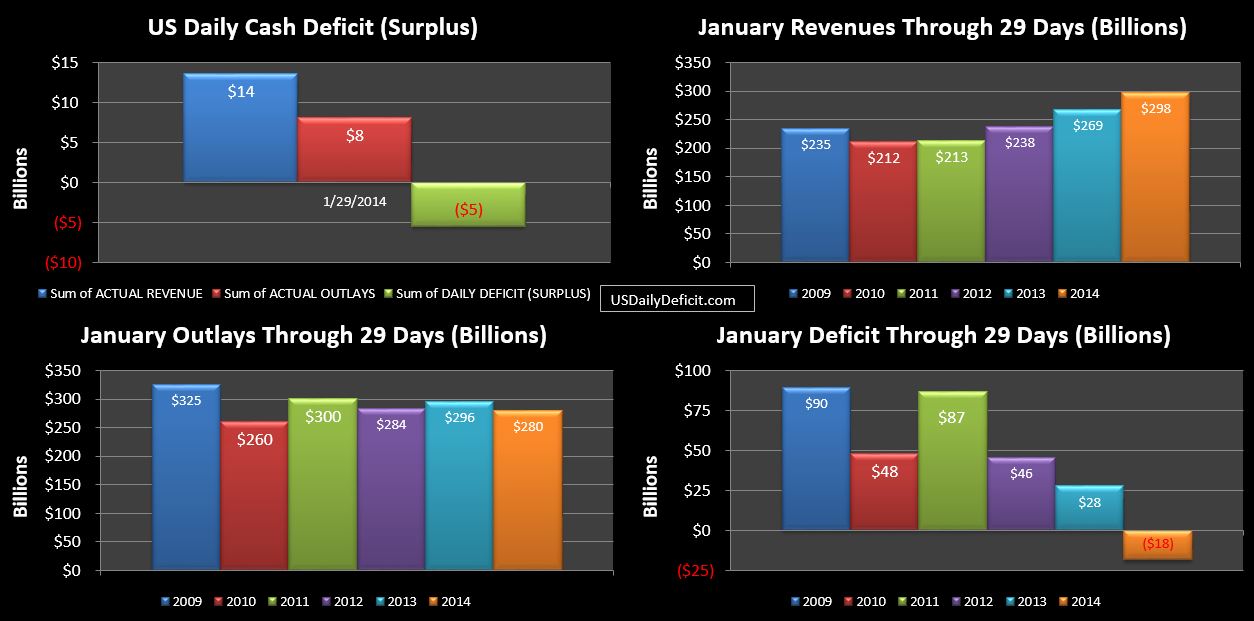

The US Daily Cash Surplus for Wednesday 1/29/2014 was $5.5B bumping the January 2014 surplus back up to $18B with two business days remaining.

It was another good day on the revenue front thanks in part to a $2B bump from “Federal Reserve Earnings.” Of course….the game here is that the Federal reserve essentially prints their own money, and with it has purchased about $4T worth of securities…including $2.2T of treasury notes (US Federal Debt) and $1.5T of mortgage backed securities. Now, whenever treasury makes a debt payment on a bond owned by the Fed….the Fed turns right back around and sends it back to Treasury. It’s a nice little game I suppose….what could go wrong? In any case…this little game nets the government a cool ~$80B per year of revenues per my math, but who knows how they account for that…negative interest expense?? I suppose it’s whatever they want it to be.

Moving on, Withheld tax deposits are sitting at +8%, taxes not withheld are at +9%, and corporate taxes are up at +16%, though that’s only $1.4B. Total cash revenues (including Fed reserve “earnings”) are at +11%. For comparison, my initial estimate for the month was +7% for total revenues, so there is not doubt, at this point revenues are over performing in my mind….I suppose we should all hope this holds up….unless you are the one paying that additional 11%.