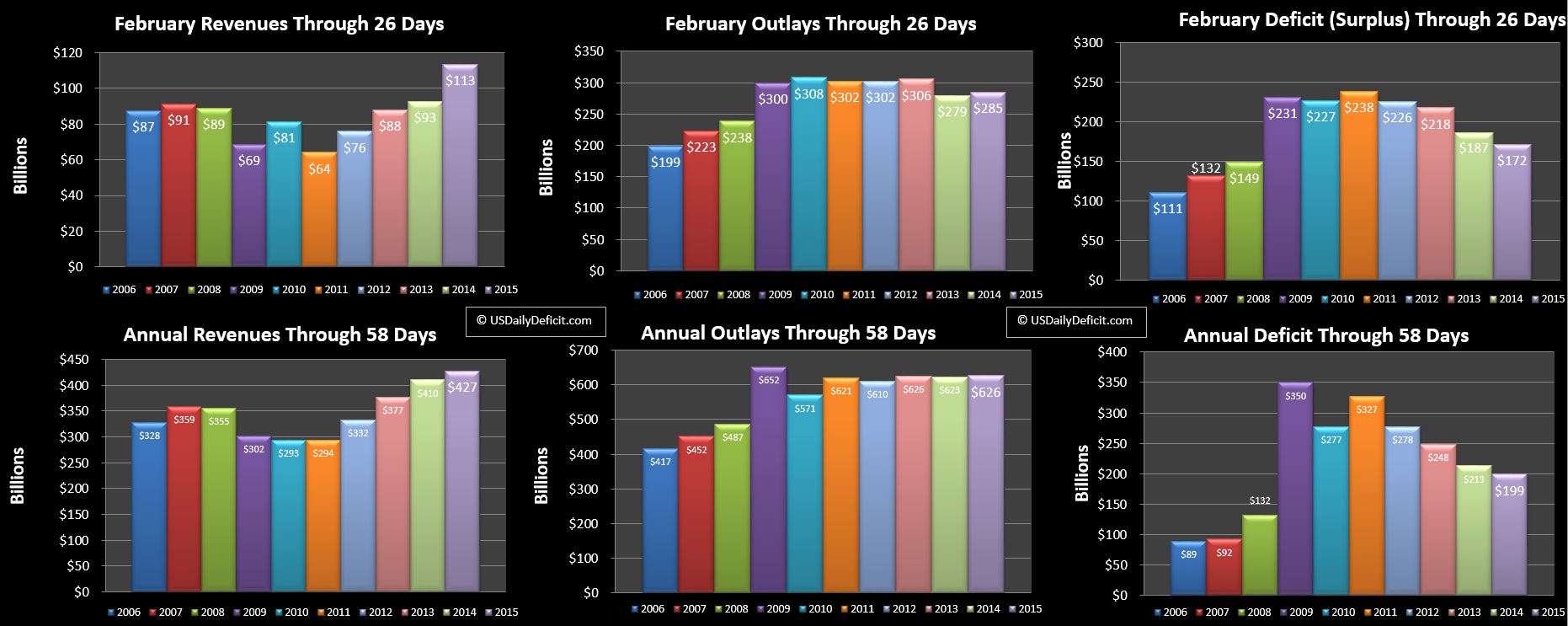

The US Daily Cash Deficit for Thursday 2/26/2015 was $7.8B bringing the February 2015 Deficit through 15 days to $172B.

The most surprising thing about February so far is that refunds have kept pace with 2014. Looking at the YTD….2014 was at $124.5B compared to 2015 at 125.2B. In my forecast, I had reduced my expected refunds by about $10B due to all the hype about Obamacare….looks like maybe it was just that.

Revenues are up about $20B….$10B of that is refund timing, and the rest is bonafide revenue growth. Outlays are at +$6B….primarily interest payment timing…..which will be be offset by another interest payment at the end of the month….where ~$6B of interest payments slip to 3/2 due to the weekend.. Put it all together, and revenue is looking at about +4% on the year, with outlays more or less flat. If I had to guess….with 95% of the data in, Friday 2/27 will post about a ~$30B deficit pushing us just over $200B for the month, and just under my $210B forecast.