good for a 59% YOY improvement. Ignoring the FCC cash, we still see improvement with withheld taxes up about 4%, with immaterial declines so far in corporate taxes and taxes not withheld.

Outlays are up $8B, $6B of which is interest timing, laving adjusted outlays at +2%. Individual refunds are still fairly flat, down only $1B or 4%. Business tax refunds are noticably up, though much smaller at $2.9B in March 2015 vs $1.8B last March. For the Year, business tax refunds are up 60% from $8.6B in 2014 to $13.7 in 2015 through 69 days. It’s not a big number, and maybe it’s not a big deal, but generally, this would mean corporate profits are down….

And now for the biggest non story… the Debt Limit. You may recall that last year the debt limit was suspended until March 15 2015…which is Sunday. Nothing that i have read indicates a battle is forthcoming, but I wouldn’t expect a deal by Friday either. That’s ok though, because if you are going to pick a time to hit the debt limit, March 15th is a pretty darn good day to do it. The actual time to run out of cash is a function of your cash in hand on D Day, the amount you can squeeze from extraordinary measures(EM), and the projected cash deficits over the coming months. Now let’s say we end Friday with $50B of cash, and that Lew can squeeze $350B out of EM. First thing monday morning, we should get ~$20B of corporate taxes, and more or less run a small surplus for the rest of March. Then comes April, which should run just shy of a $200B surplus, lets put it at $175B. that puts cash in hand 4/30 at $225B, and you haven’t even really had to tap into EM yet, which means we have nearly a $575B “cushion” to play with. The official estimate is that this gets us to October/November, but my math puts it all the way into next February. There are a lot of wild ass guesses in there, but this doesn’t seem nearly as critical as it has in the past, often right before tax refund season.

That said…I still hate the prospect of EM because it does a number on my cash deficit calculations. Essentially, treasury pulls debt off the balance sheet and pretends like it doesn’t exist so they can issue more and still stay under the limit. I can more or less account for it, but it’s a pain, and I’d rather not. Furthermore, I can’t tie everything back to the penny until after EM is wrapped up, which could be months…or a year 🙁 . So here’s to hoping they wrap this nonsense up in March…